Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show how on Excel please!!! Estimate the interest rate paid by P&G on the 5/30 swap in Business Snapshot 5.4 on p.120 if the CP

Show how on Excel please!!!

Estimate the interest rate paid by P&G on the 5/30 swap in Business Snapshot 5.4 on p.120 if the CP rate is 8% and the Treasury yield curve is flat at 7.5% with semi-annual compounding. Briefly discuss the lesson that can be learnt from this story.

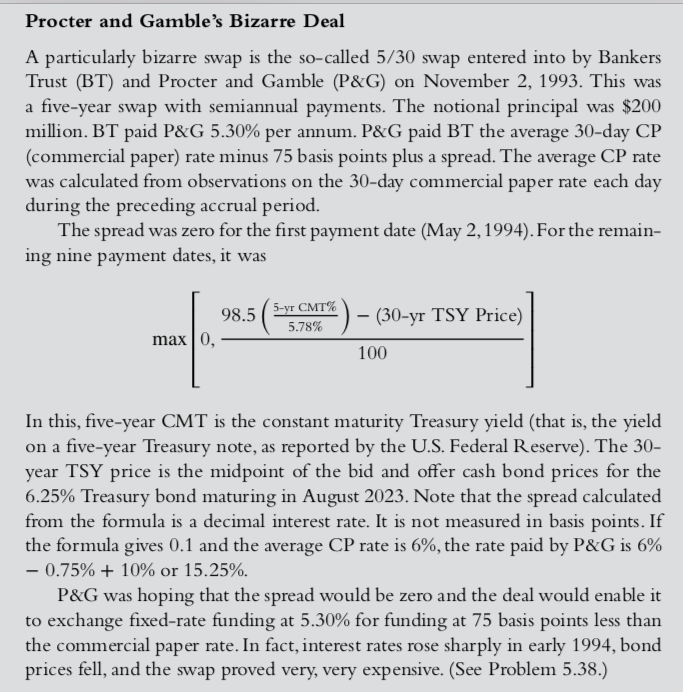

was Procter and Gamble's Bizarre Deal A particularly bizarre swap is the so-called 5/30 swap entered into by Bankers Trust (BT) and Procter and Gamble (P&G) on November 2, 1993. This wa a five-year swap with semiannual payments. The notional principal was $200 million. BT paid P&G 5.30% per annum. P&G paid BT the average 30-day CP (commercial paper) rate minus 75 basis points plus a spread. The average CP rate was calculated from observations on the 30-day commercial paper rate each day during the preceding accrual period. The spread was zero for the first payment date (May 2, 1994). For the remain- ing nine payment dates, it was 98.5 max, 5-yr CMT% 5.78% (30-yr TSY Price) 100 In this, five-year CMT is the constant maturity Treasury yield (that is, the yield on a five-year Treasury note, as reported by the U.S. Federal Reserve). The 30- year TSY price is the midpoint of the bid and offer cash bond prices for the 6.25% Treasury bond maturing in August 2023. Note that the spread calculated from the formula is a decimal interest rate. It is not measured in basis points. If the formula gives 0.1 and the average CP rate is 6%, the rate paid by P&G is 6% - 0.75% + 10% or 15.25%. P&G was hoping that the spread would be zero and the deal would enable it to exchange fixed-rate funding at 5.30% for funding at 75 basis points less than the commercial paper rate. In fact, interest rates rose sharply in early 1994, bond prices fell, and the swap proved very, very expensive. (See Problem 5.38.) was Procter and Gamble's Bizarre Deal A particularly bizarre swap is the so-called 5/30 swap entered into by Bankers Trust (BT) and Procter and Gamble (P&G) on November 2, 1993. This wa a five-year swap with semiannual payments. The notional principal was $200 million. BT paid P&G 5.30% per annum. P&G paid BT the average 30-day CP (commercial paper) rate minus 75 basis points plus a spread. The average CP rate was calculated from observations on the 30-day commercial paper rate each day during the preceding accrual period. The spread was zero for the first payment date (May 2, 1994). For the remain- ing nine payment dates, it was 98.5 max, 5-yr CMT% 5.78% (30-yr TSY Price) 100 In this, five-year CMT is the constant maturity Treasury yield (that is, the yield on a five-year Treasury note, as reported by the U.S. Federal Reserve). The 30- year TSY price is the midpoint of the bid and offer cash bond prices for the 6.25% Treasury bond maturing in August 2023. Note that the spread calculated from the formula is a decimal interest rate. It is not measured in basis points. If the formula gives 0.1 and the average CP rate is 6%, the rate paid by P&G is 6% - 0.75% + 10% or 15.25%. P&G was hoping that the spread would be zero and the deal would enable it to exchange fixed-rate funding at 5.30% for funding at 75 basis points less than the commercial paper rate. In fact, interest rates rose sharply in early 1994, bond prices fell, and the swap proved very, very expensive. (See Problem 5.38.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started