Show All Steps and euqations

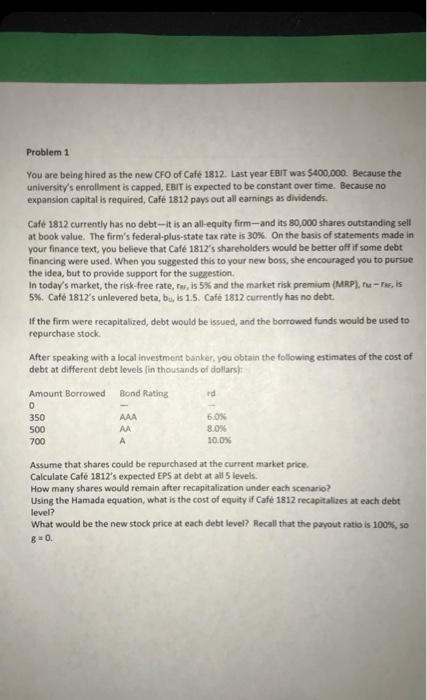

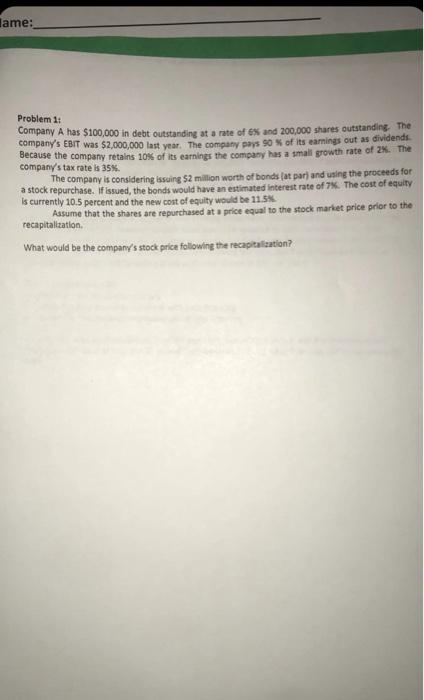

Jame: Problem 1: Company A has $100,000 in debt outstanding at a rate of ex and 200,000 shares outstanding. The company's EBIT was $2,000,000 last year. The company pays 90 % of its earnings out as dividends. Because the company retains 10% of its earnings the company has a small growth rate of 2%. The company's tax rate is 35% The company is considering issuing $2 million worth of bonds (at par) and using the proceeds for a stock repurchase. If issued, the bonds would have an estimated interest rate of 7%. The cost of equity is currently 10.5 percent and the new cost of equity would be 11.5% Assume that the shares are repurchased at a price equal to the stock market price prior to the recapitalization What would be the company's stock price following the recapitalization? Problem 2: Lyco produces premium textbooks that sell for 19.90 per book, and this year's sales are expected to be 13,000 units. Variable costs for the expected sales under present production methods are estimated at $165,000 and fixed production costs at present are $65,000. Lyco has $52,000 of debt outstanding at an Interest rate of 6.5%. At the early days of Lyco, the board of trustees each bought shares in Lyco and there are currently 7,000 shares of common stock outstanding. The dividend payout ratio is 10 percent, and Lyco has a 30% federal plus state bracket Lyco is considering investing $150,000 in new printing equipment Sales would not be affected by the new printing equipment, however variable costs would be reduced by 10%. In addition, the new printing equipment would require less labor to operate but foxed costs would increase from 65,000 to 73,000. Lyco could raise the required capital by borrowing the $150,000 from a local bank at 6% or could issue new Lyco stock by selling 2,000 additional shares at $75 per share. What would be Lyce's EDS a. under the old production process bi under the new production process with debt financing under the new production process with equity financing At what unit sales level would Lyco have the same turning it undertakes the investment and finances it with debt or with stock? Chaut yes, what financing option would be the best? Problem 1 You are being hired as the new CFO of Caf 1812. Last year EBIT was $400,000. Because the university's enrollment is capped, EBIT is expected to be constant over time. Because no expansion capital is required, Cafe 1812 pays out all earnings as dividends. Cafe 1812 currently has no debt--it is an all-equity firm-and its 80,000 shares outstanding sell at book value. The firm's federal-plus-state tax rate is 30%. On the basis of statements made in your finance text, you believe that Cafe 1812's shareholders would be better off if some debt financing were used. When you suggested this to your new boss, she encouraged you to pursue the idea, but to provide support for the suggestion In today's market, the risk-free rate, tw, is 5% and the market risk premium (MRP), tu-Tas, is 5% Caf 1812's unlevered beta, bu, is 1.5. Caf 1812 currently has no debt. If the firm were recapitalized, debt would be issued, and the borrowed funds would be used to repurchase stock After speaking with a local investment banker, you obtain the following estimates of the cost of debt at different debt levels in thousands of dollars) Amount Borrowed Bond Rating id 0 350 AAA 6.ON 500 8.ON 700 10.0% A Assume that shares could be repurchased at the current market price. Calculate Caf 1812's expected EPS at debt at all levels. How many shares would remain after recapitalization under each scenario? Using the Hamada equation, what is the cost of equity if Cafe 1812 recapitalizes at each debt level? What would be the new stock price at each debt level? Recall that the payout ratio is 100%, B0