Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show formulas please, dont use excel thx Robinson Co. is interested in purchasing a new delivery vehicle so it can become a subcontractor with Amazon

show formulas please, dont use excel

thx

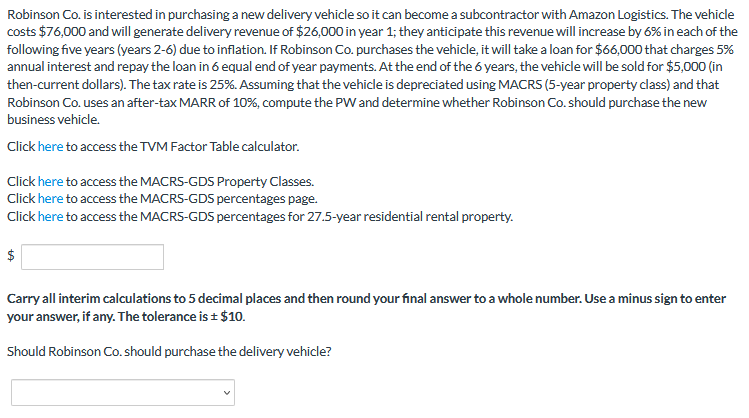

Robinson Co. is interested in purchasing a new delivery vehicle so it can become a subcontractor with Amazon Logistics. The vehicle costs $76,000 and will generate delivery revenue of $26,000 in year 1; they anticipate this revenue will increase by 6% in each of the following five years (years 2-6) due to inflation. If Robinson Co. purchases the vehicle, it will take a loan for $66,000 that charges 5% annual interest and repay the loan in 6 equal end of year payments. At the end of the 6 years, the vehicle will be sold for $5,000 (in then-current dollars). The tax rate is 25%. Assuming that the vehicle is depreciated using MACRS (5-year property class) and that Robinson Co. uses an after-tax MARR of 10%, compute the PW and determine whether Robinson Co. should purchase the new business vehicle. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. $ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. Use a minus sign to enter your answer, if any. The tolerance is $10. Should Robinson Co. should purchase the delivery vehicle? Robinson Co. is interested in purchasing a new delivery vehicle so it can become a subcontractor with Amazon Logistics. The vehicle costs $76,000 and will generate delivery revenue of $26,000 in year 1; they anticipate this revenue will increase by 6% in each of the following five years (years 2-6) due to inflation. If Robinson Co. purchases the vehicle, it will take a loan for $66,000 that charges 5% annual interest and repay the loan in 6 equal end of year payments. At the end of the 6 years, the vehicle will be sold for $5,000 (in then-current dollars). The tax rate is 25%. Assuming that the vehicle is depreciated using MACRS (5-year property class) and that Robinson Co. uses an after-tax MARR of 10%, compute the PW and determine whether Robinson Co. should purchase the new business vehicle. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. $ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. Use a minus sign to enter your answer, if any. The tolerance is $10. Should Robinson Co. should purchase the delivery vehicleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started