Answered step by step

Verified Expert Solution

Question

1 Approved Answer

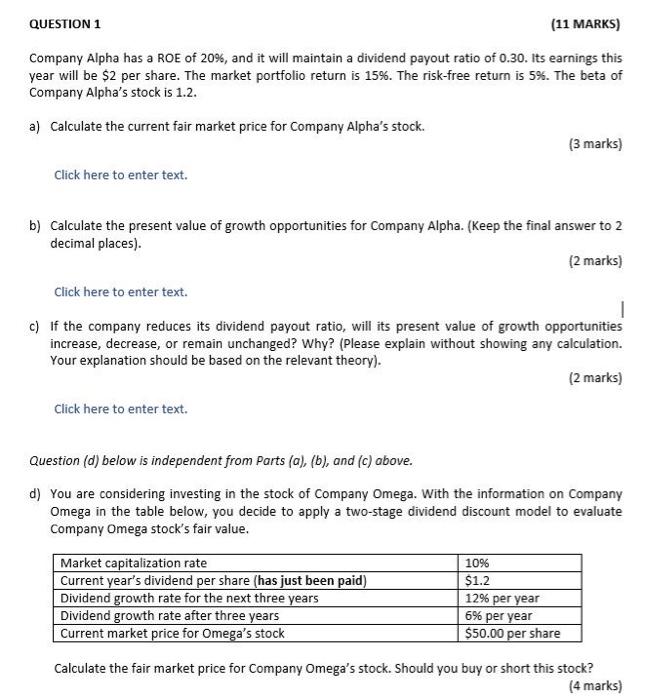

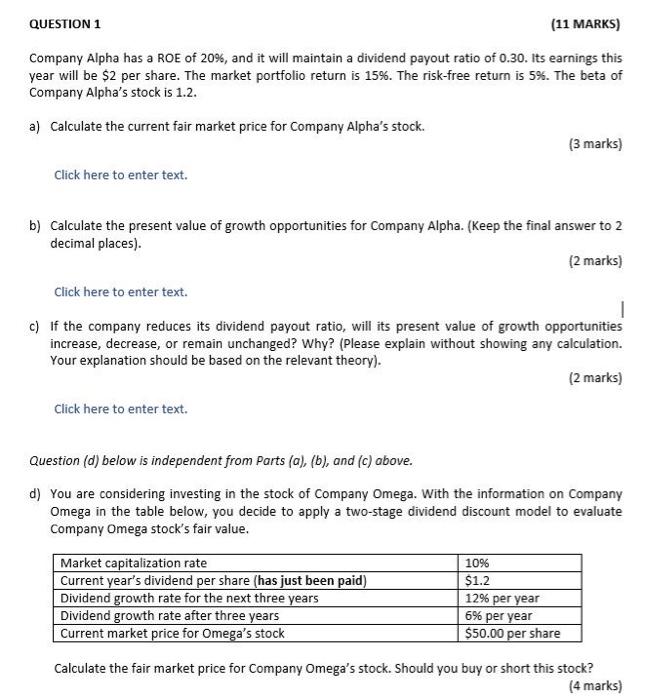

show all working QUESTION 1 (11 MARKS) Company Alpha has a ROE of 20%, and it will maintain a dividend payout ratio of 0.30. Its

show all working

QUESTION 1 (11 MARKS) Company Alpha has a ROE of 20%, and it will maintain a dividend payout ratio of 0.30. Its earnings this year will be $2 per share. The market portfolio return is 15%. The risk-free return is 5%. The beta of Company Alpha's stock is 1.2. a) Calculate the current fair market price for Company Alpha's stock. (3 marks) Click here to enter text. b) Calculate the present value of growth opportunities for Company Alpha. (Keep the final answer to 2 decimal places). (2 marks) Click here to enter text. 1 c) If the company reduces its dividend payout ratio, will its present value of growth opportunities increase, decrease, or remain unchanged? Why? (Please explain without showing any calculation. Your explanation should be based on the relevant theory). (2 marks) Click here to enter text. Question (d) below is independent from Parts (a), (b), and (c) above. d) You are considering investing in the stock of Company Omega. With the information on Company Omega in the table below, you decide to apply a two-stage dividend discount model to evaluate Company Omega stock's fair value. Market capitalization rate Current year's dividend per share (has just been paid) Dividend growth rate for the next three years Dividend growth rate after three years Current market price for Omega's stock 10% $1.2 12% per year 6% per year $50.00 per share Calculate the fair market price for Company Omega's stock. Should you buy or short this stock? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started