show all workings as well

show all workings as well

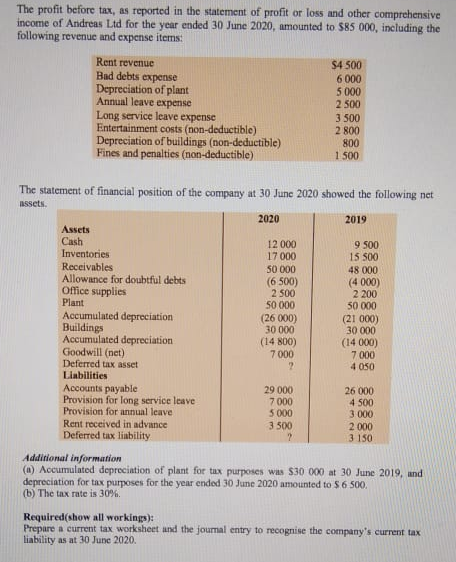

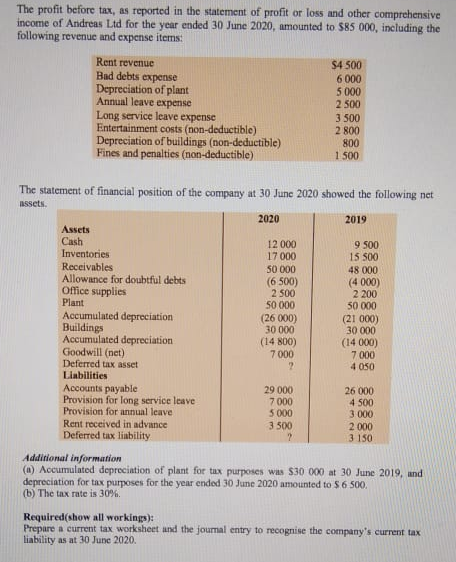

The profit before tax, as reported in the statement of profit or loss and other comprehensive income of Andreas Ltd for the year ended 30 June 2020, amounted to 585 000, including the following revenue and expense items: Rent revenue S4 500 Bad debts expense 6 000 Depreciation of plant 5 000 Annual leave expense 2 500 Long service leave expense 3 500 Entertainment costs (non-deductible) 2 800 Depreciation of buildings (non-deductible) 800 Fines and penalties (non-deductible) 1 500 The statement of financial position of the company at 30 June 2020 showed the following net assets. 2020 2019 Assets Cash 12 000 9 500 Inventories 17 000 15 500 Receivables 50 000 48 000 Allowance for doubtful debts (6 500) (4000) Office supplies 2 500 2 200 Plant 50 000 50 000 Accumulated depreciation (26 000) (21 000) Buildings 30 000 30 000 Accumulated depreciation (14 800) (14000) Goodwill (net) 7 000 7000 Deferred tax asset ? 4050 Liabilities Accounts payable 29 000 26 000 Provision for long service leave 7000 4 500 Provision for annual leave 5 000 3000 Rent received in advance 3 500 2 000 Deferred tax liability 3 150 Additional information (a) Accumulated depreciation of plant for tax purposes was $30 000 at 30 June 2019, and depreciation for tax purposes for the year ended 30 June 2020 amounted to S 6 500 (b) The tax rate is 30% Required(show all workings): Prepare a current tax worksheet and the journal entry to recognise the company's current tax liability as at 30 June 2020. The profit before tax, as reported in the statement of profit or loss and other comprehensive income of Andreas Ltd for the year ended 30 June 2020, amounted to 585 000, including the following revenue and expense items: Rent revenue S4 500 Bad debts expense 6 000 Depreciation of plant 5 000 Annual leave expense 2 500 Long service leave expense 3 500 Entertainment costs (non-deductible) 2 800 Depreciation of buildings (non-deductible) 800 Fines and penalties (non-deductible) 1 500 The statement of financial position of the company at 30 June 2020 showed the following net assets. 2020 2019 Assets Cash 12 000 9 500 Inventories 17 000 15 500 Receivables 50 000 48 000 Allowance for doubtful debts (6 500) (4000) Office supplies 2 500 2 200 Plant 50 000 50 000 Accumulated depreciation (26 000) (21 000) Buildings 30 000 30 000 Accumulated depreciation (14 800) (14000) Goodwill (net) 7 000 7000 Deferred tax asset ? 4050 Liabilities Accounts payable 29 000 26 000 Provision for long service leave 7000 4 500 Provision for annual leave 5 000 3000 Rent received in advance 3 500 2 000 Deferred tax liability 3 150 Additional information (a) Accumulated depreciation of plant for tax purposes was $30 000 at 30 June 2019, and depreciation for tax purposes for the year ended 30 June 2020 amounted to S 6 500 (b) The tax rate is 30% Required(show all workings): Prepare a current tax worksheet and the journal entry to recognise the company's current tax liability as at 30 June 2020

show all workings as well

show all workings as well