Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show all your work. I can only give you partial credit if you show how you approached the problem! For the time value of money

Show all your work. I can only give you partial credit if you show how you approached the problem! For the time value of money computations show what information you used to calculate the answer. Do not just write down the final answer.

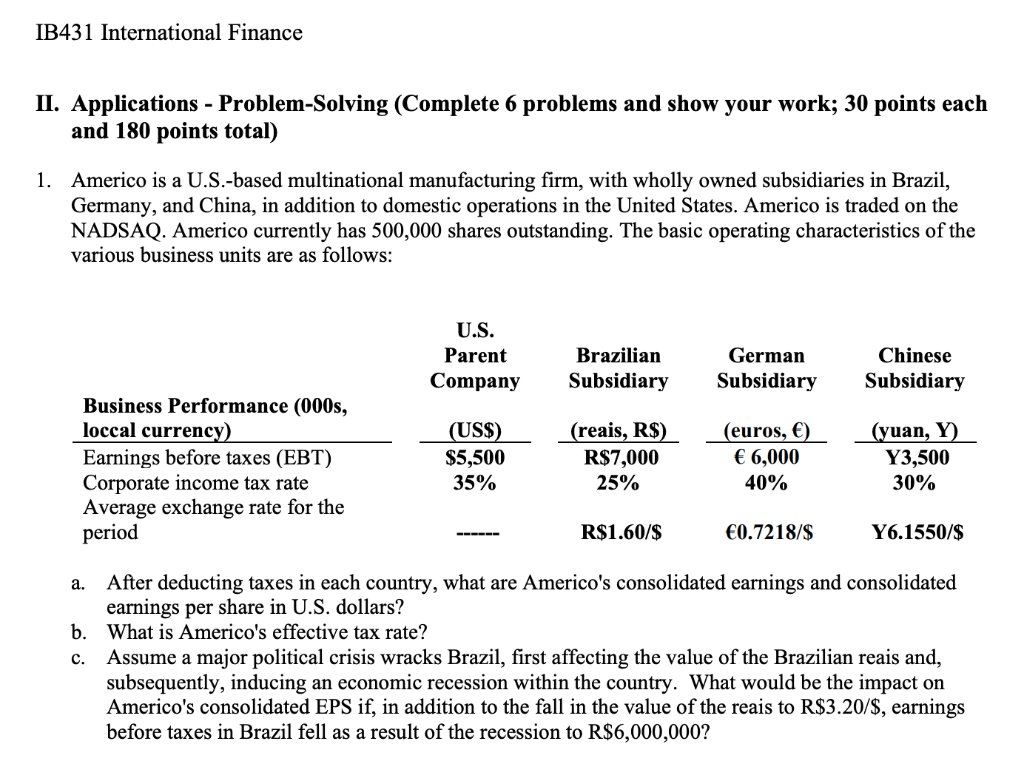

IB431 International Finance II. Applications - Problem Solving (Complete 6 problems and show your work; 30 points each and 180 points total) 1. Americo is a U.S.-based multinational manufacturing firm, with wholly owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo is traded on the NADSAQ. Americo currently has 500,000 shares outstanding. The basic operating characteristics of the various business units are as follows: U.S. Parent Company Brazilian Subsidiary German Subsidiary Chinese Subsidiary Business Performance (000s, loccal currency) Earnings before taxes (EBT) Corporate income tax rate Average exchange rate for the period (US$) $5,500 35% (reais, R$) R$7,000 25% (euros, ) 6,000 40% (yuan, Y) Y3,500 30% R$1.60/$ 0.7218/$ Y6.1550/$ a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? b. What is Americo's effective tax rate? c. Assume a major political crisis wracks Brazil, first affecting the value of the Brazilian reais and, subsequently, inducing an economic recession within the country. What would be the impact on Americo's consolidated EPS if, in addition to the fall in the value of the reais to R$3.20/$, earnings before taxes in Brazil fell as a result of the recession to R$6,000,000? IB431 International Finance II. Applications - Problem Solving (Complete 6 problems and show your work; 30 points each and 180 points total) 1. Americo is a U.S.-based multinational manufacturing firm, with wholly owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo is traded on the NADSAQ. Americo currently has 500,000 shares outstanding. The basic operating characteristics of the various business units are as follows: U.S. Parent Company Brazilian Subsidiary German Subsidiary Chinese Subsidiary Business Performance (000s, loccal currency) Earnings before taxes (EBT) Corporate income tax rate Average exchange rate for the period (US$) $5,500 35% (reais, R$) R$7,000 25% (euros, ) 6,000 40% (yuan, Y) Y3,500 30% R$1.60/$ 0.7218/$ Y6.1550/$ a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? b. What is Americo's effective tax rate? c. Assume a major political crisis wracks Brazil, first affecting the value of the Brazilian reais and, subsequently, inducing an economic recession within the country. What would be the impact on Americo's consolidated EPS if, in addition to the fall in the value of the reais to R$3.20/$, earnings before taxes in Brazil fell as a result of the recession to R$6,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started