Answered step by step

Verified Expert Solution

Question

1 Approved Answer

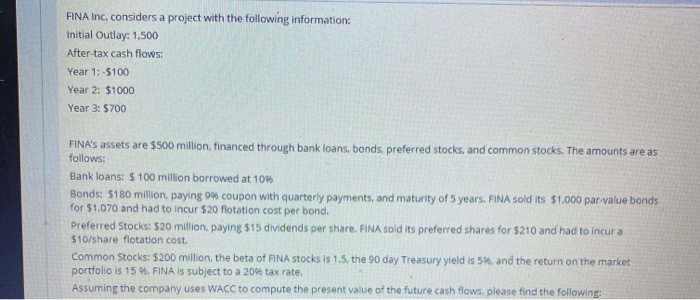

show eotk please show work please FINA Inc. considers a project with the following information: Initial Outlay: 1,500 After-tax cash flows: Year 1: $100 Year

show eotk please

show work please

FINA Inc. considers a project with the following information: Initial Outlay: 1,500 After-tax cash flows: Year 1: $100 Year 2: 51000 Year 3: 5700 FINA's assets are 5500 million, financed through bank loans, bonds, preferred stocks, and common stocks. The amounts are as follows: Bank loans: $ 100 million borrowed at 10% Bonds: 5180 million, paying 9 coupon with quarterly payments, and maturity of 5 years. FINA sold its 51.000 par value bonds for $1,070 and had to incur 520 flotation cost per bond. Preferred Stocks: 520 million, paying $15 dividends per share. FINA sold its preferred shares for 5210 and had to incura $10/share flotation cost. Common Stocks: $200 million the beta of FINA stocks is 1.5. the 90 day Treasury yield is 5%, and the return on the market portfolio is 15 %. FINA is subject to a 20% tax rate. Assuming the company uses WACC to compute the present value of the future cash flows, please find the following: 5) What is the WACC? 6) What is the IRR? 7) What is the Payback Period? 8) What is the NPV? 9) Should FINA accept the project? According to IRR? According to the Payback period? According to NPV? 10) FINA is expected to pay a 54 per share common stock dividend at the end of this year. The dividends are expected to grow at 6% per year forever. How much should be the value of FINA's shares Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started