Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show all details please 30. Pratt Company acquired all of the outstanding shares of Spider, Inc., on December 31, 2021, for $495,000 cash. Pratt will

show all details please

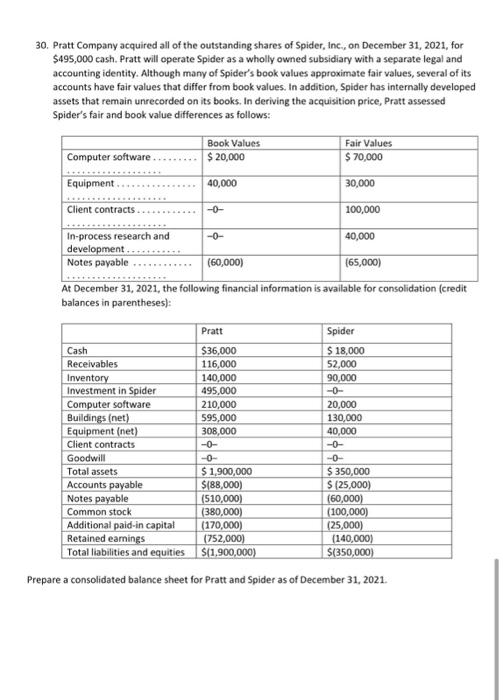

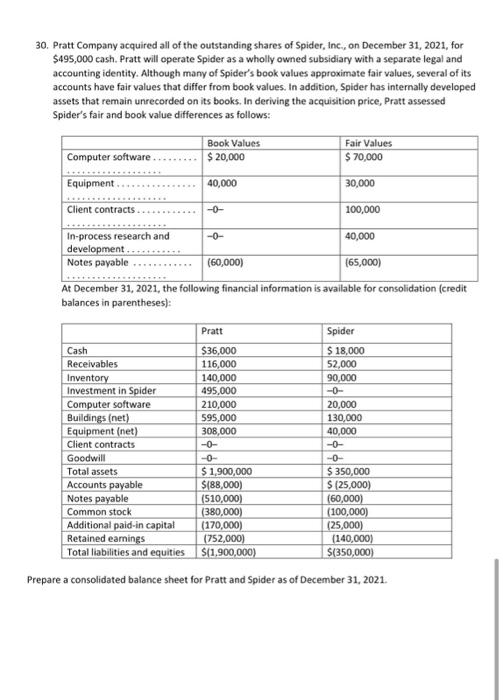

30. Pratt Company acquired all of the outstanding shares of Spider, Inc., on December 31, 2021, for $495,000 cash. Pratt will operate Spider as a wholly owned subsidiary with a separate legal and accounting identity. Although many of Spider's book values approximate fair values, several of its accounts have fair values that differ from book values. In addition, Spider has internally developed assets that remain unrecorded on its books. In deriving the acquisition price, Pratt assessed Spider's fair and book value differences as follows: Book Values Fair Values Computer software $ 20,000 $ 70,000 Equipment 40,000 30,000 Client contracts -0- 100,000 In-process research and -0- 40,000 development Notes payable (60,000) (65,000) At December 31, 2021, the following financial information is available for consolidation (credit balances in parentheses): Pratt Spider $ 18,000 52,000 90,000 20,000 130,000 40,000 Cash $36,000 Receivables 116,000 Inventory 140,000 Investment in Spider 495,000 Computer software 210,000 Buildings (net) 595,000 Equipment (net) 308,000 Client contracts -0- Goodwill -0- Total assets $1,900,000 Accounts payable $(88,000) Notes payable (510,000) Common stock (380,000) Additional paid-in capital (170,000) Retained earnings (752,000) Total liabilities and equities S(1,900,000) -0- $ 350,000 $ 125,000) (60,000) (100,000) (25,000) (140,000) $(350,000) Prepare a consolidated balance sheet for Pratt and Spider as of December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started