Answered step by step

Verified Expert Solution

Question

1 Approved Answer

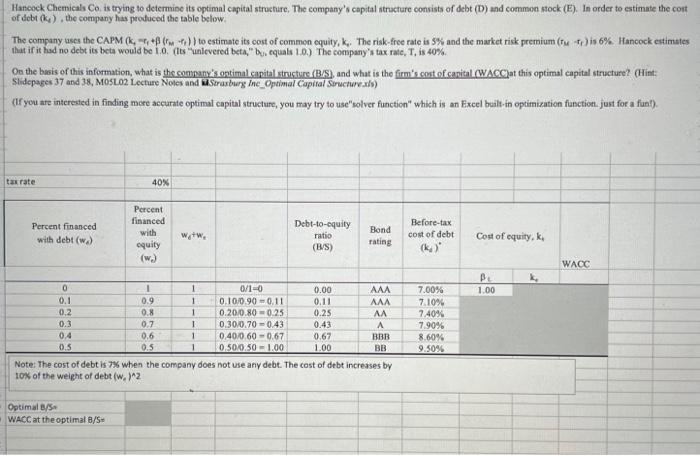

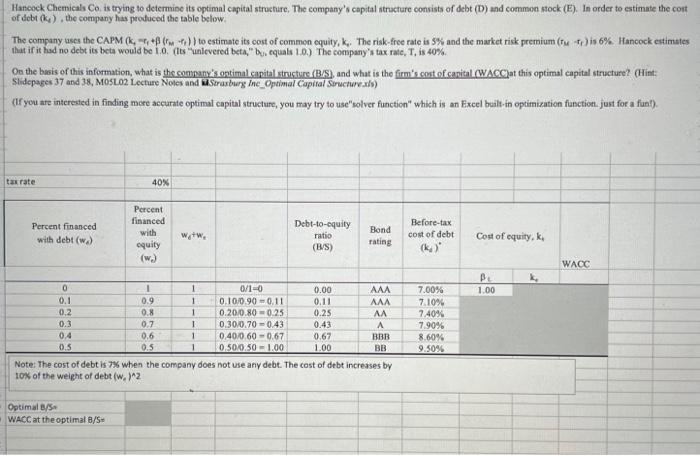

SHOW ALL CALCULATIONS Haneock Chemicals Co, is trying to determine its optimal capital struchire, The company's capital structure consists of debt (D) and common stock

SHOW ALL CALCULATIONS

Haneock Chemicals Co, is trying to determine its optimal capital struchire, The company's capital structure consists of debt (D) and common stock (E). In order to estimate the cost of debt (k4), the company has produced the table below. The company ases the CAPM (k,r1+(rm+r1)) to estimate its cost of commen equity, k0. The risk-free rate is 5% and the market rick premium ( frr) is 6%. Hancock estimates that if it had no debt its beta would be 1.0. (tes "unicvered beta," bu, equals 1.D.) The company's tax rate, T, is 40\%, Oe the busis of this information, what is thecompany's ontimal capital structure (B/S), and what is the firm's cost of capital (WACClat this optimal capital structure? (Hint: Stidepages 37 and 38, M051.02 Lecture Noles and IiStraxburg Ine_Optimal (apifal Seructurexh) (If you are interested in finding mere accurate optimal capital structure, you may try to use"solver function" which is an Excel built, in optimization finctiont just for a funt). Note: The cost of debt is 7\% when the company does not use any debt. The cost of debt increases by 10% of the weight of debt (we)n2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started