Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show all of your work to arrive at a final result. 1.) Two alternatives are being considered to perform a given job. Both of

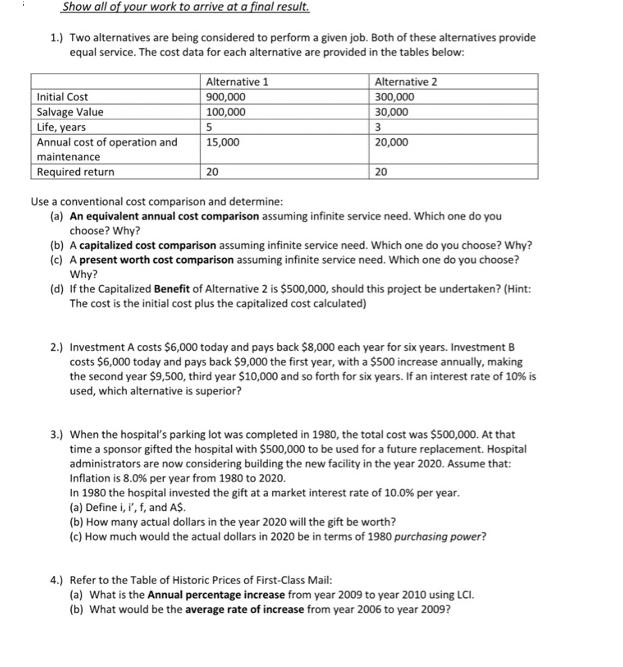

Show all of your work to arrive at a final result. 1.) Two alternatives are being considered to perform a given job. Both of these alternatives provide equal service. The cost data for each alternative are provided in the tables below: Initial Cost Salvage Value Life, years Annual cost of operation and maintenance Required return Alternative 1 900,000 100,000 5 15,000 20 Alternative 2 300,000 30,000 3 20,000 20 Use a conventional cost comparison and determine: (a) An equivalent annual cost comparison assuming infinite service need. Which one do you choose? Why? (b) A capitalized cost comparison assuming infinite service need. Which one do you choose? Why? (c) A present worth cost comparison assuming infinite service need. Which one do you choose? Why? (d) If the Capitalized Benefit of Alternative 2 is $500,000, should this project be undertaken? (Hint: The cost is the initial cost plus the capitalized cost calculated) 2.) Investment A costs $6,000 today and pays back $8,000 each year for six years. Investment B costs $6,000 today and pays back $9,000 the first year, with a $500 increase annually, making the second year $9,500, third year $10,000 and so forth for six years. If an interest rate of 10% is used, which alternative is superior? 3.) When the hospital's parking lot was completed in 1980, the total cost was $500,000. At that time a sponsor gifted the hospital with $500,000 to be used for a future replacement. Hospital administrators are now considering building the new facility in the year 2020. Assume that: Inflation is 8.0% per year from 1980 to 2020. In 1980 the hospital invested the gift at a market interest rate of 10.0% per year. (a) Define i, i', f, and A$. (b) How many actual dollars in the year 2020 will the gift be worth? (c) How much would the actual dollars in 2020 be in terms of 1980 purchasing power? 4.) Refer to the Table of Historic Prices of First-Class Mail: (a) What is the Annual percentage increase from year 2009 to year 2010 using LCI. (b) What would be the average rate of increase from year 2006 to year 2009?

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

4 Answer a Alternative 1 PW of Salvage Value 1000001205 100000125 1000002...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started