Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show all work Problem 1. Hope has negotiated $50,000 price on a new BMW. The manufacturer is offering $4,000 rebate or zero%, four year financing.

show all work

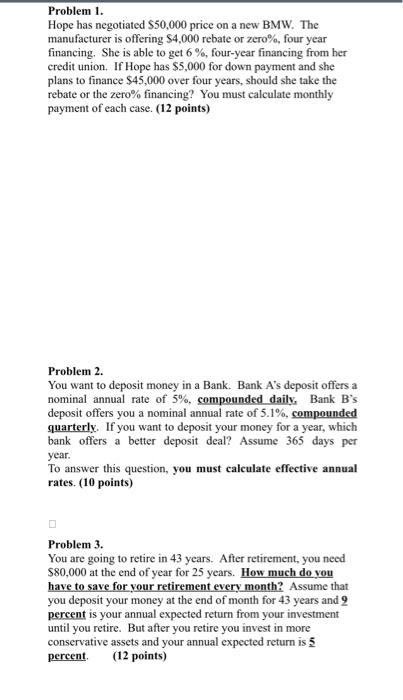

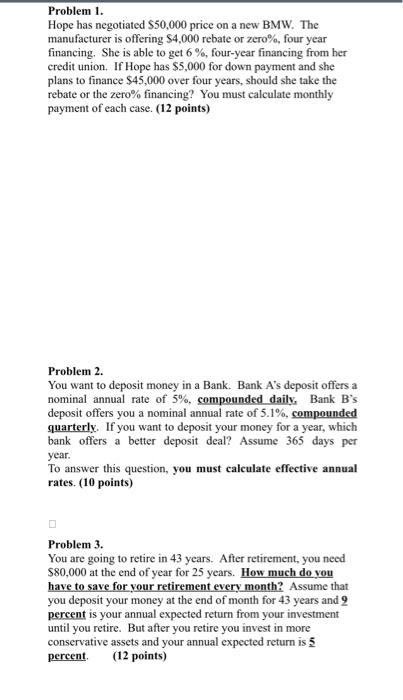

Problem 1. Hope has negotiated $50,000 price on a new BMW. The manufacturer is offering $4,000 rebate or zero%, four year financing. She is able to get 6%, four-year financing from her credit union. If Hope has $5,000 for down payment and she plans to finance $45,000 over four years, should she take the rebate or the zero% financing? You must calculate monthly payment of each case. (12 points) Problem 2. You want to deposit money in a Bank. Bank A's deposit offers a nominal annual rate of 5%, compounded daily, Bank B's deposit offers you a nominal annual rate of 5.1%, compounded quarterly. If you want to deposit your money for a year, which bank offers a better deposit deal? Assume 365 days per year. To answer this question, you must calculate effective annual rates. (10 points) Problem 3. You are going to retire in 43 years. After retirement, you need $80,000 at the end of year for 25 years. How much do you have to save for your retirement every month? Assume that you deposit your money at the end of month for 43 years and 9 percent is your annual expected return from your investment until you retire. But after you retire you invest in more conservative assets and your annual expected return is 5 percent. (12 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started