Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SHOW CALCULATION Q2. In the following are Treasury bill quotes from the Wall Street Journal (i.e.quoted based on the bank discount yield, IBD = (FV-P)/FV)*(360)).

SHOW CALCULATION

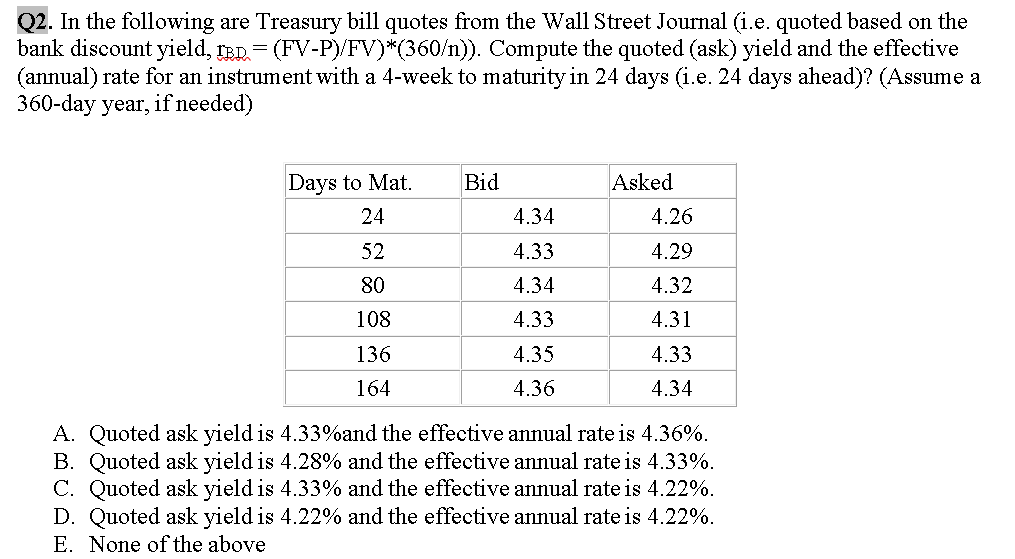

Q2. In the following are Treasury bill quotes from the Wall Street Journal (i.e.quoted based on the bank discount yield, IBD = (FV-P)/FV)*(360)). Compute the quoted (ask) yield and the effective (annual) rate for an instrument with a 4-week to maturity in 24 days (i.e. 24 days ahead)? (Assume a 360-day year, if needed) Bid Days to Mat. 24 Asked 4.26 52 4.34 4.33 4.34 4.33 80 4.29 4.32 4.31 108 136 4.35 4.33 4.34 164 4.36 A. Quoted ask yield is 4.33%and the effective annual rate is 4.36%. B. Qu ask yield is 4.28% and the effective annual rate is 4.33%. C. Quoted ask yield is 4.33% and the effective annual rate is 4.22%. D. Quoted ask yield is 4.22% and the effective annual rate is 4.22%. E. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started