Question

SHOW ALL MATH CALCULATIONS, written out. Please attach the income statement and balance sheet used. Please highlight the numbers used on the financial statement. 1.

SHOW ALL MATH CALCULATIONS, written out.

Please attach the income statement and balance sheet used.

Please highlight the numbers used on the financial statement.

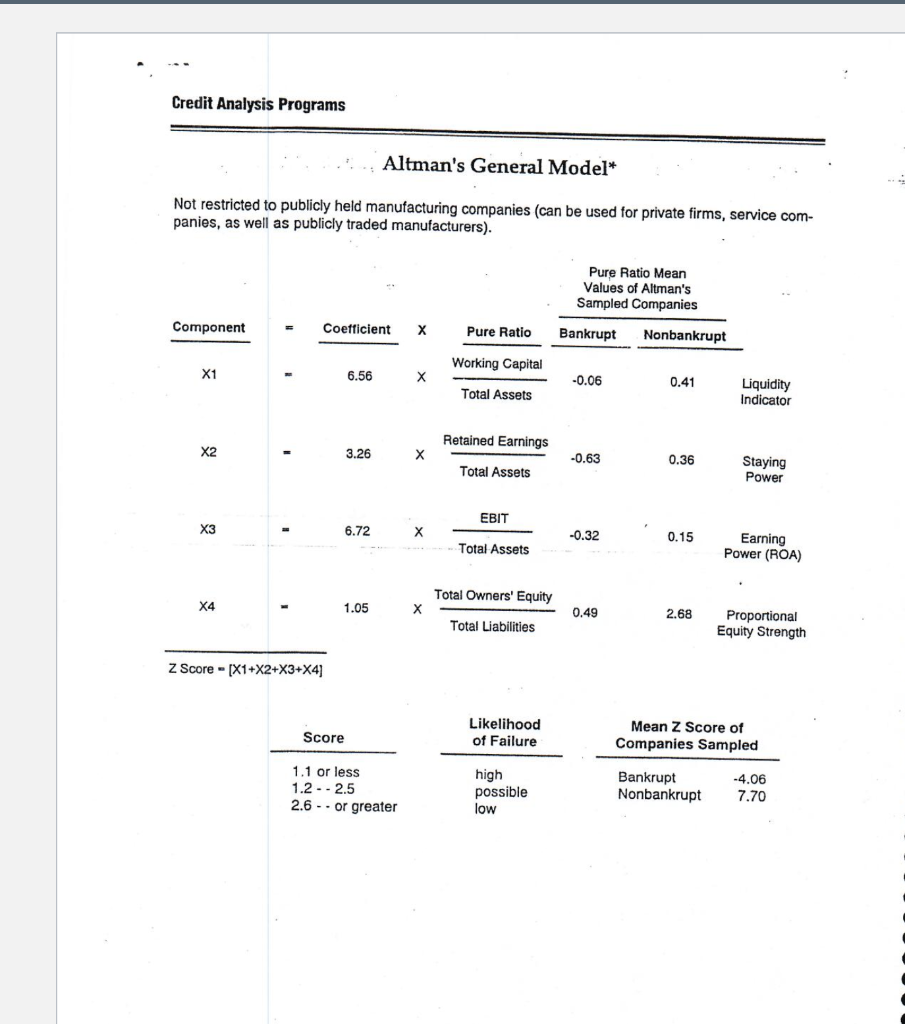

1. Calculate the 4 ratios indicated on the handout by finding the balance sheet or income statement numbers on the annual financial statements you have procured. NO NOT USE QUARTERLY FINANCIALS.

2. Working Capital = current assets - current liabilities

3. EBIT = Earnings before interest and taxes (operating income)

4. Multiply each ratio by the coefficient given in the second column. This is a constant.

5. Add up each of the 4 components. This is the Z score.

6. Interpret your score based on the information at the bottom of the page.

7. Write a brief paragraph answering the question "Were you surprised with the answer you calculated given what you know of the company?" Tell me a bit about the company you chose. What is the business in?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started