Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show Attempt History Current Attempt in Progress The Sandhill Products Co. currently has debt with a market value of $275 million outstanding. The debt consists

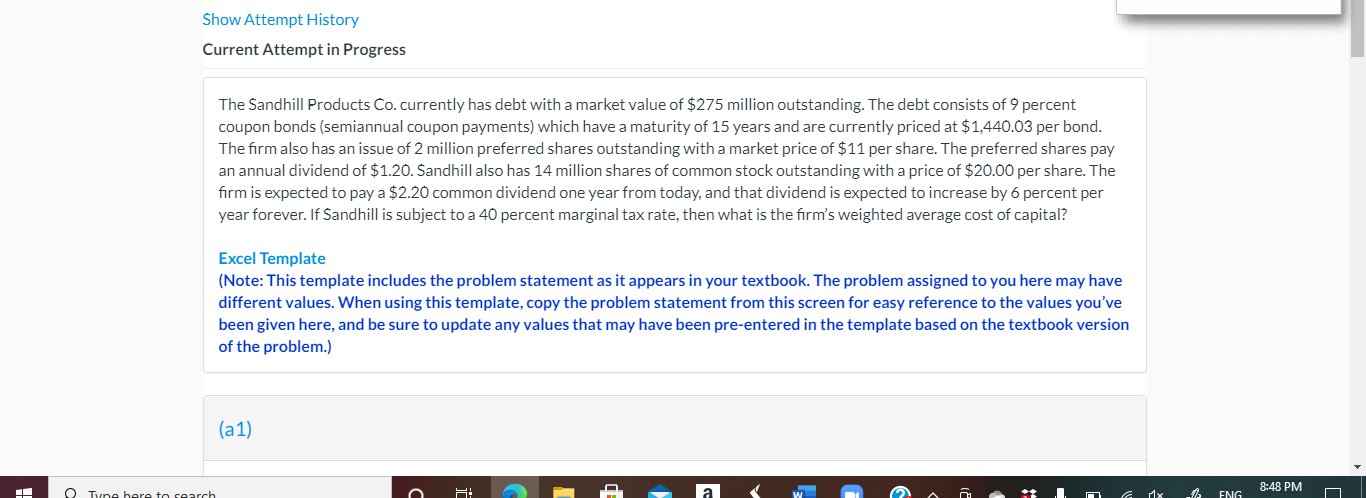

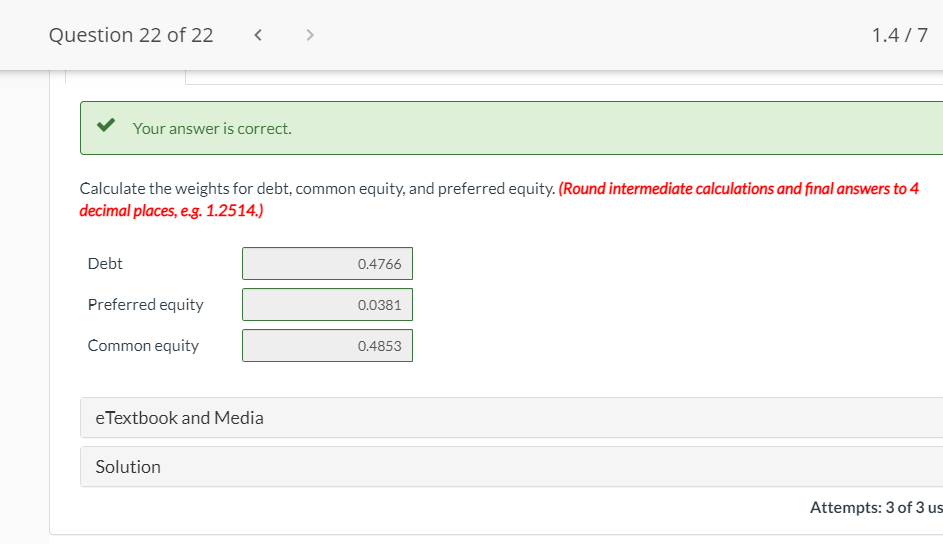

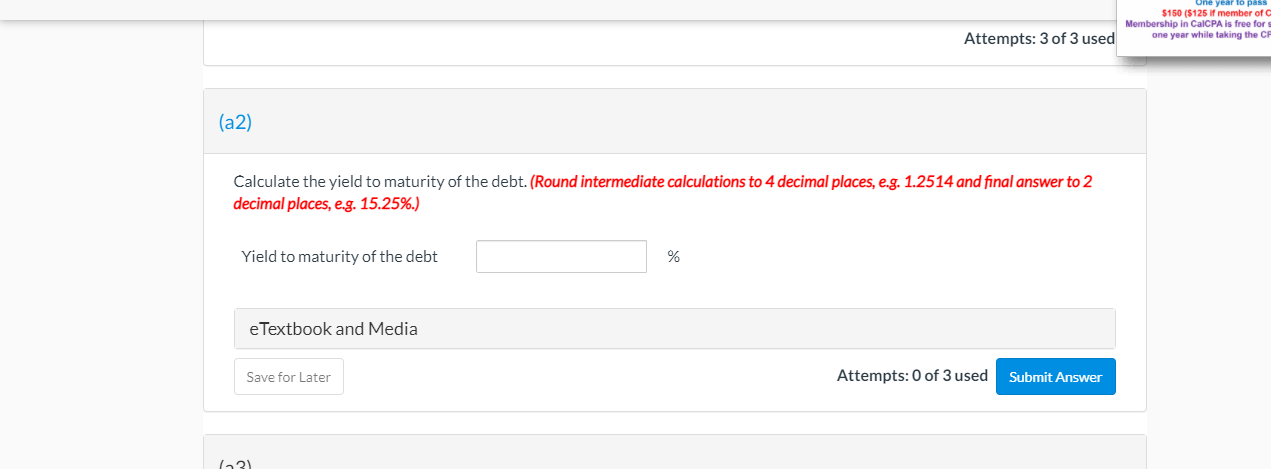

Show Attempt History Current Attempt in Progress The Sandhill Products Co. currently has debt with a market value of $275 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15 years and are currently priced at $1,440.03 per bond. The firm also has an issue of 2 million preferred shares outstanding with a market price of $11 per share. The preferred shares pay an annual dividend of $1.20. Sandhill also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 6 percent per year forever. If Sandhill is subject to a 40 percent marginal tax rate, then what is the firm's weighted average cost of capital? Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) (a 1) 8:48 PM Tyne here to search HI ma *** nx ENG Question 22 of 22 1.4/7 Your answer is correct. Calculate the weights for debt, common equity, and preferred equity. (Round intermediate calculations and final answers to 4 decimal places, e.g. 1.2514.) Debt 0.4766 Preferred equity 0.0381 Common equity 0.4853 eTextbook and Media Solution Attempts: 3 of 3 us $150 ($125 if member of Membership in CalCPA is free for one year while taking the CF Attempts: 3 of 3 used (a2) Calculate the yield to maturity of the debt. (Round intermediate calculations to 4 decimal places, e.g. 1.2514 and final answer to 2 decimal places, e.g. 15.25%.) Yield to maturity of the debt % e Textbook and Media Save for Later Attempts: 0 of 3 used Submit Answer G21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started