Question: show all steps show excel amortization table also You plan to purchase a house for $600,000 using a 30-year mortgage obtained from your local bank.

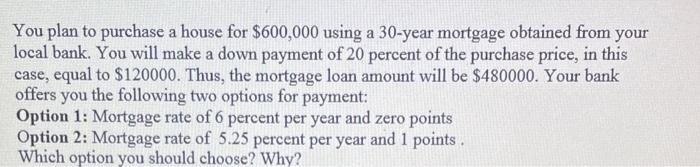

You plan to purchase a house for $600,000 using a 30-year mortgage obtained from your local bank. You will make a down payment of 20 percent of the purchase price, in this case, equal to $120000. Thus, the mortgage loan amount will be $480000. Your bank offers you the following two options for payment: Option 1: Mortgage rate of 6 percent per year and zero points Option 2: Mortgage rate of 5.25 percent per year and 1 points . Which option you should choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts