Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show all workings and full table also Hor 38. On 1st April, 2018 XY Ltd. has 15,000 equity shares of ABC Ltd. at a book

show all workings and full table also

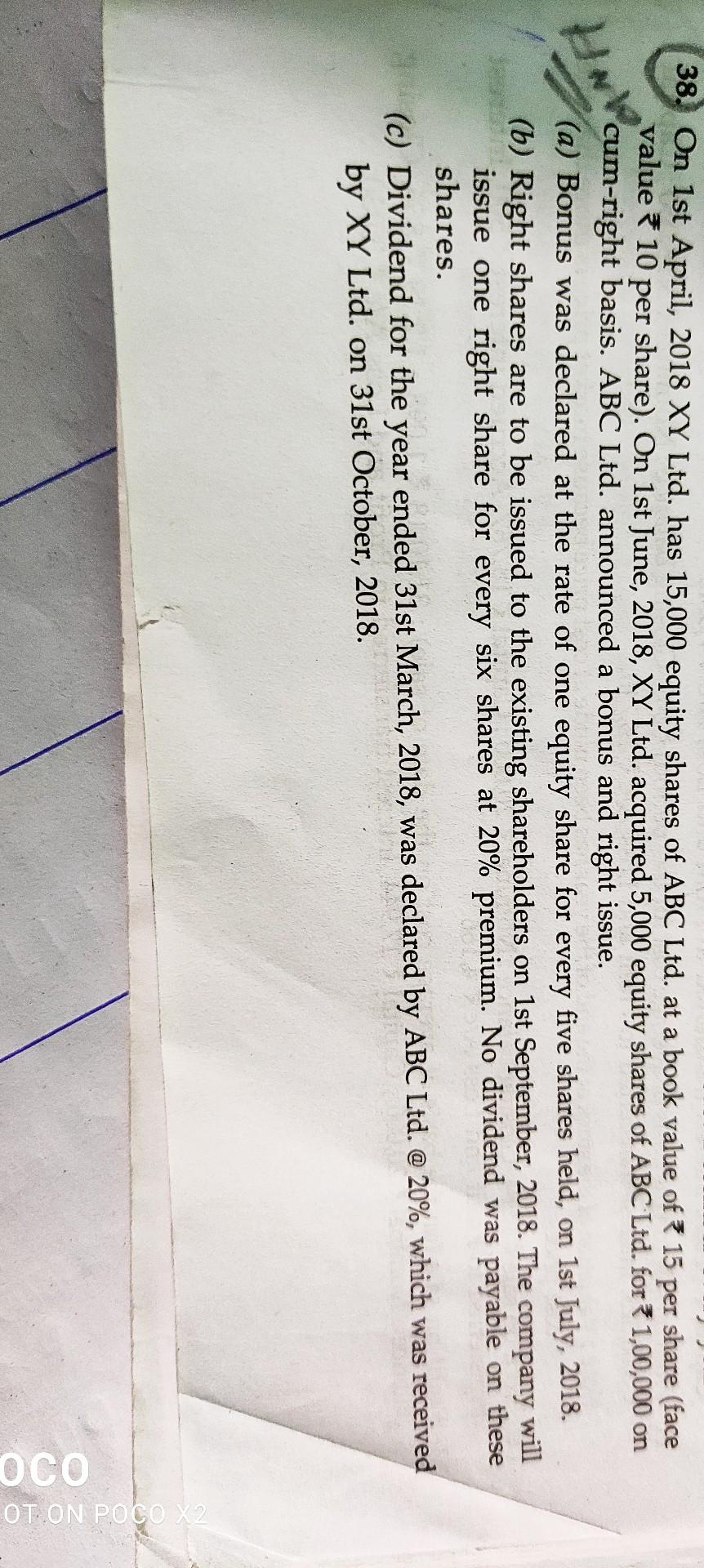

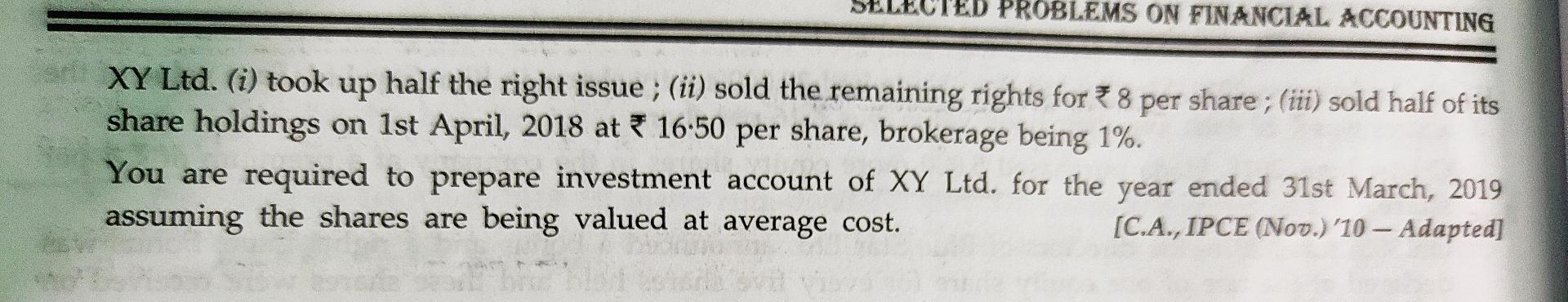

Hor 38. On 1st April, 2018 XY Ltd. has 15,000 equity shares of ABC Ltd. at a book value of * 15 per share (face value *10 per share). On 1st June, 2018, XY Ltd. acquired 5,000 equity shares of ABC Ltd. for 3 1,00,000 on cum-right basis. ABC Ltd. announced a bonus and right issue. (a) Bonus was declared at the rate of one equity share for every five shares held, on 1st July, 2018. (b) Right shares are to be issued to the existing shareholders on 1st September, 2018. The company will issue one right share for every six shares at 20% premium. No dividend was payable on these shares. (c) Dividend for the year ended 31st March, 2018, was declared by ABC Ltd. @ 20%, which was received by XY Ltd. on 31st October, 2018. OT ON POCO) PROBLEMS ON FINANCIAL ACCOUNTING XY Ltd. (i) took up half the right issue; (ii) sold the remaining rights for 8 per share; (iii) sold half of its share holdings on 1st April, 2018 at 16-50 per share, brokerage being 1%. You are required to prepare investment account of XY Ltd. for the year ended 31st March, 2019 assuming the shares are being valued at average cost. [C.A., IPCE (Nov.) '10 - Adapted]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started