Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show calculations please After Dar's analysis of East Coast Yachts's cash flow (at the end of our previous chapter, Larissa approached Dan about the company's

show calculations please

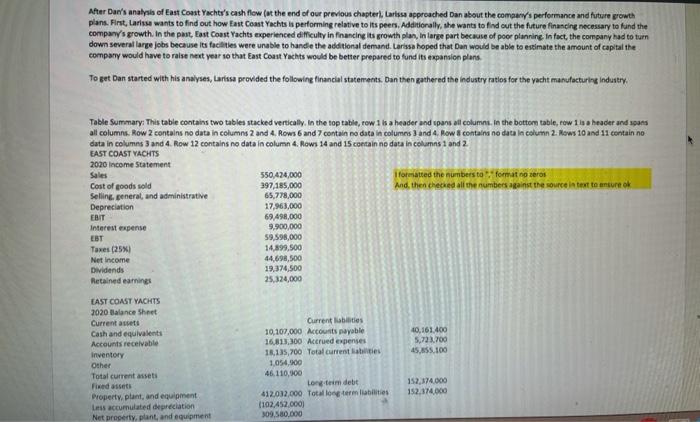

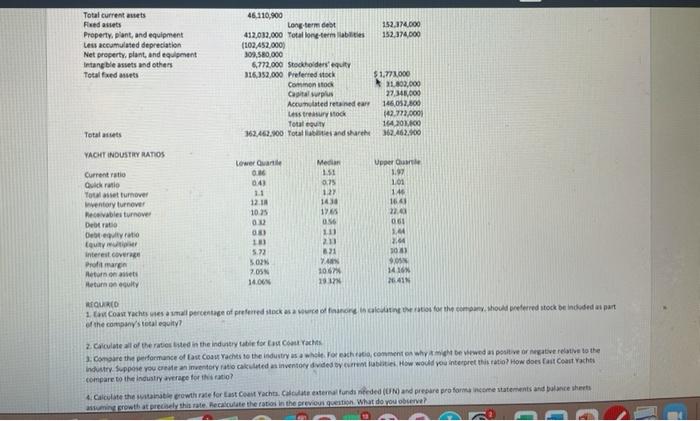

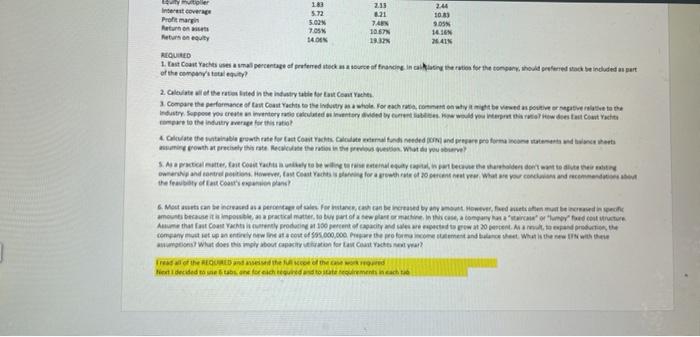

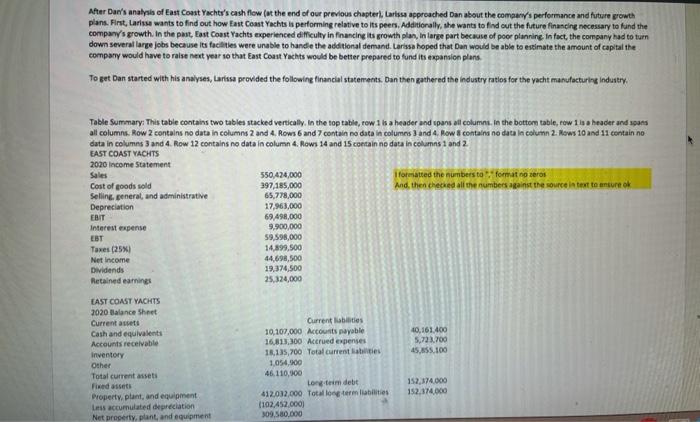

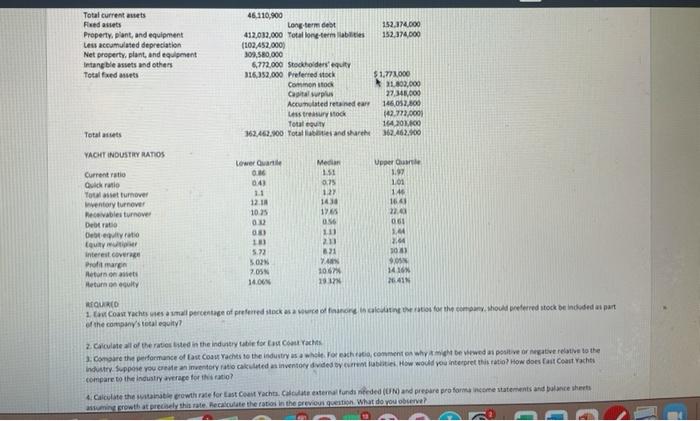

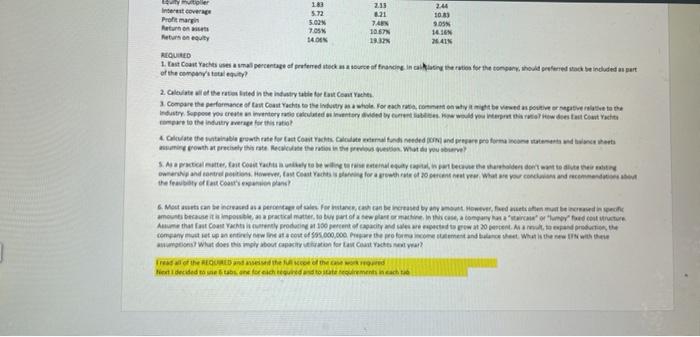

After Dar's analysis of East Coast Yachts's cash flow (at the end of our previous chapter, Larissa approached Dan about the company's performance and future growth plans. First, Larissa wants to find out how East Coast Yachts is performing relative to its peers, Additionally, she wants to find out the future financing necessary to fund the company's growth in the past, East Coast Yachts experienced difficulty in financing its growth plan, in large part because of poor planning In fact, the company had to turn down several large jobs because its facilities were unable to handle the additional demand, Larissa hoped that Dan would be able to estimate the amount of capital the company would have to raise next year so that East Coast Yachts would be better prepared to fund its expansion plans. To pet ban started with his analyses, Larissa provided the following financial statements. Dan then gathered the industry tatlos for the yacht manufacturing Industry Table Summary: This table contains two tables stacked vertically. In the top table, row 1 is a header and spans all columns. In the bottom table, row 1 header and spars all columns Row 2 contains no data in columns 2 and 4. Rows 6 and 7 contain no data in columns 3 and 4. How contains no data in column 2. Rows 10 and 11 contain no data in columns 3 and 4. Row 12 contains no data in column 4. Rows 14 and 15 contain no data in columns 1 and 2 EAST COAST YACHTS 2020 Income Statement Sales 550,424,000 formatted the numbers to formato zero Cost of goods sold 397,185,000 And then checked all the numbers against the source in text to ansune ok Selling generat, and administrative 65,778,000 Depreciation 17,963,000 EBIT 69.498,000 Interest expense 9,900,000 EBT 59,598,000 Taxes (25%) 14,899,500 Net Income 44,698,500 Dividends 19.374,500 Retained earnings 25,324,000 40,161.400 5,721.700 45.85.100 EAST COAST YACHTS 2020 Balance Sheet Current assets Cash and equivalents Accounts receivable Inventory Other Total current asset Fixed assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Current Abilities 10,107,000 Accounts payable 16,813,300 Accrued expenses 18,135,700 Total currenties 1,054,500 46.110,000 Long tim debt 412.032,000 Total long term liabilities (102.452.000) 309,580,000 152,374,000 152,174.000 Total current wets Fixed assets Property, plant, and equipment Les accumulated depreciation Net property, plant and equipment Intang ble sets and others Total fed 46,110,900 Long-term det 152,374.000 412.033.000 Total long-term abilities 152,374.000 (1.02.452.000 309,580,000 6772,000 Stockholders equity 316.352.000 Preferred stock $1.771.000 Common stock 1.800.000 Capital plus 27,348,000 Accumulated retained ear 146.057.000 Less treasuryo 142.722.000 Total equity 16420 362.462.900 Total and share 362,462.000 Totales YACHT INDUSTRY RATIOS Lower One 0.86 043 1.1 12.18 105 OD Current Patio Quick ratio Totale turnover ventory turnover Penables turnover Debratio Debate Equity Interest.cover Profit man Return on avete Return on culty Men 1.51 0.75 1.2 143 1 016 111 211 821 Uporate 1.97 101 146 16.43 22.0 061 1.4 2,44 103 ON 141 264 18 5.22 SON 7.OSN 36.00 106 19 N REQUIRED 1. Cat Coast Yachts was a percentage of preferred stock as a coffrontation test for the company thout preferred stock be included as part of the comes totaleguity? 2. Calculate all of the rate sted in the industry table for East Coach 3.come the performance of East Coast Yachts to the industry as a whole Forecht, comment on why mich bewed positive orative relative to the Industry Suppose you can inventory ratio calculated as inventory vided by cuttitil How would you interpretatio? How does East Coast Yachts compare to the industry average for this ratio Calculate the state growth rate for East Coast Yacht Clute external and feded (UN) and prepare proforma income statements and balance sheets amirowth at precisely this rate Recalculate the ratio in the previous Question What do you beve? rutier Interest Cover Pomar Return Maturs on uity 183 5.72 5.G2N 7.05 14. DEN 2.35 021 TAN 10.57% 19. IN 2.44 103) 9.05 14.10 264N REQUIRED 1. tat Contacte amal percentage of entered socks offrending In certion for the concerny, od fered to be included as part of the coastality 2. Ce the mosted in the industry tale for tant Contact 3. Compare the performance of tast Contacts to the industry as a whole for each common why we sportive to the Industry Support you create inventory led to view current you want How does it out we compare to the interage for that Olete both rate for East Coast Cote wandded proformance that growth rate Recherche prove What you sve Stter, tout contact to well, wiece the whole want to wwer and controvert Codes for a who ear What you can do the fitofast Coast 6. Most sta can be increased in for a chan bered by any out. However, we were amount because it is importactical matter to wartoftware in company of her Am that fast Coast de 100 percent of any de 20 percent. Martin company with an entirely new line out of 3.000.000 for comment and balance. What there were mos? What does this my capacitation for Cont Yachtsextyar? rah Rhether decided to be forced to mentina

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started