Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show calculator work dont use excel to solve You just finished calculating the NPV of project A and found it to be $49,242. A concurrent

Show calculator work dont use excel to solve

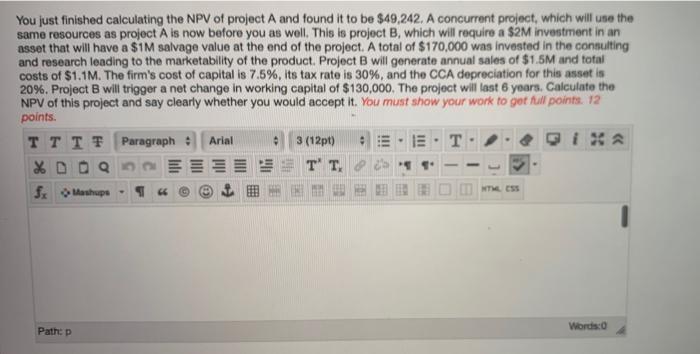

You just finished calculating the NPV of project A and found it to be $49,242. A concurrent project, which will use the same resources as project A is now before you as well. This is project B, which will require a $2M investment in an asset that will have a $1M salvage value at the end of the project. A total of $170,000 was invested in the consulting and research leading to the marketability of the product. Project B will generate annual sales of $1.5M and total costs of $1.1M. The firm's cost of capital is 7.5%, its tax rate is 30%, and the CCA depreciation for this asset is 20%. Project will trigger a not change in working capital of $130,000. The project will last 6 years. Calculate the NPV of this project and say clearly whether you would accept it. You must show your work to got full points. 12 points. Arial 3 (12pt) gix TT TT Paragraph * DOO T" T, $x Mashup 16 THE ESS Pathp Words Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started