Answered step by step

Verified Expert Solution

Question

1 Approved Answer

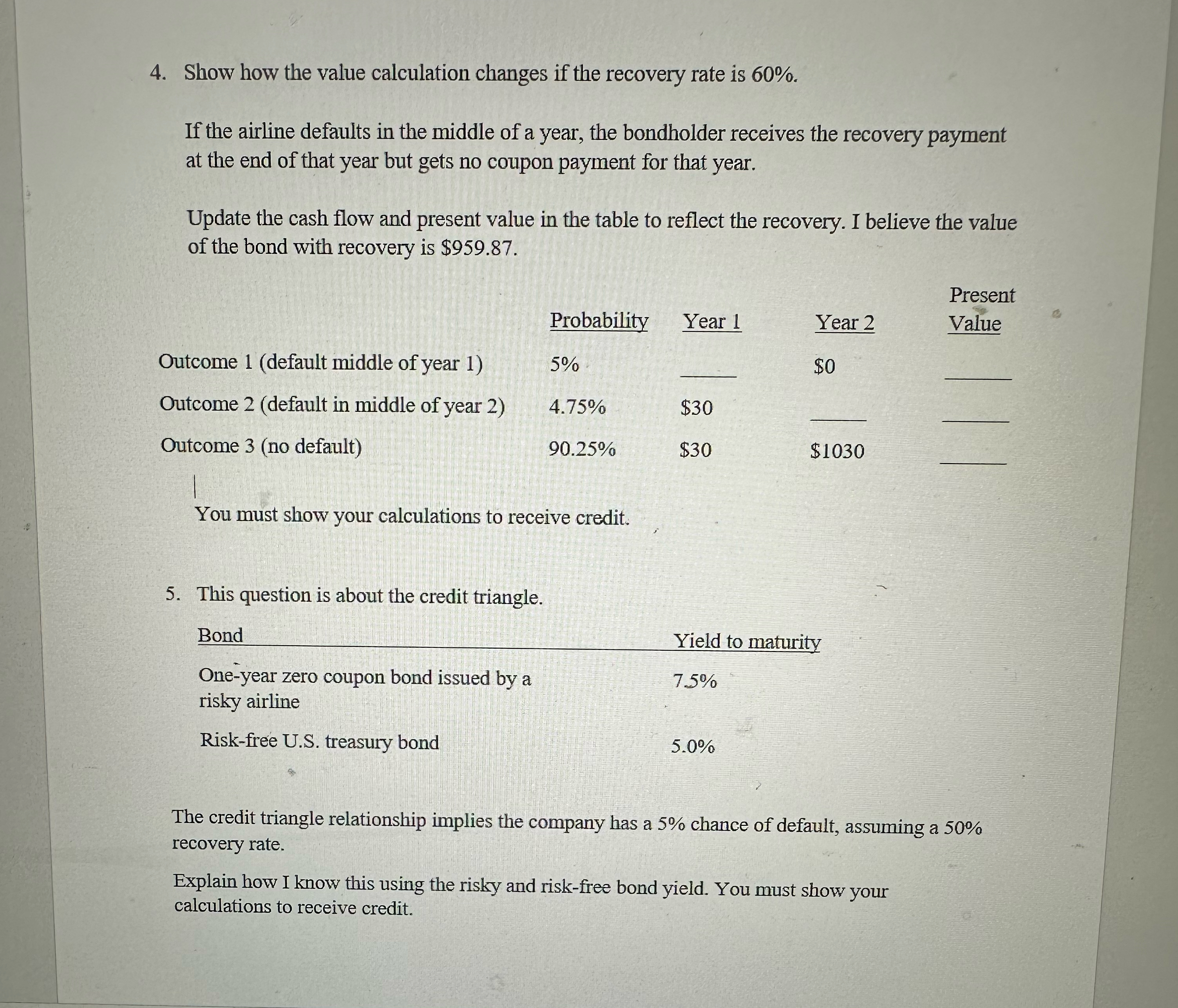

Show how the value calculation changes if the recovery rate is 6 0 % . If the airline defaults in the middle of a year,

Show how the value calculation changes if the recovery rate is

If the airline defaults in the middle of a year, the bondholder receives the recovery payment at the end of that year but gets no coupon payment for that year.

Update the cash flow and present value in the table to reflect the recovery. I believe the value of the bond with recovery is $

tableProbability,Year Year PresentOutcome default middle of year $Outcome default in middle of year $Outcome no default$$

You must show your calculations to receive credit.

This question is about the credit triangle.

Bond

Oneyear zero coupon bond issued by a risky airline

Riskfree US treasury bond

Yield to maturity

The credit triangle relationship implies the company has a chance of default, assuming a recovery rate.

Explain how I know this using the risky and riskfree bond yield. You must show your calculations to receive credit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started