SHOW COMPUTATIONS X+X=X format

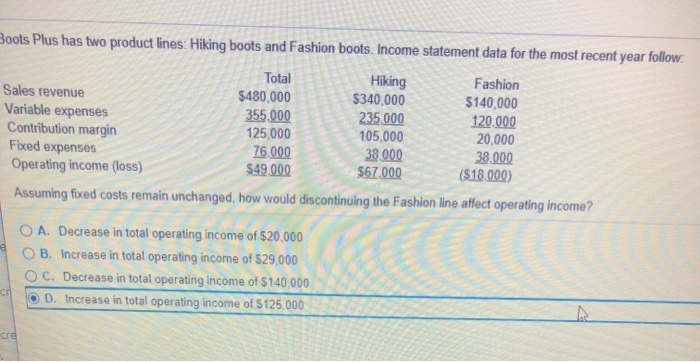

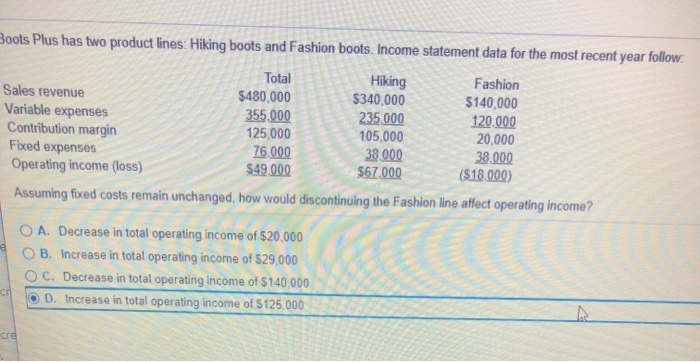

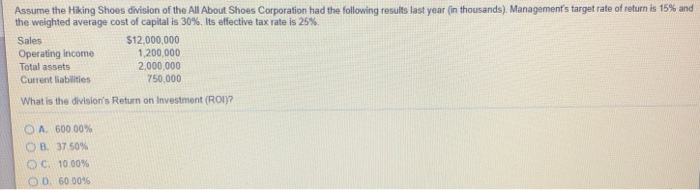

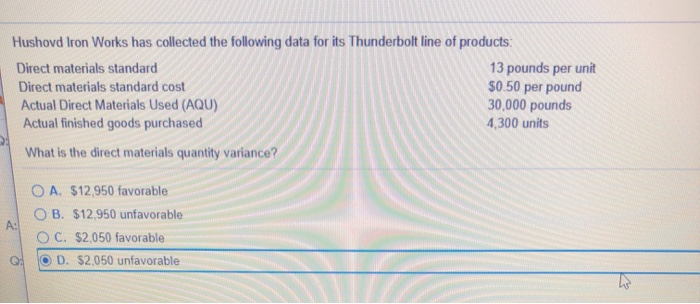

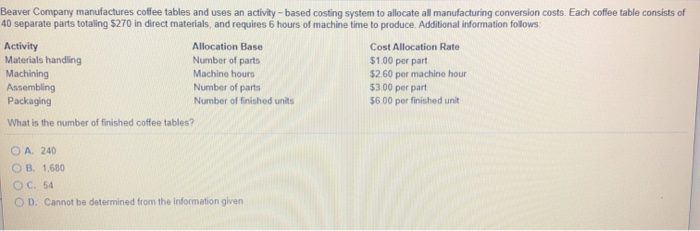

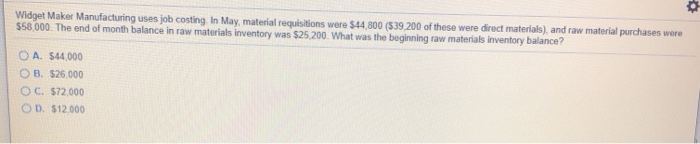

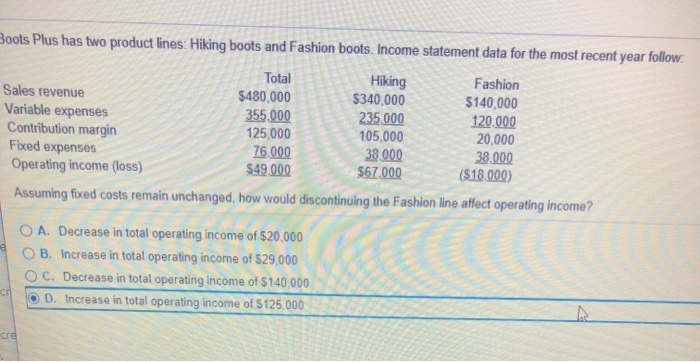

Boots Plus has two product lines: Hiking boots and Fashion boots. Income statement data for the most recent year follow Total Hiking Fashion Sales revenue $480,000 $340,000 $140,000 Variable expenses 355.000 235.000 120.000 Contribution margin 125,000 105,000 20,000 Fixed expenses 76.000 38.000 38.000 Operating income (loss) $49.000 $67.000 ($18.000) Assuming fixed costs remain unchanged, how would discontinuing the Fashion line affect operating income? O A. Decrease in total operating income of $20,000 OB. Increase in total operating income of $29,000 O c. Decrease in total operating income of $140,000 D. Increase in total operating income of $125.000 co Assume the Hiking Shoes division of the All About Shoes Corporation had the following results last year (in thousands). Management's target rate of return is 15% and the weighted average cost of capital is 30%. Its effective tax rate is 25% Sales $12,000,000 Operating income 1,200,000 Total assets 2.000.000 Current liabilities 750.000 What is the division's Return on Investment (ROI)? OA 600.00% OB37 50% C. 10.00% OD 60.00% Hushovd Iron Works has collected the following data for its Thunderbolt line of products: Direct materials standard 13 pounds per unit Direct materials standard cost $0.50 per pound Actual Direct Materials Used (AQU) 30,000 pounds Actual finished goods purchased 4,300 units What is the direct materials quantity variance? A: O A. $12,950 favorable OB. $12,950 unfavorable O C. $2,050 favorable OD. $2.050 unfavorable Q: Beaver Company manufactures coffee tables and uses an activity - based costing system to allocate all manufacturing conversion costs. Each coffee table consists of 40 separate parts totaling $270 in direct materials, and requires 6 hours of machine time to produce. Additional information follows Activity Allocation Base Cost Allocation Rate Materials handling Number of parts $1.00 per part Machining Machine hours $2.60 per machine hour Assembling Number of parts $3.00 per part Packaging Number of finished units $6.00 per finished unit What is the number of finished coffee tables? O A 240 OB 1,680 OC. 54 OD. Cannot be determined from the information given Widget Maker Manufacturing uses job casting in May, material requisitions were $44.800 (539 200 of these were direct materials), and raw material purchases were $58,000. The end of month balance in raw materials inventory was 525200. What was the beginning raw materials inventory balance? O A $44.000 B. $26.000 OC. $72.000 OD. $12.000