Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SHOW good accounting form Show journal entry and to record 1. Arizona Company acquired a financial asset not held for trading during the last quarter

SHOW good accounting form

Show journal entry and "to record"

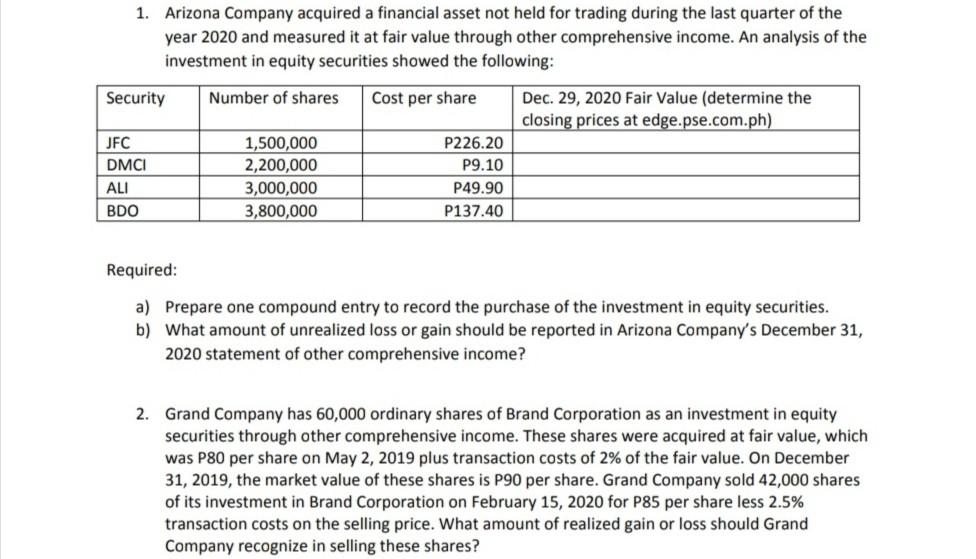

1. Arizona Company acquired a financial asset not held for trading during the last quarter of the year 2020 and measured it at fair value through other comprehensive income. An analysis of the investment in equity securities showed the following: Security Number of shares Cost per share Dec. 29, 2020 Fair Value (determine the closing prices at edge.pse.com.ph) JFC DMCI ALI BDO 1,500,000 2,200,000 3,000,000 3,800,000 P226.20 P9.10 P49.90 P137.40 Required: a) Prepare one compound entry to record the purchase of the investment in equity securities. b) What amount of unrealized loss or gain should be reported in Arizona Company's December 31, 2020 statement of other comprehensive income? 2. Grand Company has 60,000 ordinary shares of Brand Corporation as an investment in equity securities through other comprehensive income. These shares were acquired at fair value, which was P80 per share on May 2, 2019 plus transaction costs of 2% of the fair value. On December 31, 2019, the market value of these shares is P90 per share. Grand Company sold 42,000 shares of its investment in Brand Corporation on February 15, 2020 for P85 per share less 2.5% transaction costs on the selling price. What amount of realized gain or loss should Grand Company recognize in selling these sharesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started