Answered step by step

Verified Expert Solution

Question

1 Approved Answer

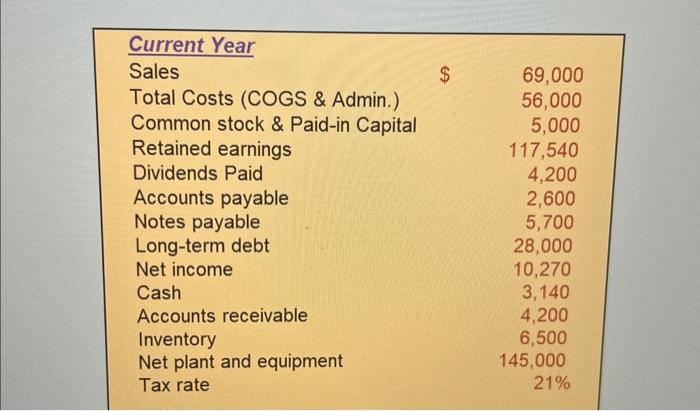

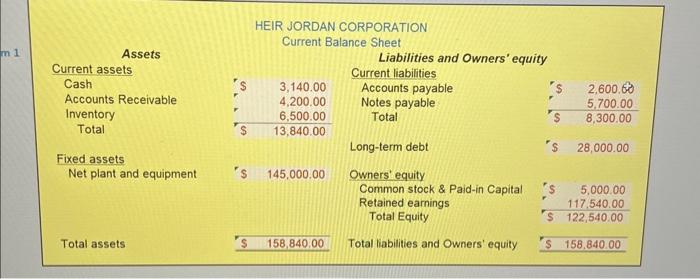

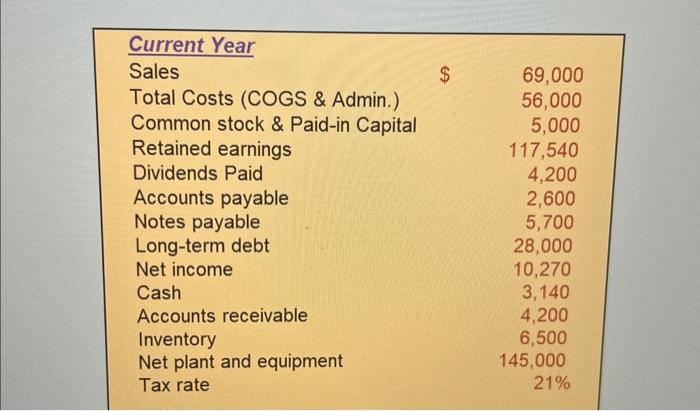

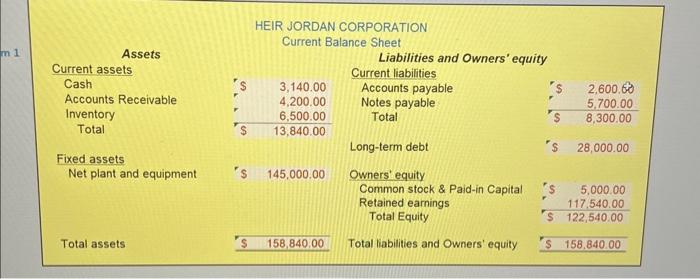

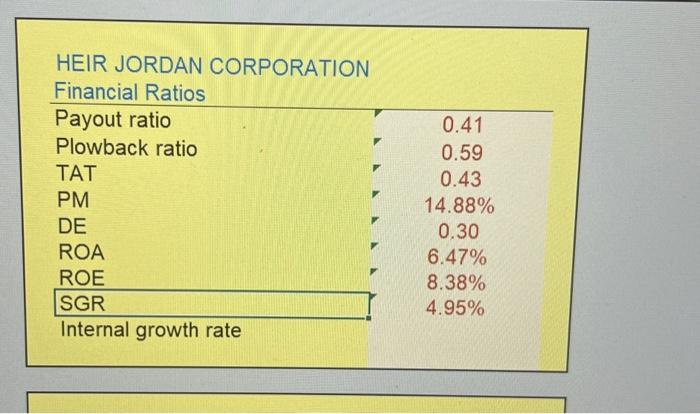

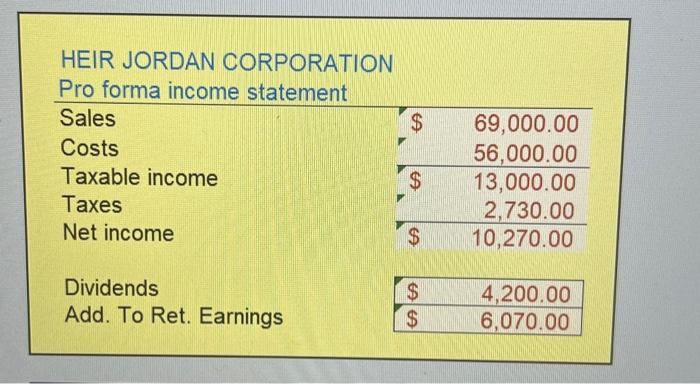

show formulas-- need help with all missing blanks CurrentYearSalesTotalCosts(COGS&Admin.)Commonstock&Paid-inCapitalRetainedearningsDividendsPaidAccountspayableNotespayableLong-termdebtNetincomeCashAccountsreceivableInventoryNetplantandequipmentTaxrate69,00056,0005,000117,5404,2002,6005,70028,00010,2703,1404,2006,500145,00021% HEIR JORDAN CORPORATION Current Balance Sheet Assets Liabilities and Owners' equity Current assets Fixed assets Net

show formulas-- need help with all missing blanks

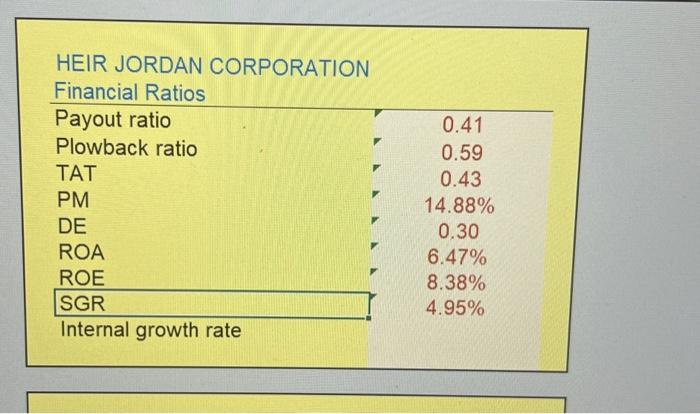

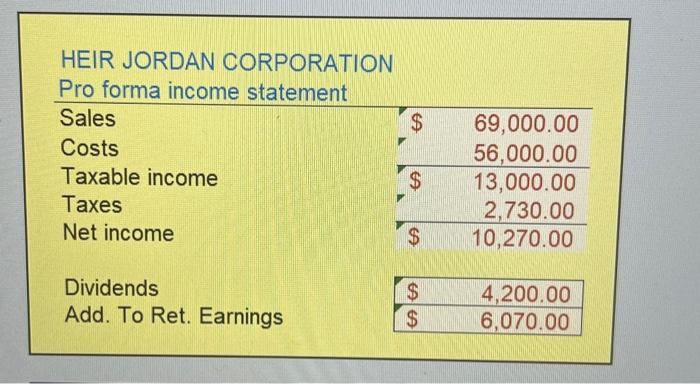

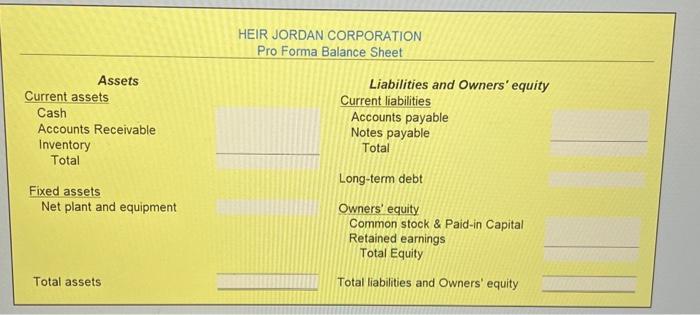

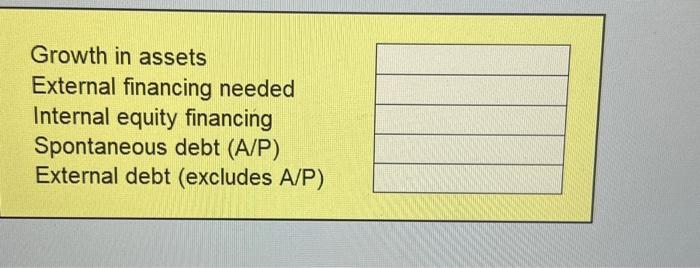

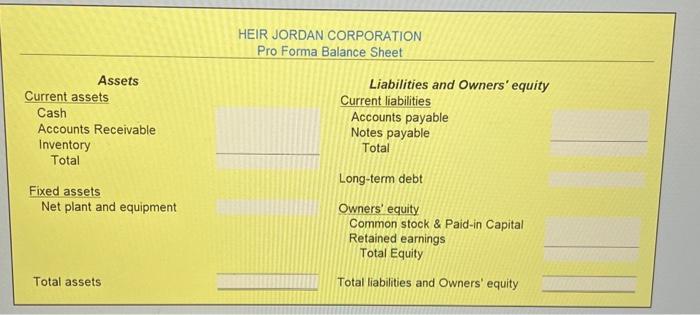

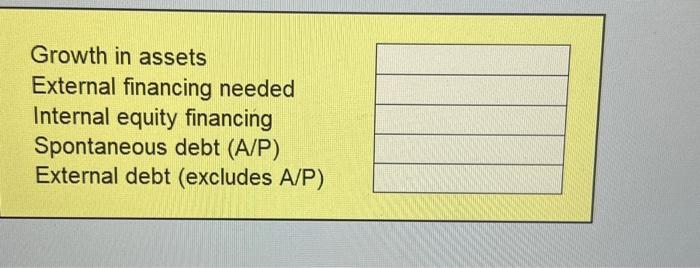

CurrentYearSalesTotalCosts(COGS&Admin.)Commonstock&Paid-inCapitalRetainedearningsDividendsPaidAccountspayableNotespayableLong-termdebtNetincomeCashAccountsreceivableInventoryNetplantandequipmentTaxrate69,00056,0005,000117,5404,2002,6005,70028,00010,2703,1404,2006,500145,00021% HEIR JORDAN CORPORATION Current Balance Sheet Assets Liabilities and Owners' equity Current assets Fixed assets Net plant and equipment (\$ 145,000,00 Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock \& Paid-in Capital Retained earnings Total Equity \$ 158,840,00 Total liabilities and Owners' equity \begin{tabular}{lr} \hline & 2,600.00 \\ \hline & 5,700.00 \\ \hline & 8,300.00 \end{tabular} (\$ 28,000.00 \begin{tabular}{rr} 5 & 5,000.00 \\ \hline & 117.540 .00 \\ \hline & 122,540.00 \end{tabular} is 158.840 .00 HEIR JORDAN CORPORATION Financial Ratios Payout ratio Plowback ratio TAT PM DE ROA ROE SGR \begin{tabular}{cc} \hline & 0.41 \\ \hline & 0.59 \\ \hline & 14.43% \\ \hline & 0.30 \\ \hline & 8.47% \\ \hline & 4.95% \end{tabular} Internal growth rate HEIR JORDAN CORPORATION Pro forma income statement HEIR JORDAN CORPORATION Pro Forma Balance Sheet Assets Current assets Cash Accounts Receivable Inventory Total Fixed assets Net plant and equipment Liabilities and Owners' equity Current liabilities Accounts payable Notes payable Total Long-term debt Owners' equity Common stock \& Paid-in Capital Retained earnings Total Equity Total liabilities and Owners' equity Growth in assets External financing needed Internal equity financing Spontaneous debt (A/P) External debt (excludes A/P)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started