Show all calculations and workings (Notes) included.

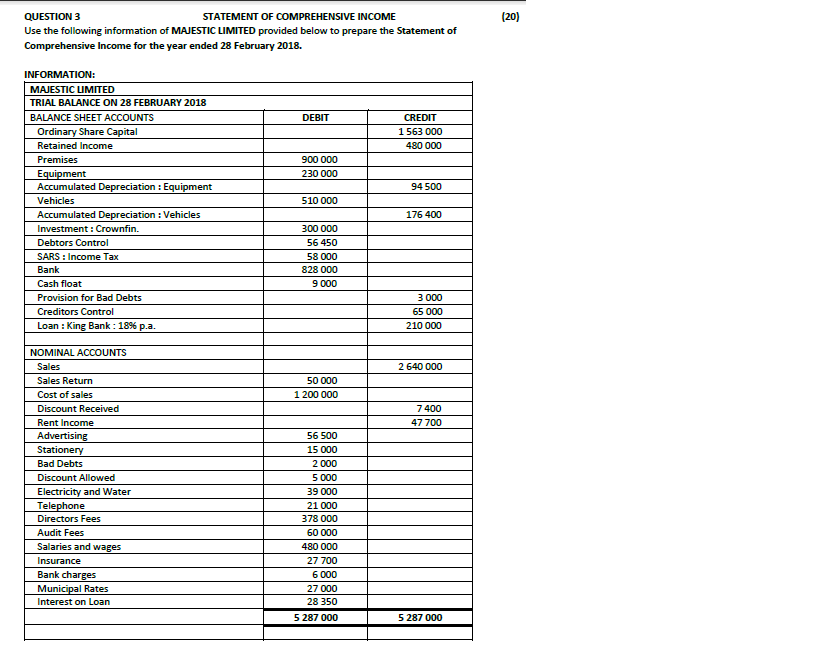

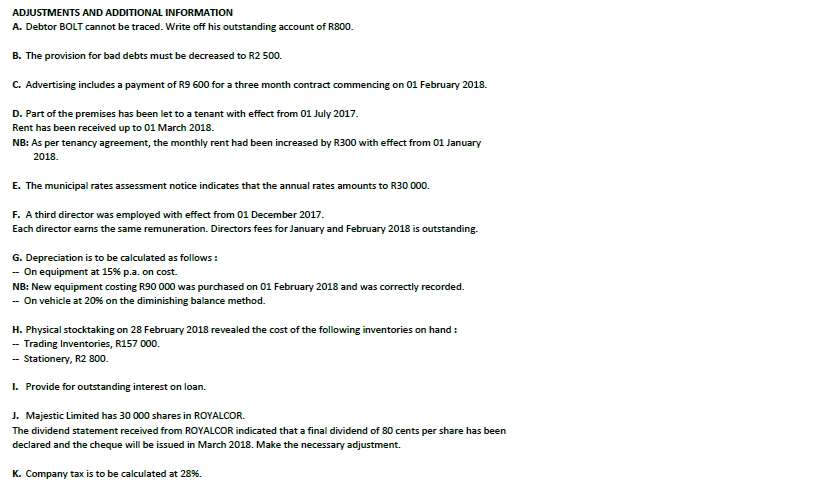

20) QUESTION 3 Use the following information of MAJESTIC LIMITED provided below to prepare the Statement of Comprehensive Income for the year ended 28 February 2018. STATEMENT OF COMPREHENSIVE INCOME INFORMATIO: MAJESTIC LIMITED TRIAL BALANCE ON 28 FEBRUARY 2018 BALANCE SHEET ACCOUNTS DEBIT Ordinary Share Capital Retained Income CREDIT 1563 000 480 000 900 000 230 000 Accumulated Depreciation Equipment Vehicles Accumulated Depreciation: Vehicles 94 500 510 000 176 400 Debtors Control SARS: Income Tax Bank Cash float Provision for Bad Debts Creditors Control Loan: King Bank 18% p.a 300 000 56 450 58 000 828 000 9 000 3 000 65 000 210 000 NOMINAL ACCOUNTS Sales Sales Return Cost of sales 2 640 000 50 000 1200 000 7 400 47 700 Rent Income Bad Debts Discount Allowed Electricity and Water Tele Directors Fees Audit Fees Salie and wages Insurance Bank charges Mu Interest on Loan 56 500 15 000 2 000 5 000 39 000 21 000 378 000 60 000 480 000 27 700 6 000 27 000 28 350 5 287 000 l Rates 5 287 000 ADJUSTMENTS AND ADDITIONAL INFORMATION A. Debtor BOLT cannot be traced. Write off his outstanding account of R800. B. The provision for bad debts must be decreased to R2 500. C. Advertising includes a payment of R9 600 for a three month contract commencing on 01 February 2018. D. Part of the premises has been let to a tenant with effect from 01 July 2017. Rent has been received up to 01 March 2018. NB: As per tenancy agreement, the monthly rent had been increased by R300 with effect from 01 January 2018. E. The municipal rates assessment notice indicates that the annual rates amounts to R30 000 F. A third director was employed with effect from 01 December 2017 Each director earns the same remuneration. Directors fees for Januay d February 2018 is outstanding. G. Depreciation is to be calculated as follows: -on equipment at 15% p.a. on cost. NB: New equipment costing R90 000 was purchased on 01 February 2018 and was correctly recorded. On vehicle at 20% on the diminishing balance method. H. Physical stocktaking on 28 February 2018 revealed the cost of the following inventories on hand: - Trading Inventories, R157 000. - Stationery, R2 800. I. Provide for outstanding interest on loan. J. Majestic Limited has 30 000 shares in ROYALCOR. The dividend statement received from ROYALCOR indicated that a final dividend of 80 cents per share has been declared and the cheque will be issued in March 2018. Make the necessary adjustment. K. Company tax is to be calculated at 28%