Answered step by step

Verified Expert Solution

Question

1 Approved Answer

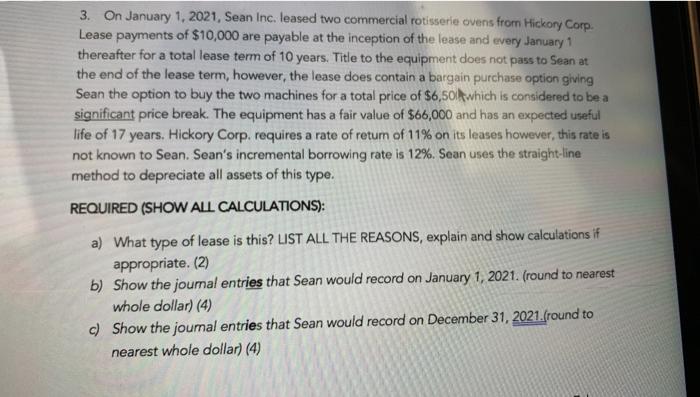

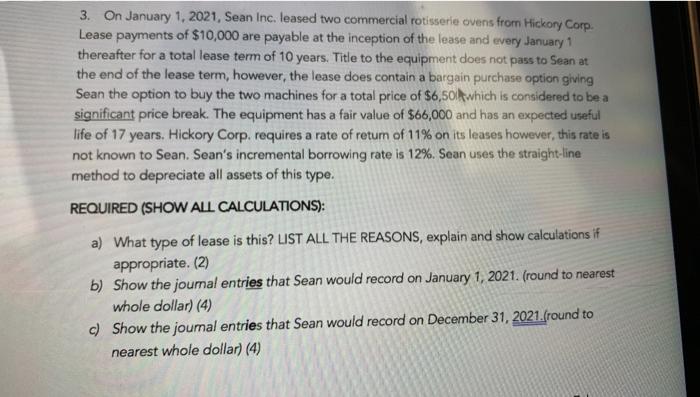

show all the work please 3. On January 1, 2021, Sean Inc. leased two commercial rotisserie ovens from Hickory Corp. Lease payments of $10,000 are

show all the work please

3. On January 1, 2021, Sean Inc. leased two commercial rotisserie ovens from Hickory Corp. Lease payments of $10,000 are payable at the inception of the lease and every January 1 thereafter for a total lease term of 10 years. Title to the equipment does not pass to Sean at the end of the lease term, however, the lease does contain a bargain purchase option giving Sean the option to buy the two machines for a total price of $6,501 which is considered to be a significant price break. The equipment has a fair value of $66,000 and has an expected useful life of 17 years. Hickory Corp. requires a rate of return of 11% on its leases however, this rate is not known to Sean. Sean's incremental borrowing rate is 12%. Sean uses the straight-line method to depreciate all assets of this type. REQUIRED (SHOW ALL CALCULATIONS): a) What type of lease is this? LIST ALL THE REASONS, explain and show calculations if appropriate. (2) b) Show the journal entries that Sean would record on January 1, 2021. (round to nearest whole dollar) (4) c) Show the journal entries that Sean would record on December 31, 2021.(round to nearest whole dollar) (4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started