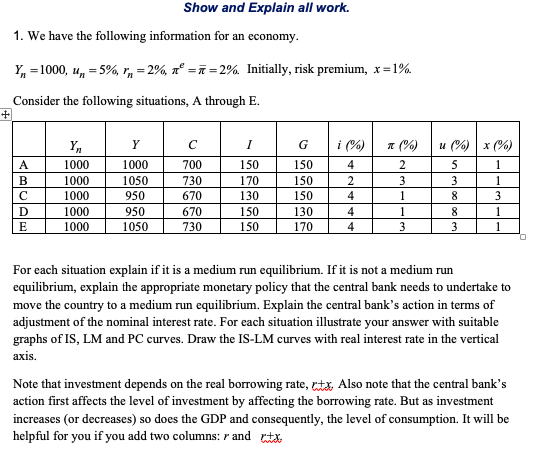

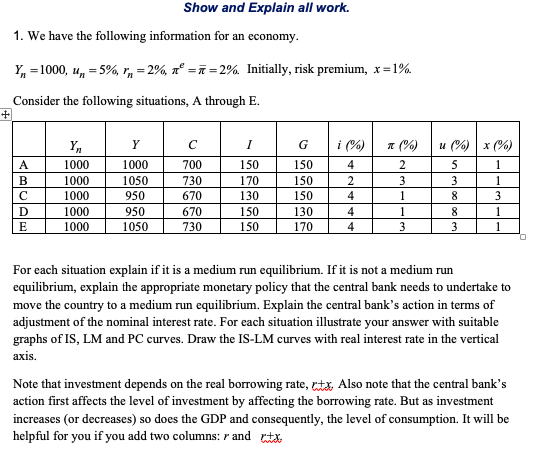

Show and Explain all work. 1. We have the following information for an economy. Y = 1000, un 5% -2%, ==2%. Initially, risk premium, x=1%. Consider the following situations, A through E. + A B D E Yn 1000 1000 1000 1000 1000 1000 1050 950 950 1050 700 730 670 670 730 1 150 170 130 150 150 G 150 150 150 130 170 i %) 4 2 4 4 4 * (%) 2 3 1 1 3 u (%) * (%) 5 1 3 1 8 3 8 1 3 1 For each situation explain if it is a medium run equilibrium. If it is not a medium run equilibrium, explain the appropriate monetary policy that the central bank needs to undertake to move the country to a medium run equilibrium. Explain the central bank's action in terms of adjustment of the nominal interest rate. For each situation illustrate your answer with suitable graphs of IS, LM and PC curves. Draw the IS-LM curves with real interest rate in the vertical axis. Note that investment depends on the real borrowing rate, ctx. Also note that the central bank's action first affects the level of investment by affecting the borrowing rate. But as investment increases (or decreases) so does the GDP and consequently, the level of consumption. It will be helpful for you if you add two columns: r and rtx Show and Explain all work. 1. We have the following information for an economy. Y = 1000, un 5% -2%, ==2%. Initially, risk premium, x=1%. Consider the following situations, A through E. + A B D E Yn 1000 1000 1000 1000 1000 1000 1050 950 950 1050 700 730 670 670 730 1 150 170 130 150 150 G 150 150 150 130 170 i %) 4 2 4 4 4 * (%) 2 3 1 1 3 u (%) * (%) 5 1 3 1 8 3 8 1 3 1 For each situation explain if it is a medium run equilibrium. If it is not a medium run equilibrium, explain the appropriate monetary policy that the central bank needs to undertake to move the country to a medium run equilibrium. Explain the central bank's action in terms of adjustment of the nominal interest rate. For each situation illustrate your answer with suitable graphs of IS, LM and PC curves. Draw the IS-LM curves with real interest rate in the vertical axis. Note that investment depends on the real borrowing rate, ctx. Also note that the central bank's action first affects the level of investment by affecting the borrowing rate. But as investment increases (or decreases) so does the GDP and consequently, the level of consumption. It will be helpful for you if you add two columns: r and rtx