Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show all workings urgent please Personal Finance Problem P8-25 Beta coefficients and the capital asset pricing model Suppose you are your wondering how much risk

show all workings urgent please

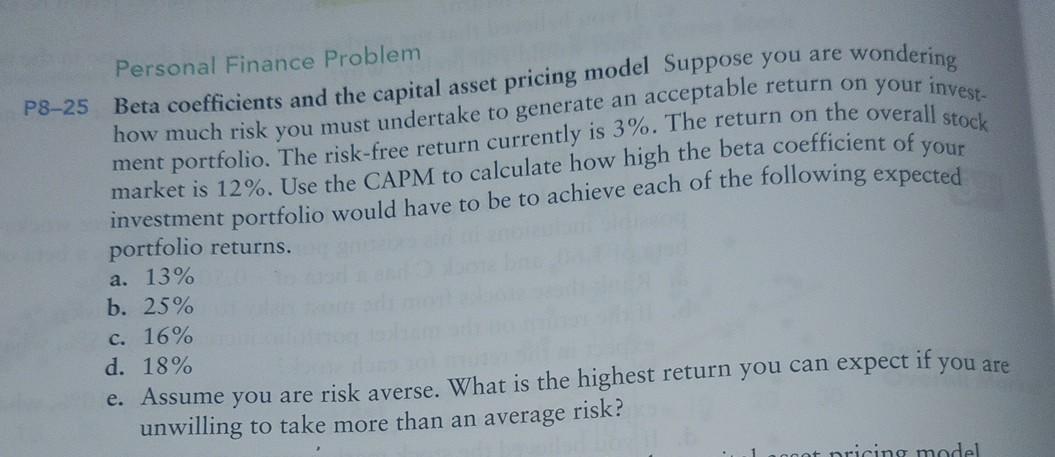

Personal Finance Problem P8-25 Beta coefficients and the capital asset pricing model Suppose you are your wondering how much risk you must undertake to generate an acceptable return on your invest- ment portfolio. The risk-free return currently is 3%. The return on the overall stock market is 12%. Use the CAPM to calculate how high the beta coefficient of investment portfolio would have to be to achieve each of the following expected portfolio returns. a. 13% b. 25% c. 16% d. 18% e. Assume you are risk averse. What is the highest return you can expect if you are unwilling to take more than an average risk? it nricing modelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started