show formula only please!

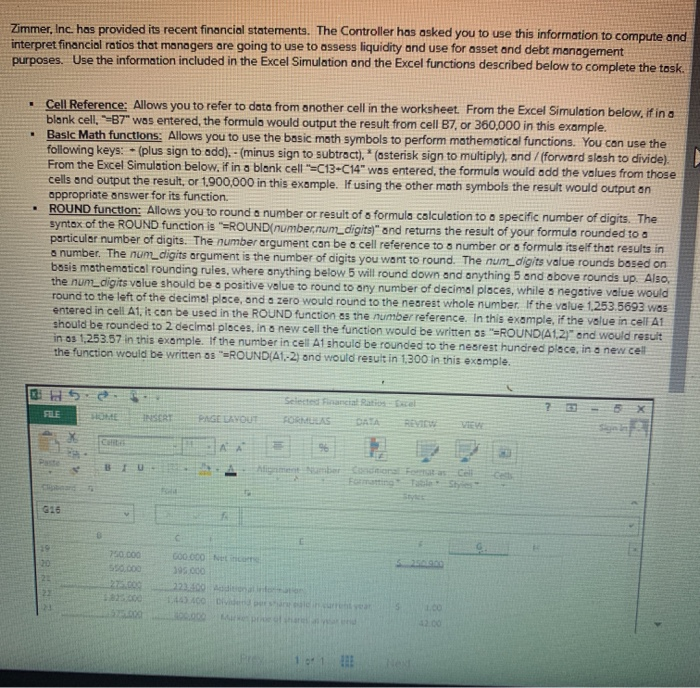

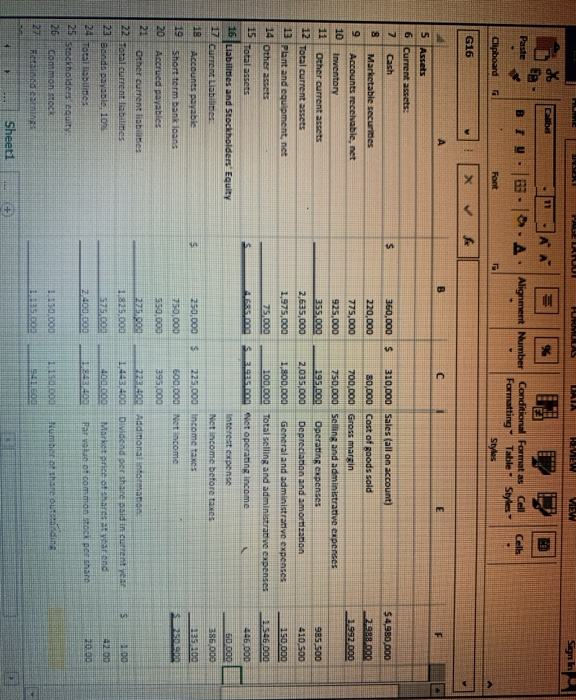

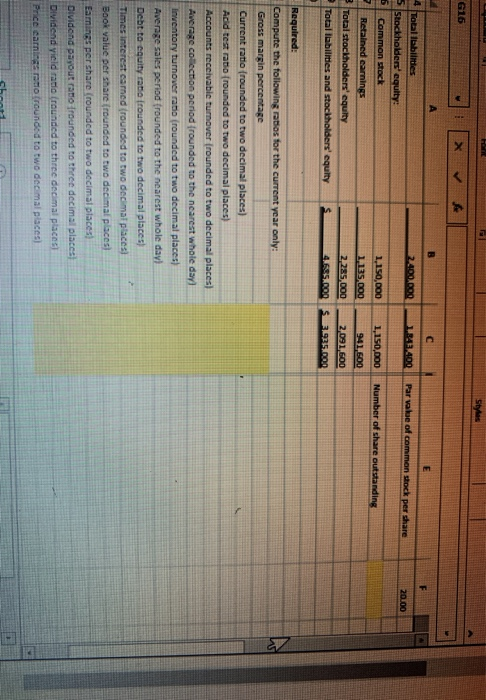

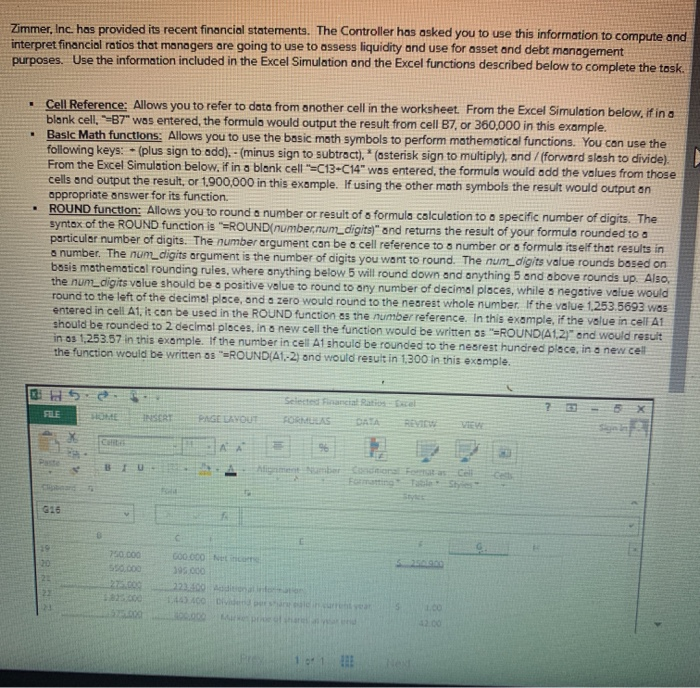

Zimmer, Inc has provided its recent financial statements. The Controller has asked you to use this information to compute and interpret financial ratios that managers are going to use to assess liquidity and use for asset and debt management purposes. Use the information included in the Excel Simulation and the Excel functions described below to complete the task. Cell Reference: Allows you to refer to data from another cell in the worksheet From the Excel Simulation below.itina blank cell. =87" was entered the formula would output the result from cell B7, or 360,000 in this example. Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: - (plus sign to add). - (minus sign to subtract). * (asterisk sign to multiply), and / (forward slash to divide). From the Excel Simulation below, if in a blank cell "=C13-C14" was entered the formula would add the values from those cells and output the result, or 1.900,000 in this example. If using the other math symbols the result would output on appropriate answer for its function ROUND function: Allows you to round a number or result of a formula calculation to a specific number of digits. The syntax of the ROUND function is "=ROUND(numbernum_digits)" and returns the result of your formula rounded to a particular number of digits. The number argument can be a cell reference to a number or a formuls itself that results in a number. The num_digits argument is the number of digits you want to round. The num_digits value rounds based on basis mathematical rounding rules, where anything below 5 will round down and anything 5 and above rounds up. Also, the nunt digits value should be a positive value to round to any number of decimal places, while a negative value would round to the left of the decimal place, and a zero would round to the nearest whole number. If the value 1.253.5693 was entered in cell A1, it can be used in the ROUND function as the number reference. In this example, if the value in cell A1 should be rounded to 2 decimal places, in a new cell the function would be written as "=ROUND(A121" and would result in as 1,253.57 in this example. If the number in cell A1 should be rounded to the nesrest hundred place in a new cell the function would be written as "=ROUND(A1-2) and would result in 1.300 in this example. - 5 x INSCRI PAGE LAYOUT AA 96 BU G16 750 DOO 5.000 CO0.000 Net 12.000 100 42.00 11 il SENI PAGE LITUUT HRMULAS DATA HOWTEW VIEW Sign in 11 Paste U A Alignment Number Cells Condition Formats Cell Formatting Table Styles Styles Clipboard Font G16 X for B c E F 5 Assets 6 Current assets: 7 Cash $ $4,980,000 22999.00 1992 000 985 500 410 500 150 000 1546 000 445.000 360,000 $ 310,000 Sales (all an account) 220,000 80,000 Cost of goods sold 775,000 700,000 Gross margin 925,000 750,000 Selling and administrative expenses 355.000 195.000 Operating expenses 2,635,000 2,035,000 Depreciation and amortization 1,975,000 1.800.000 General and administrative expenses 75.000 100 000 Total selling and administrative expenses 4.58C.ROSSES ROQ Not operating income Interest expense Net income before taxes 250,000 $ 225.000 income taxes 750,000 600 000 Net income 550.000 395.000 275.000 2240 Adiongan 1825.000 1.443.400 Dividend per shis current year TERCE 400.000 Market price of shares at year and 2400 000 LEO Fof common stock per share 8 Marketable securities 9 Accounts receivable, net 10 Inventory Other current assets 12 Total current assets 13 plant and equipment, net 14 Other assets 15 Total assets 16 Liabilities and Stockholders' Equity 17 Current Liabilities 18 Accounts payable 519 Short term bank loans 20 Accrued payables Other current liabilities 22 Total current liabilimes 22 Bonda payable, 1096 24 Totallites 25 Stockholders uity 26 common stock 23 derings 50.000 386,000 $ 135200 250 5 100 200 20.00 1.150.000 Humber of the ording 19 800 Sheet1 Styles G16 & B E F 2.400.000 1.43.400 Par value of common stock per share 20.00 4 Total abilities stockholders' equity: Common stock 7 Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Number of share outstanding 1,150,000 1,150,000 1135.000 941.500 2 285,000 2,091,600 465.000 1925.000 Required: Compute the following ratios for the current year only: Gross margin percentage Current ratio (rounded to two decimal places) Add test ratio (rounded to two decimal places) Accounts receivable turnover (rounded to two decimal places) Average collection period frounded to the nearest whole day) inventory turnover ratio (rounded to two decimal places) Average sales period frounded to the nearest whole day! Debt to cquity ratio (rounded to two decimal places) Times interest camned (rounded to two decimal places) Book value per Share (rounded to two decimal places Earnings per share (rounded to two decimal places) Dividend payout rato frounded to three decimal places Dividend yield ratio (rounded to three decimal places Price earnings ratio (rounded to two decimal places)