Answered step by step

Verified Expert Solution

Question

1 Approved Answer

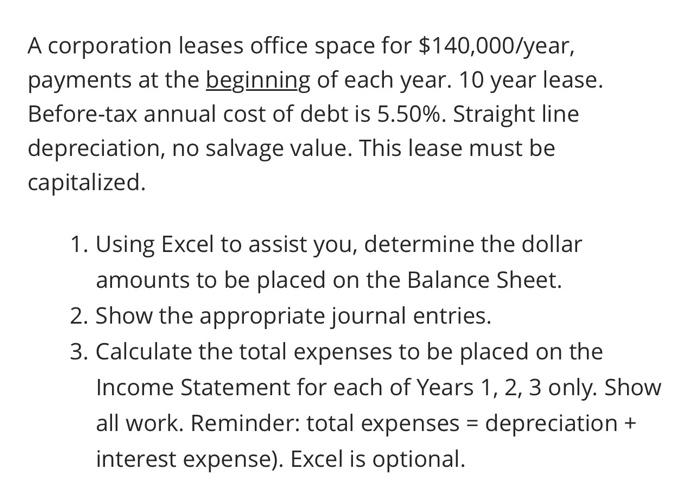

show calculations please A corporation leases office space for $140,000 /year, payments at the beginning of each year. 10 year lease. Before-tax annual cost of

show calculations please

A corporation leases office space for $140,000 /year, payments at the beginning of each year. 10 year lease. Before-tax annual cost of debt is 5.50%. Straight line depreciation, no salvage value. This lease must be capitalized. 1. Using Excel to assist you, determine the dollar amounts to be placed on the Balance Sheet. 2. Show the appropriate journal entries. 3. Calculate the total expenses to be placed on the Income Statement for each of Years 1, 2, 3 only. Shol all work. Reminder: total expenses = depreciation + interest expense). Excel is optional. A corporation leases office space for $140,000 /year, payments at the beginning of each year. 10 year lease. Before-tax annual cost of debt is 5.50%. Straight line depreciation, no salvage value. This lease must be capitalized. 1. Using Excel to assist you, determine the dollar amounts to be placed on the Balance Sheet. 2. Show the appropriate journal entries. 3. Calculate the total expenses to be placed on the Income Statement for each of Years 1, 2, 3 only. Shol all work. Reminder: total expenses = depreciation + interest expense). Excel is optional Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started