Answered step by step

Verified Expert Solution

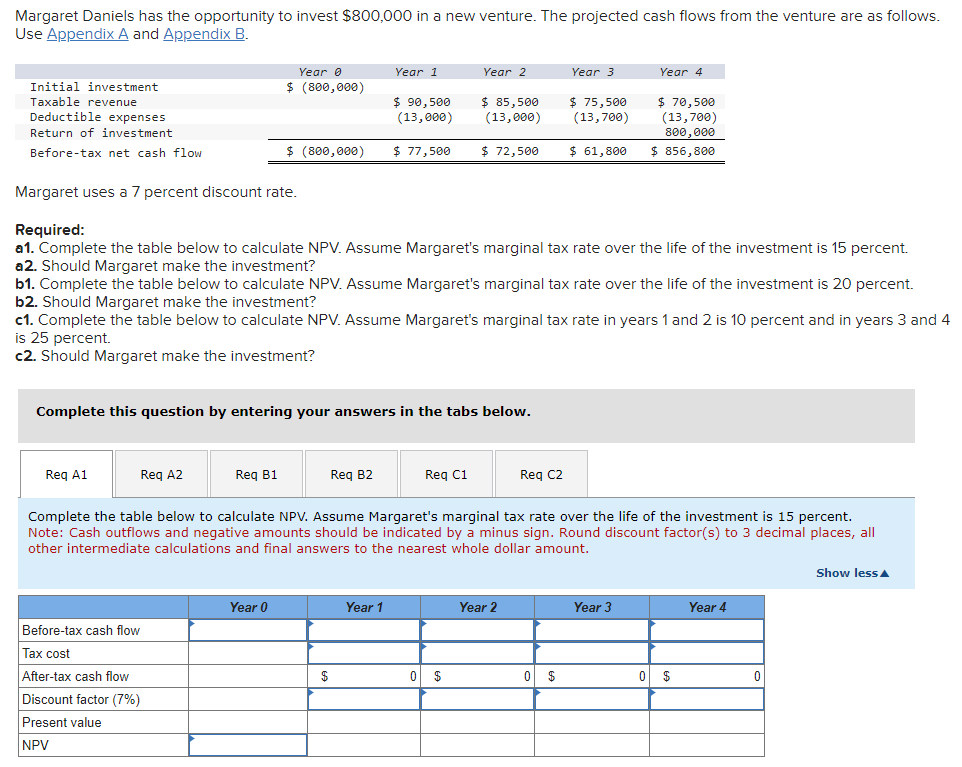

Question

1 Approved Answer

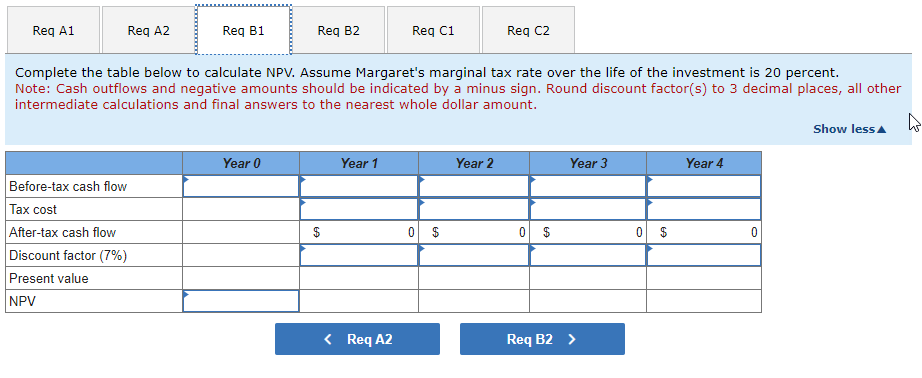

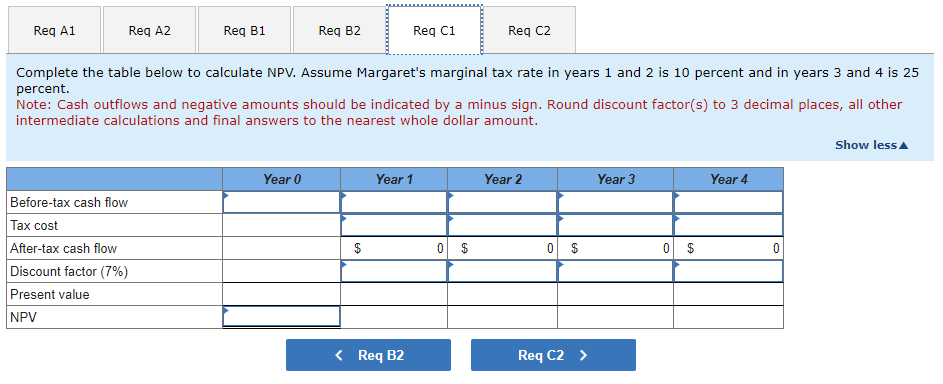

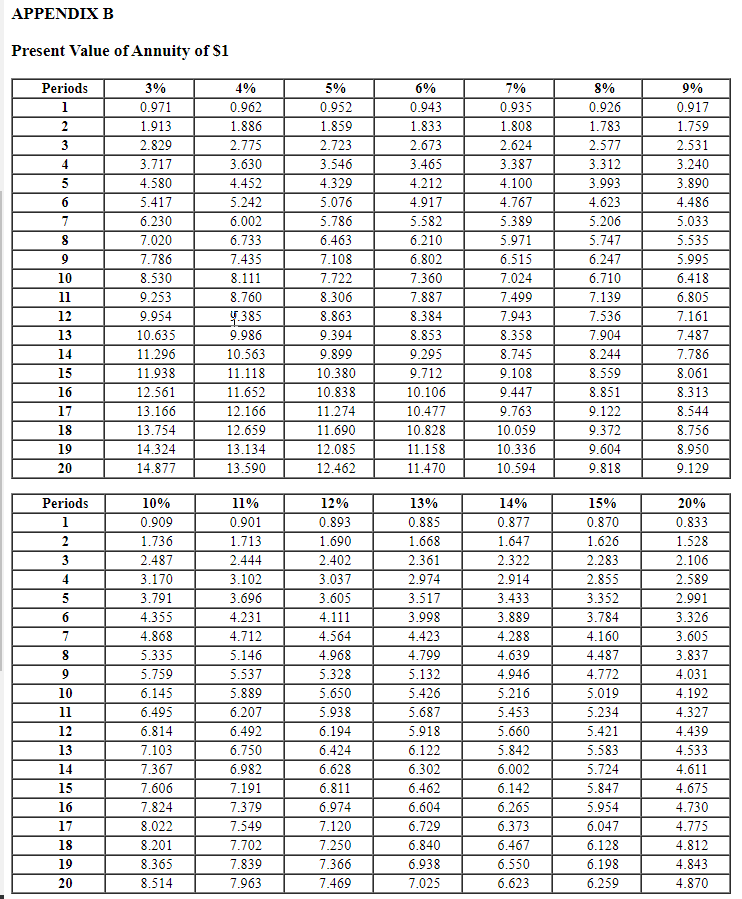

Should Margaret make the investment? Complete this question by entering your answers in the tabs below. Should Margaret make the investment? Complete the table below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started