Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show calculation steps please. Thanks. To use prepare entries and calculations for a manufacturer using a job order costing system. Hint: . For requirement (c)

Show calculation steps please. Thanks.

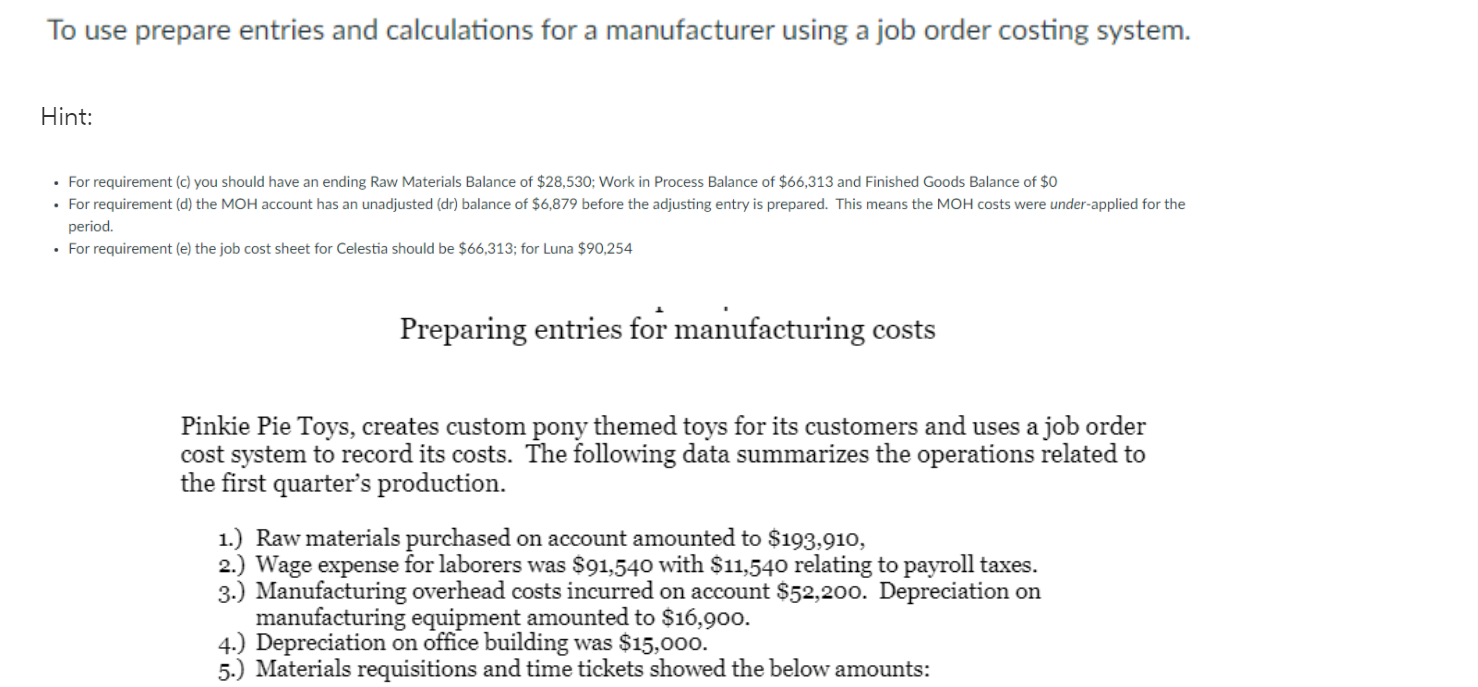

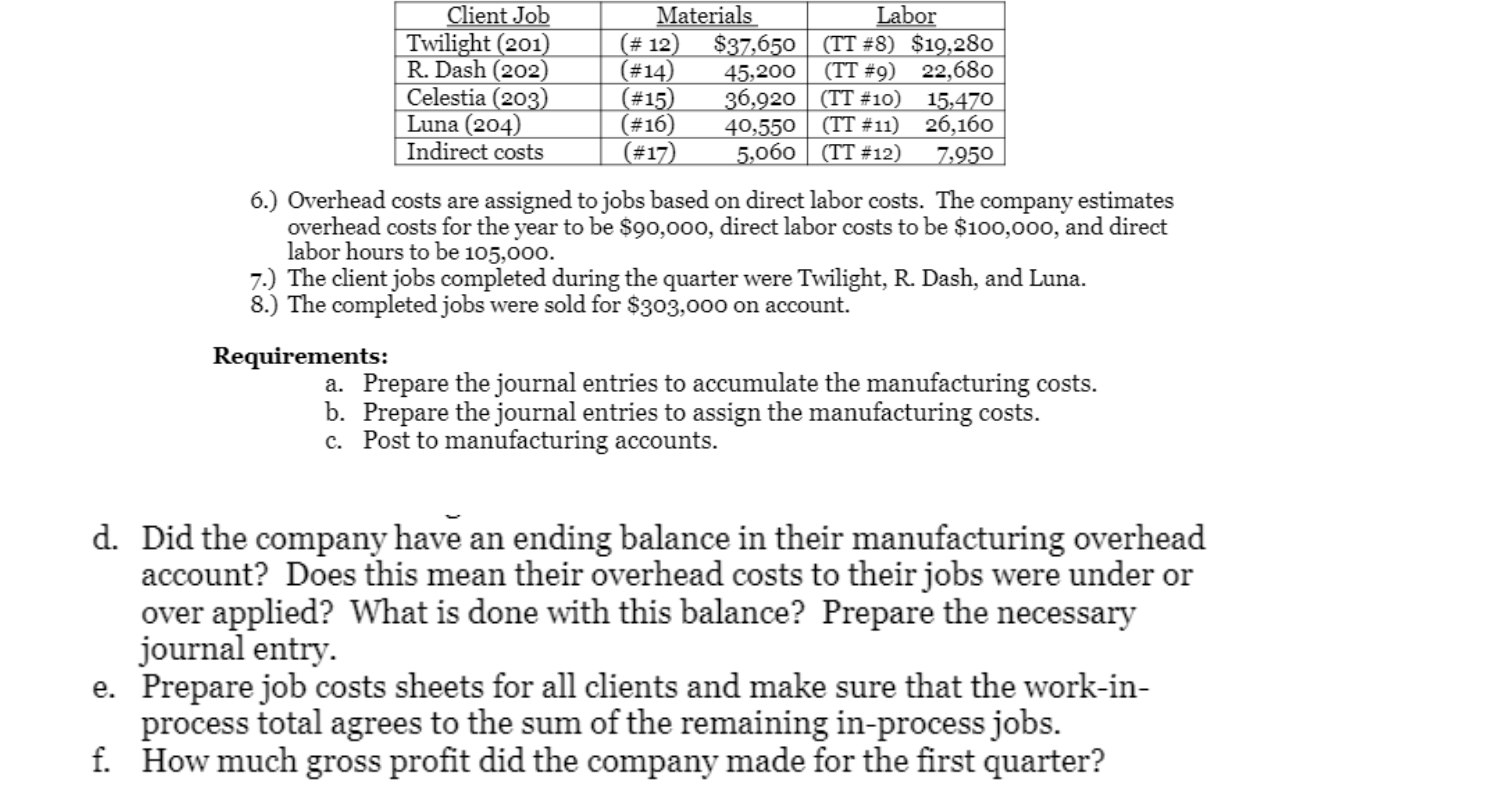

To use prepare entries and calculations for a manufacturer using a job order costing system. Hint: . For requirement (c) you should have an ending Raw Materials Balance of $28,530; Work in Process Balance of $66,313 and Finished Goods Balance of $0 For requirement (d) the MOH account has an unadjusted (dr) balance of $6,879 before the adjusting entry is prepared. This means the MOH costs were under-applied for the period. . For requirement (e) the job cost sheet for Celestia should be $66,313; for Luna $90,254 Preparing entries for manufacturing costs Pinkie Pie Toys, creates custom pony themed toys for its customers and uses a job order cost system to record its costs. The following data summarizes the operations related to the first quarter's production. 1.) Raw materials purchased on account amounted to $193,910, 2.) Wage expense for laborers was $91,540 with $11,540 relating to payroll taxes. 3.) Manufacturing overhead costs incurred on account $52,200. Depreciation on manufacturing equipment amounted to $16,900. 4.) Depreciation on office building was $15,000. 5.) Materials requisitions and time tickets showed the below amounts: Client Job Materials Labor Twilight (201) (# 12) $37,650 (TT #8) $19,280 R. Dash (202) (#14) 45,200 (TT #9) 22,680 Celestia (203) (#15) 36,920 (TT #10) 15,470 Luna (204) (#16) 40,550 (TT #11) 26,160 Indirect costs (#17) 5,060 (TT #12) 7,950 6.) Overhead costs are assigned to jobs based on direct labor costs. The company estimates overhead costs for the year to be $90,000, direct labor costs to be $100,000, and direct labor hours to be 105,000. 7.) The client jobs completed during the quarter were Twilight, R. Dash, and Luna. 8.) The completed jobs were sold for $303,000 on account. Requirements: a. Prepare the journal entries to accumulate the manufacturing costs. b. Prepare the journal entries to assign the manufacturing costs. c. Post to manufacturing accounts. d. Did the company have an ending balance in their manufacturing overhead account? Does this mean their overhead costs to their jobs were under or over applied? What is done with this balance? Prepare the necessary journal entry. e. Prepare job costs sheets for all clients and make sure that the work-in- process total agrees to the sum of the remaining in-process jobs. f. How much gross profit did the company made for the first quarter? To use prepare entries and calculations for a manufacturer using a job order costing system. Hint: . For requirement (c) you should have an ending Raw Materials Balance of $28,530; Work in Process Balance of $66,313 and Finished Goods Balance of $0 For requirement (d) the MOH account has an unadjusted (dr) balance of $6,879 before the adjusting entry is prepared. This means the MOH costs were under-applied for the period. . For requirement (e) the job cost sheet for Celestia should be $66,313; for Luna $90,254 Preparing entries for manufacturing costs Pinkie Pie Toys, creates custom pony themed toys for its customers and uses a job order cost system to record its costs. The following data summarizes the operations related to the first quarter's production. 1.) Raw materials purchased on account amounted to $193,910, 2.) Wage expense for laborers was $91,540 with $11,540 relating to payroll taxes. 3.) Manufacturing overhead costs incurred on account $52,200. Depreciation on manufacturing equipment amounted to $16,900. 4.) Depreciation on office building was $15,000. 5.) Materials requisitions and time tickets showed the below amounts: Client Job Materials Labor Twilight (201) (# 12) $37,650 (TT #8) $19,280 R. Dash (202) (#14) 45,200 (TT #9) 22,680 Celestia (203) (#15) 36,920 (TT #10) 15,470 Luna (204) (#16) 40,550 (TT #11) 26,160 Indirect costs (#17) 5,060 (TT #12) 7,950 6.) Overhead costs are assigned to jobs based on direct labor costs. The company estimates overhead costs for the year to be $90,000, direct labor costs to be $100,000, and direct labor hours to be 105,000. 7.) The client jobs completed during the quarter were Twilight, R. Dash, and Luna. 8.) The completed jobs were sold for $303,000 on account. Requirements: a. Prepare the journal entries to accumulate the manufacturing costs. b. Prepare the journal entries to assign the manufacturing costs. c. Post to manufacturing accounts. d. Did the company have an ending balance in their manufacturing overhead account? Does this mean their overhead costs to their jobs were under or over applied? What is done with this balance? Prepare the necessary journal entry. e. Prepare job costs sheets for all clients and make sure that the work-in- process total agrees to the sum of the remaining in-process jobs. f. How much gross profit did the company made for the first quarterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started