Answered step by step

Verified Expert Solution

Question

1 Approved Answer

McReath Corporation is a leading producer of fresh, frozen, and made-from-concentrate citrus drinks. The firm was founded in 1922 by Charles McReath, an army

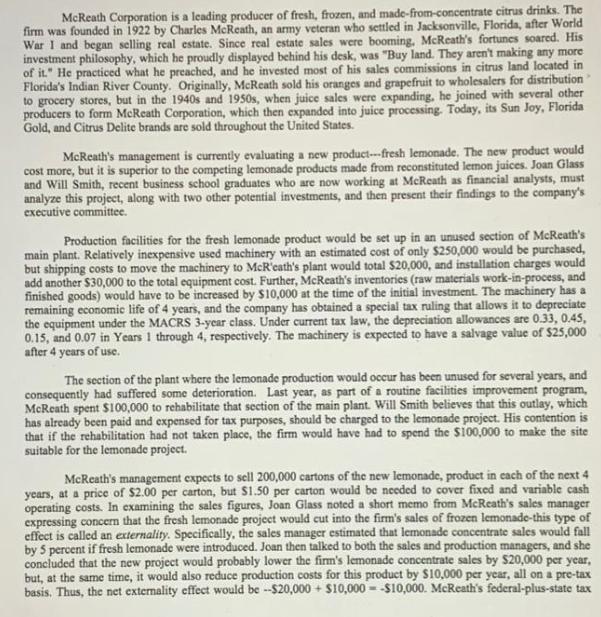

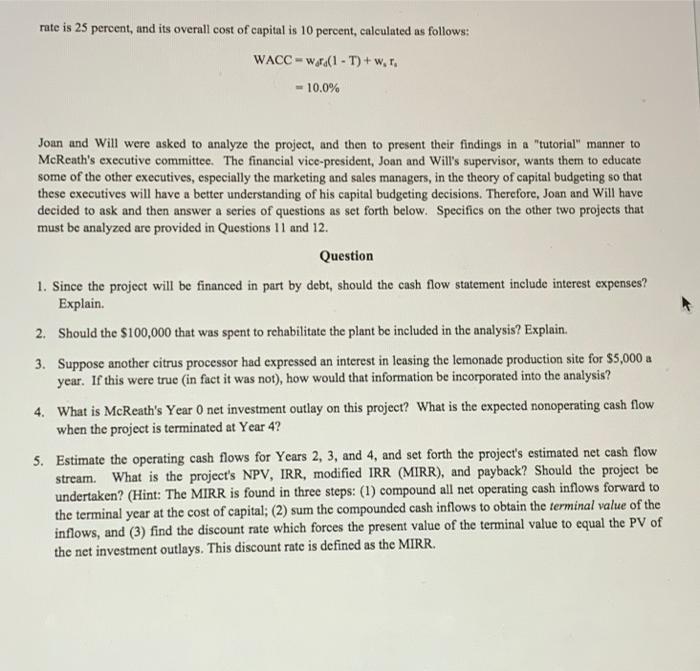

McReath Corporation is a leading producer of fresh, frozen, and made-from-concentrate citrus drinks. The firm was founded in 1922 by Charles McReath, an army veteran who settled in Jacksonville, Florida, after World War I and began selling real estate. Since real estate sales were booming, McReath's fortunes soared. His investment philosophy, which he proudly displayed behind his desk, was "Buy land. They aren't making any more of it." He practiced what he preached, and he invested most of his sales commissions in citrus land located in Florida's Indian River County. Originally, McReath sold his oranges and grapefruit to wholesalers for distribution to grocery stores, but in the 1940s and 1950s, when juice sales were expanding, he joined with several other producers to form McReath Corporation, which then expanded into juice processing. Today, its Sun Joy, Florida Gold, and Citrus Delite brands are sold throughout the United States. McReath's management is currently evaluating a new product--fresh lemonade. The new product would cost more, but it is superior to the competing lemonade products made from reconstituted lemon juices. Joan Glass and Will Smith, recent business school graduates who are now working at McReath as financial analysts, must analyze this project, along with two other potential investments, and then present their findings to the company's executive committee. Production facilities for the fresh lemonade product would be set up in an unused section of McReath's main plant. Relatively inexpensive used machinery with an estimated cost of only $250,000 would be purchased, but shipping costs to move the machinery to McR'eath's plant would total $20,000, and installation charges would add another $30,000 to the total equipment cost. Further, McReath's inventories (raw materials work-in-process, and finished goods) would have to be increased by $10,000 at the time of the initial investment. The machinery has a remaining economic life of 4 years, and the company has obtained a special tax ruling that allows it to depreciate the equipment under the MACRS 3-year class. Under current tax law, the depreciation allowances are 0.33, 0.45, 0.15, and 0.07 in Years 1 through 4, respectively. The machinery is expected to have a salvage value of $25,000 after 4 years of use. The section of the plant where the lemonade production would occur has been unused for several years, and consequently had suffered some deterioration. Last year, as part of a routine facilities improvement program, McReath spent $100,000 to rehabilitate that section of the main plant. Will Smith believes that this outlay, which has already been paid and expensed for tax purposes, should be charged to the lemonade project. His contention is that if the rehabilitation had not taken place, the firm would have had to spend the $100,000 to make the site suitable for the lemonade project. McReath's management expects to sell 200,000 cartons of the new lemonade, product in cach of the next 4 years, at a price of $2.00 per carton, but S1.50 per carton would be needed to cover fixed and variable cash operating costs. In examining the sales figures, Joan Glass noted a short memo from McReath's sales manager expressing concern that the fresh lemonade project would cut into the firm's sales of frozen lemonade-this type of effect is called an externality. Specifically, the sales manager estimated that lemonade concentrate sales would fall by 5 percent if fresh lemonade were introduced. Joan then talked to both the sales and production managers, and she concluded that the new project would probably lower the firm's lemonade concentrate sales by $20,000 per year, but, at the same time, it would also reduce production costs for this product by $10,000 per year, all on a pre-tax basis. Thus, the net externality effect would be --$20,000 + $10,000 - -$10,000. McReath's federal-plus-state tax rate is 25 percent, and its overall cost of capital is 10 percent, calculated as follows: WACC - wra(1 - T) + w, r, 10.0% Joan and Will were asked to analyze the project, and then to present their findings in a "tutorial" manner to McReath's executive committee. The financial vice-president, Joan and Will's supervisor, wants them to educate some of the other executives, especially the marketing and sales managers, in the theory of capital budgeting so that these executives will have a better understanding of his capital budgeting decisions. Therefore, Joan and Will have decided to ask and then answer a series of questions as set forth below. Specifics on the other two projects that must be analyzed are provided in Questions I1 and 12. Question 1. Since the project will be financed in part by debt, should the cash flow statement include interest expenses? Explain. 2. Should the $100,000 that was spent to rehabilitate the plant be included in the analysis? Explain. 3. Suppose another citrus processor had expressed an interest in leasing the lemonade production site for $5,000 a year. If this were true (in fact it was not), how would that information be incorporated into the analysis? 4. What is McReath's Year 0 net investment outlay on this project? What is the expected nonoperating cash flow when the project is terminated at Year 4? 5. Estimate the operating cash flows for Years 2, 3, and 4, and set forth the project's estimated net cash flow stream. What is the project's NPV, IRR, modified IRR (MIRR), and payback? Should the project be undertaken? (Hint: The MIRR is found in three steps: (1) compound all net operating cash inflows forward to the terminal year at the cost of capital; (2) sum the compounded cash inflows to obtain the terminal value of the inflows, and (3) find the discount rate which forces the present value of the terminal value to equal the PV of the net investment outlays. This discount rate is defined as the MIRR.

Step by Step Solution

★★★★★

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 Yes the cash flow statement should include interest expenses Interest is an important component of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started