Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show Attempt History Current Attempt in Progress Crane Manufacturing uses a job-order costing system. On May 1, the company has a balance in Work

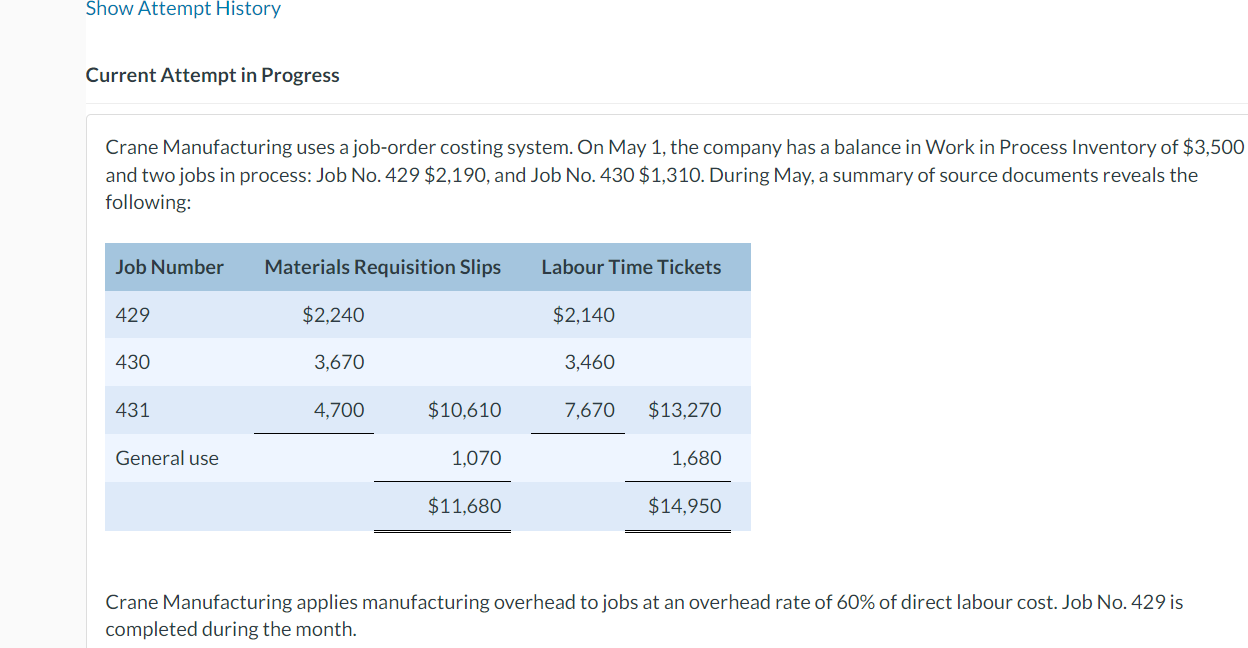

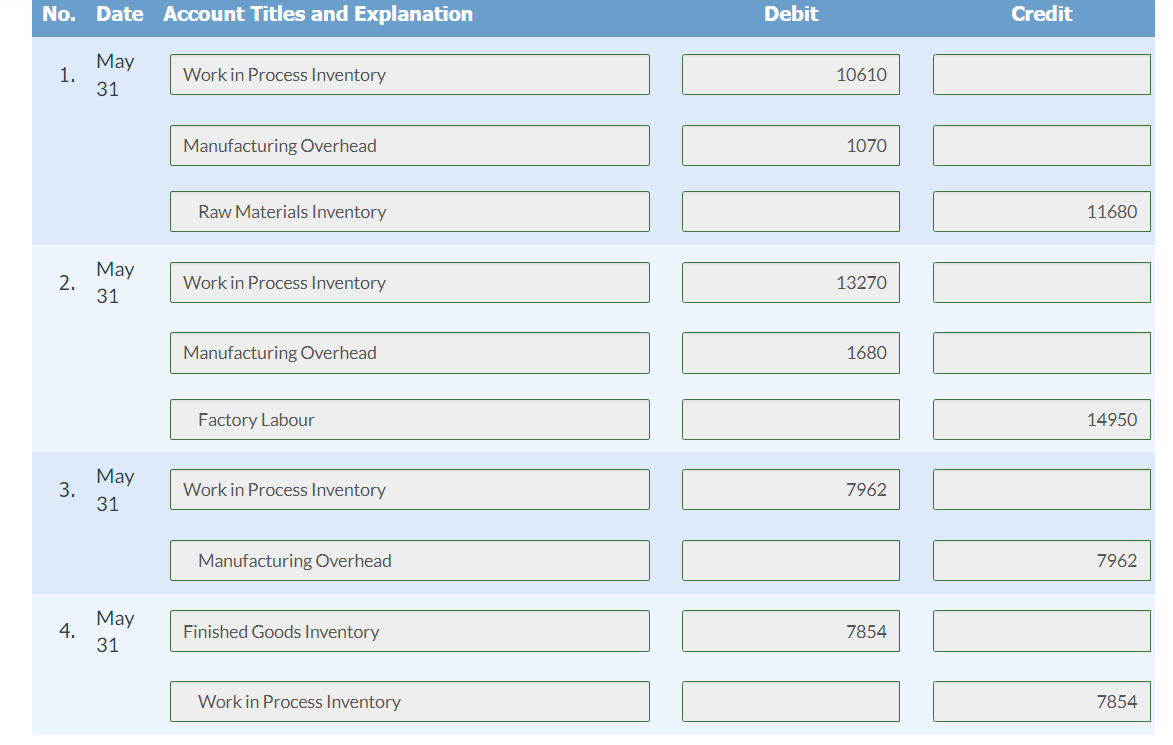

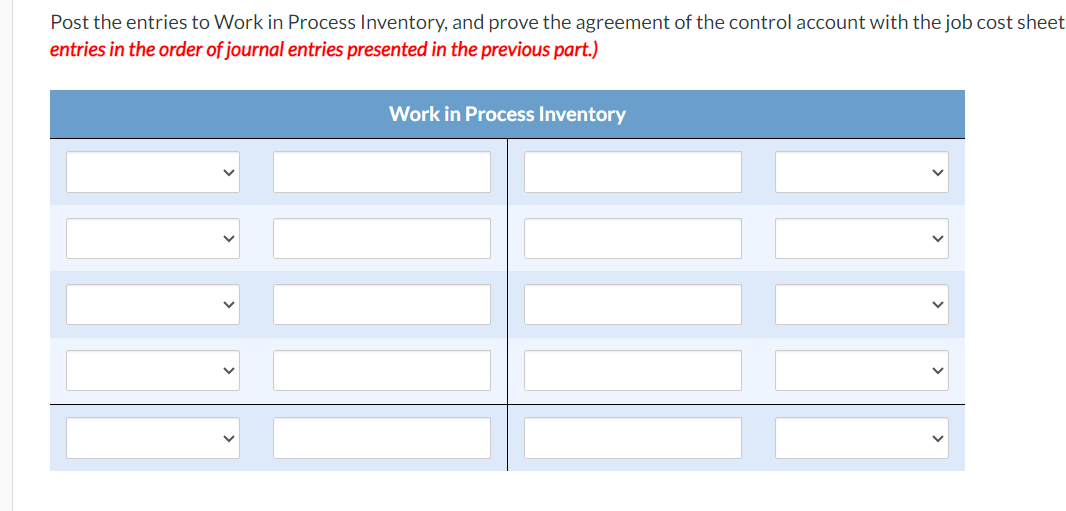

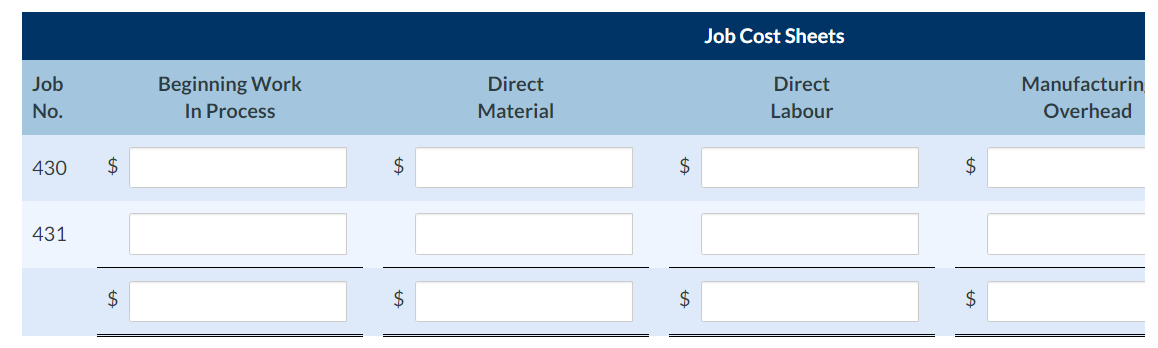

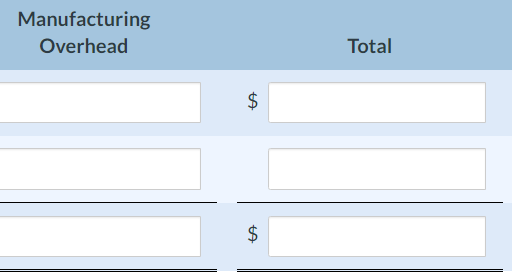

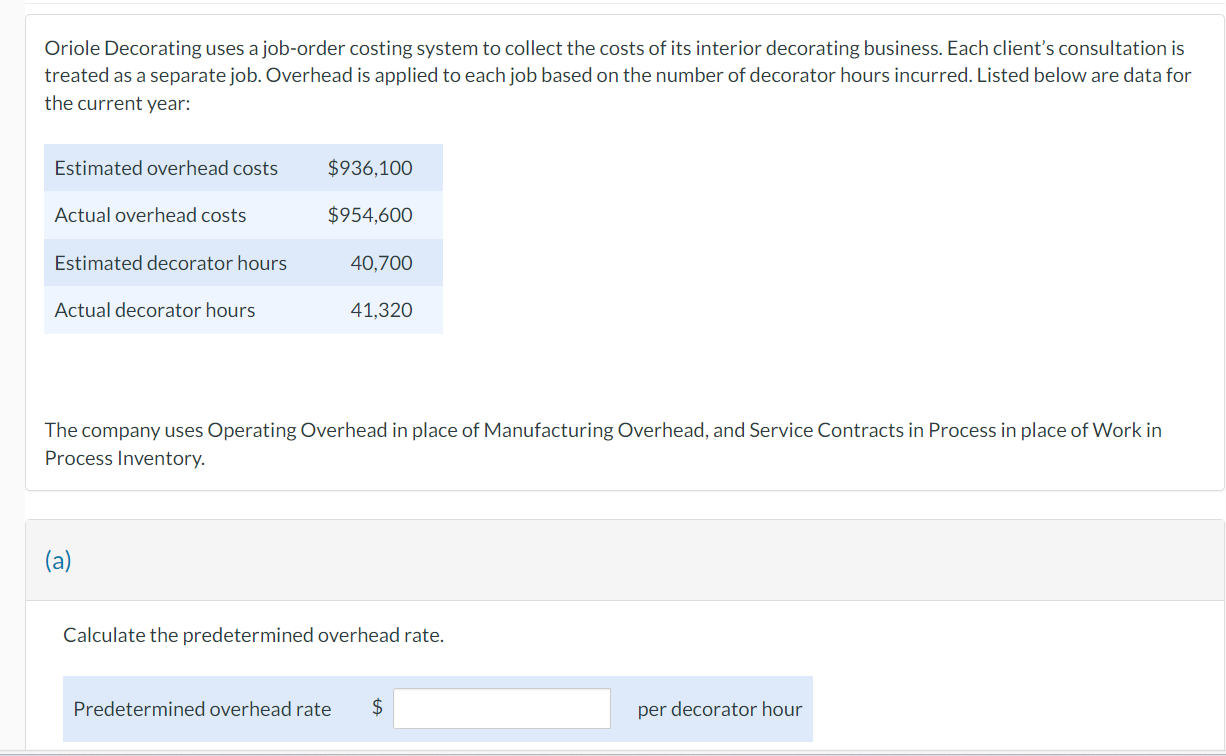

Show Attempt History Current Attempt in Progress Crane Manufacturing uses a job-order costing system. On May 1, the company has a balance in Work in Process Inventory of $3,500 and two jobs in process: Job No. 429 $2,190, and Job No. 430 $1,310. During May, a summary of source documents reveals the following: Job Number Materials Requisition Slips Labour Time Tickets 429 $2.240 $2,140 430 3,670 3,460 431 4,700 $10,610 7,670 $13,270 General use 1,070 1,680 $11,680 $14,950 Crane Manufacturing applies manufacturing overhead to jobs at an overhead rate of 60% of direct labour cost. Job No. 429 is completed during the month. No. Date Account Titles and Explanation 1. May 31 Work in Process Inventory Manufacturing Overhead Raw Materials Inventory Debit 10610 1070 May 13270 2. Work in Process Inventory 31 Manufacturing Overhead Factory Labour 1680 May 7962 3. Work in Process Inventory 31 Manufacturing Overhead May 4. Finished Goods Inventory 31 Work in Process Inventory 7854 Credit 11680 14950 7962 7854 Post the entries to Work in Process Inventory, and prove the agreement of the control account with the job cost sheet entries in the order of journal entries presented in the previous part.) Work in Process Inventory Job No. 430 $ 431 Beginning Work In Process $ Direct Material Job Cost Sheets Direct Manufacturin Labour Overhead $ $ $ $ $ $ Manufacturing Overhead +A $ Total Oriole Decorating uses a job-order costing system to collect the costs of its interior decorating business. Each client's consultation is treated as a separate job. Overhead is applied to each job based on the number of decorator hours incurred. Listed below are data for the current year: Estimated overhead costs $936,100 Actual overhead costs $954,600 Estimated decorator hours 40,700 Actual decorator hours 41,320 The company uses Operating Overhead in place of Manufacturing Overhead, and Service Contracts in Process in place of Work in Process Inventory. (a) Calculate the predetermined overhead rate. Predetermined overhead rate $ per decorator hour

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started