Answered step by step

Verified Expert Solution

Question

1 Approved Answer

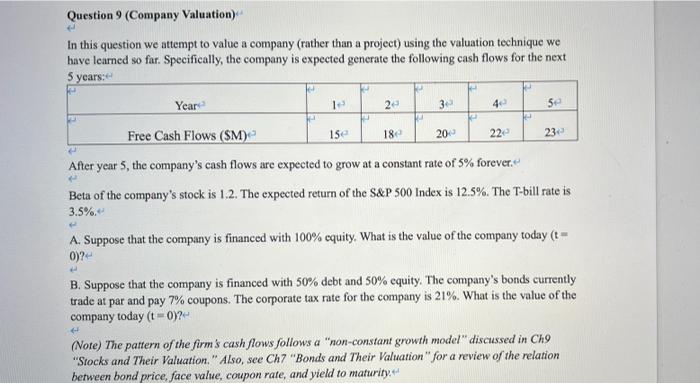

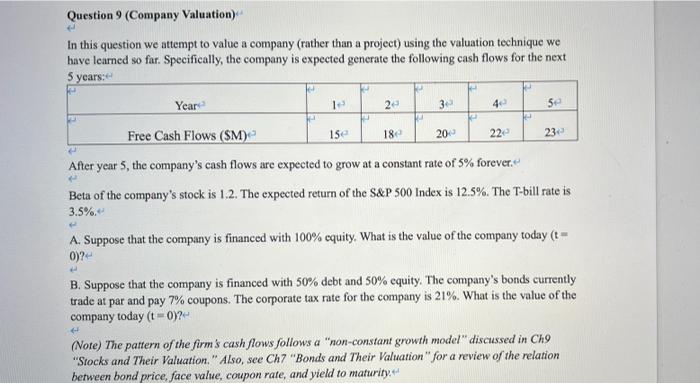

Show every steps Thank you so much 9 Question 9 (Company Valuation) In this question we attempt to value a company (rather than a project)

Show every steps Thank you so much

9 Question 9 (Company Valuation) In this question we attempt to value a company (rather than a project) using the valuation technique we have learned so far. Specifically, the company is expected generate the following cash flows for the next 5 years: Year 2- 3 4. Se ise 18 20 232 Free Cash Flows (SM) 22e After year 5, the company's cash flows are expected to grow at a constant rate of 5% forever. Beta of the company's stock is 1.2. The expected return of the S&P 500 Index is 12.5%. The T-bill rate is 3.5%. A. Suppose that the company is financed with 100% cquity. What is the value of the company today (t = 0)? B. Suppose that the company is financed with 50% debt and 50% equity. The company's bonds currently trade at par and pay 7% coupons. The corporate tax rate for the company is 21%. What is the value of the company today (t-0)? (Note) The pattern of the firm cash flows follows a "non-constant growth model" discussed in Che Stocks and Their Valuation." Also, see Ch7 "Bonds and Their Valuation for a review of the relation between bond price, face value, coupon rate, and yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started