Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 1. Susan Casey is the controller of Casey's Collectibles. The business uses the accrual method of accounting and recognizes sales revenue in the

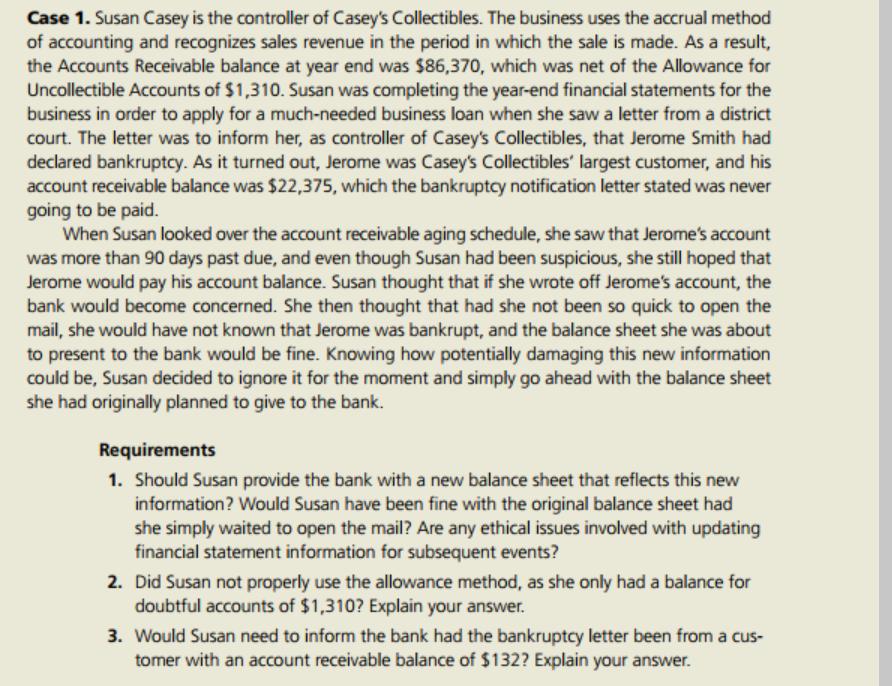

Case 1. Susan Casey is the controller of Casey's Collectibles. The business uses the accrual method of accounting and recognizes sales revenue in the period in which the sale is made. As a result, the Accounts Receivable balance at year end was $86,370, which was net of the Allowance for Uncollectible Accounts of $1,310. Susan was completing the year-end financial statements for the business in order to apply for a much-needed business loan when she saw a letter from a district court. The letter was to inform her, as controller of Casey's Collectibles, that Jerome Smith had declared bankruptcy. As it turned out, Jerome was Casey's Collectibles' largest customer, and his account receivable balance was $22,375, which the bankruptcy notification letter stated was never going to be paid. When Susan looked over the account receivable aging schedule, she saw that Jerome's account was more than 90 days past due, and even though Susan had been suspicious, she still hoped that Jerome would pay his account balance. Susan thought that if she wrote off Jerome's account, the bank would become concerned. She then thought that had she not been so quick to open the mail, she would have not known that Jerome was bankrupt, and the balance sheet she was about to present to the bank would be fine. Knowing how potentially damaging this new information could be, Susan decided to ignore it for the moment and simply go ahead with the balance sheet she had originally planned to give to the bank. Requirements 1. Should Susan provide the bank with a new balance sheet that reflects this new information? Would Susan have been fine with the original balance sheet had she simply waited to open the mail? Are any ethical issues involved with updating financial statement information for subsequent events? 2. Did Susan not properly use the allowance method, as she only had a balance for doubtful accounts of $1,310? Explain your answer. 3. Would Susan need to inform the bank had the bankruptcy letter been from a cus- tomer with an account receivable balance of $132? Explain your answer.

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Solution to all three requirements are given below Solution 1 Susan should provide the Bank with a n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started