Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show calculation and which one is correct? On 1 Jan 2018 Co A acquires equipment for its manufacturing plant and receives a government grant of

show calculation and which one is correct?

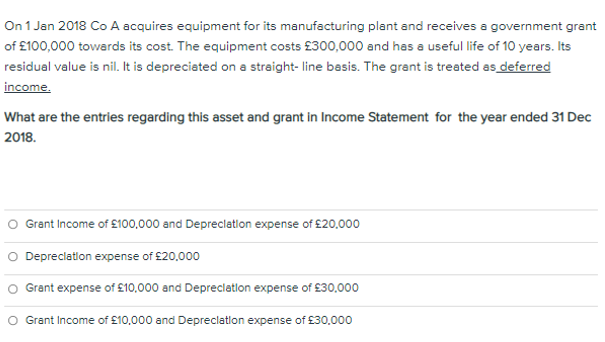

On 1 Jan 2018 Co A acquires equipment for its manufacturing plant and receives a government grant of 100,000 towards its cost. The equipment costs 300,000 and has a useful life of 10 years. Its residual value is nil. It is depreciated on a straight-line basis. The grant is treated as deferred income. What are the entries regarding this asset and grant in Income Statement for the year ended 31 Dec 2018. Grant Income of 100.000 and Depreciation expense of 20.000 O Depreciation expense of 20,000 Grant expense of 10,000 and Depreciation expense of 30,000 O Grant Income of 10,000 and Depreciation expense of 30.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started