Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show all working. 2. (9 pts) Five years ago you paid $10,000 for five, 10-year $2,000 bonds to help finance Engineer Paul's worm composting farm

show all working.

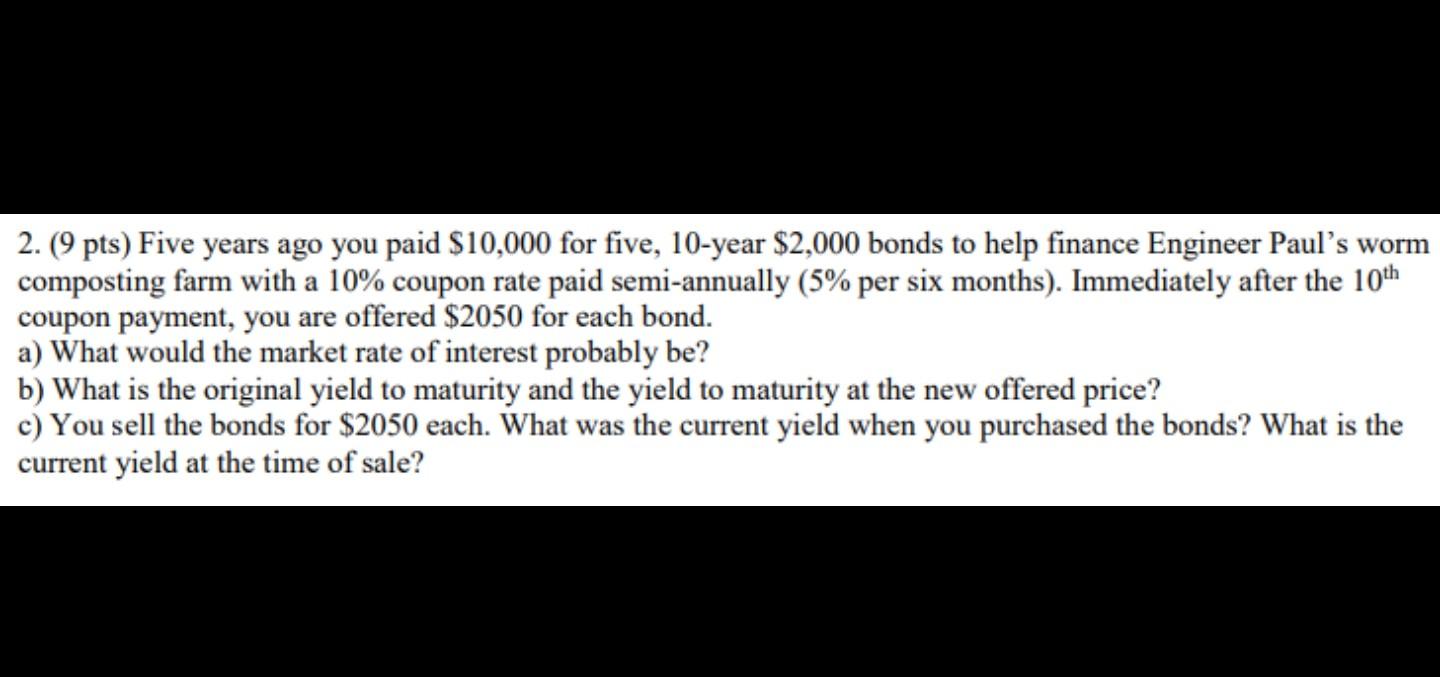

2. (9 pts) Five years ago you paid $10,000 for five, 10-year $2,000 bonds to help finance Engineer Paul's worm composting farm with a 10% coupon rate paid semi-annually (5% per six months). Immediately after the 10th coupon payment, you are offered $2050 for each bond. a) What would the market rate of interest probably be? b) What is the original yield to maturity and the yield to maturity at the new offered price? c) You sell the bonds for $2050 each. What was the current yield when you purchased the bonds? What is the current yield at the time of saleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started