Show all work for each highlighted cell.

Show all work for each highlighted cell.

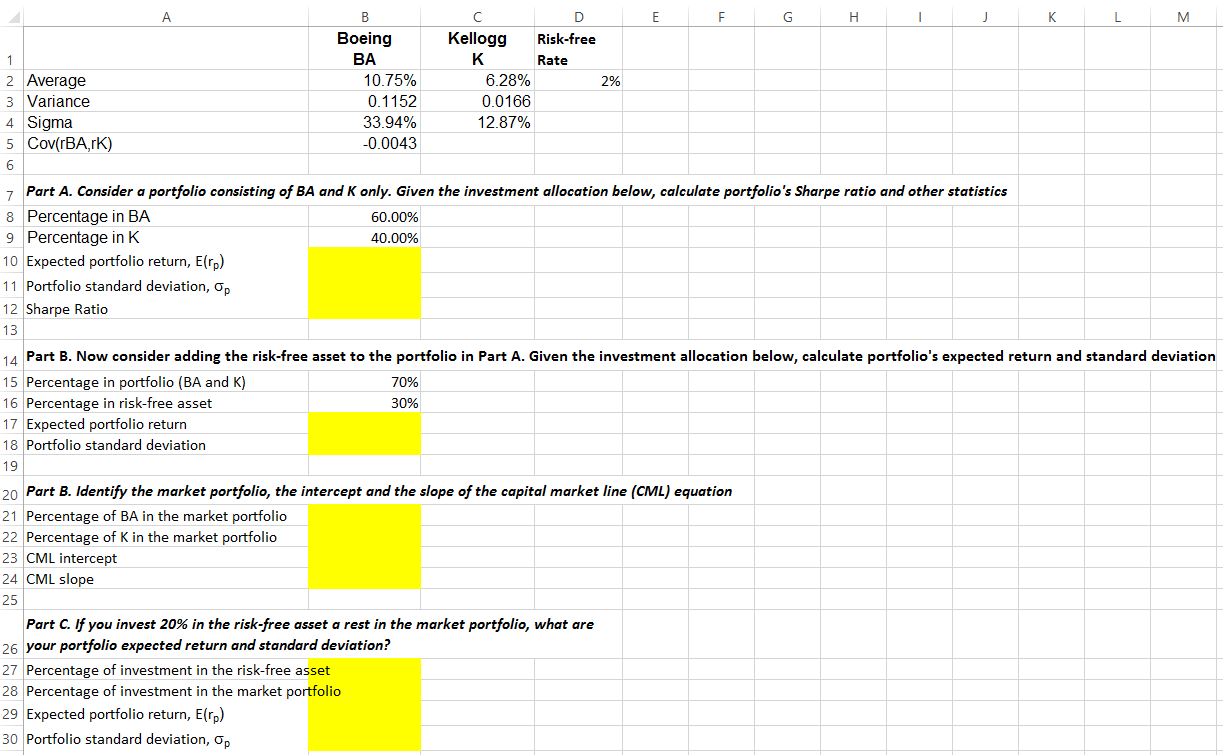

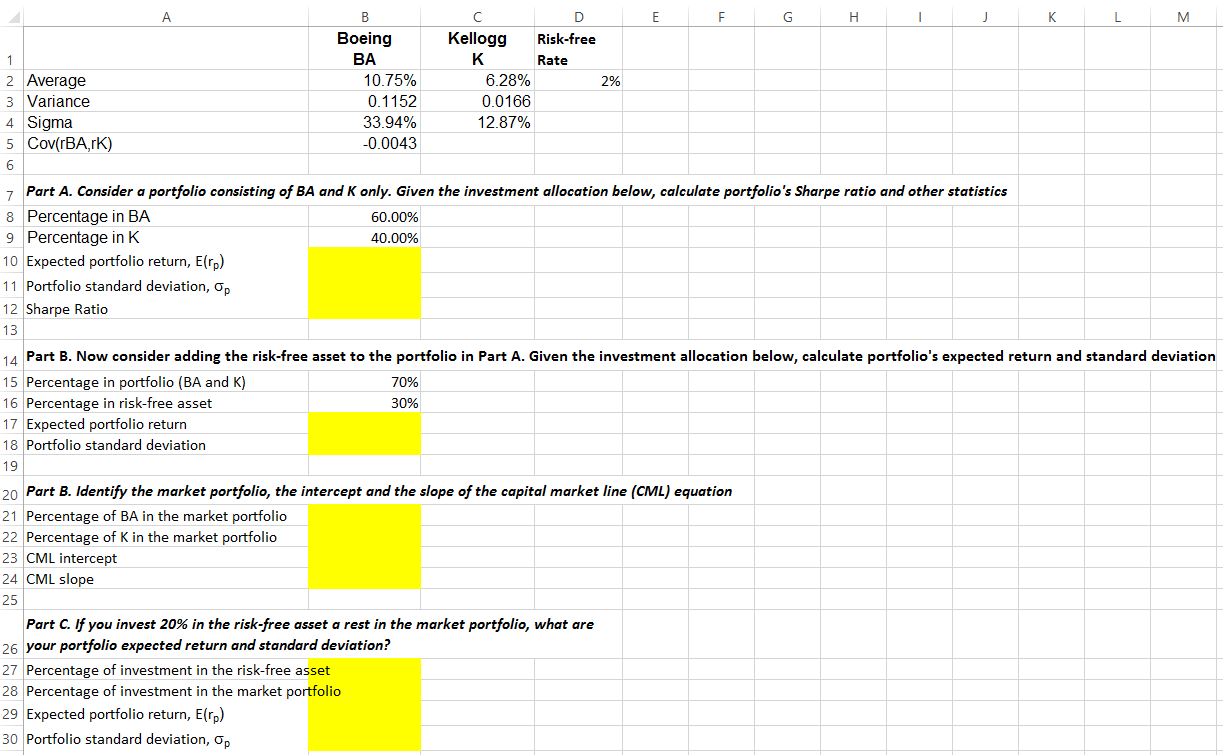

Consider a portfolio consisting of BA and K only. Given the investment allocation below, calculate portfolio's Sharpe ratio and other statistics Percentage in BA 60.00% Percentage in K 40.00% Expected portfolio return, E(r_p) Portfolio standard deviation, sigma_p Sharpe Ratio Now consider adding the risk - free asset to the portfolio in Part A. Given the investment allocation below, calculate portfolio's expected return and standard deviation Percentage in portfolio (BA and K) 70% Percentage in risk - free asset 30% Expected portfolio return Portfolio standard deviation Identify the market portfolio, the intercept and the slope of the capital market line (CML) equation Percentage of BA in the market portfolio Percentage of K in the market portfolio CML intercept CML slope If you invest 20% in the risk - free asset a rest in the market portfolio, what are your portfolio expected return and standard deviation Percentage of investment in the risk - free asset Percentage of investment in the market portfolio Expected portfolio return, E(r_p) Portfolio standard deviation, sigma_p Consider a portfolio consisting of BA and K only. Given the investment allocation below, calculate portfolio's Sharpe ratio and other statistics Percentage in BA 60.00% Percentage in K 40.00% Expected portfolio return, E(r_p) Portfolio standard deviation, sigma_p Sharpe Ratio Now consider adding the risk - free asset to the portfolio in Part A. Given the investment allocation below, calculate portfolio's expected return and standard deviation Percentage in portfolio (BA and K) 70% Percentage in risk - free asset 30% Expected portfolio return Portfolio standard deviation Identify the market portfolio, the intercept and the slope of the capital market line (CML) equation Percentage of BA in the market portfolio Percentage of K in the market portfolio CML intercept CML slope If you invest 20% in the risk - free asset a rest in the market portfolio, what are your portfolio expected return and standard deviation Percentage of investment in the risk - free asset Percentage of investment in the market portfolio Expected portfolio return, E(r_p) Portfolio standard deviation, sigma_p

Show all work for each highlighted cell.

Show all work for each highlighted cell.