Answered step by step

Verified Expert Solution

Question

1 Approved Answer

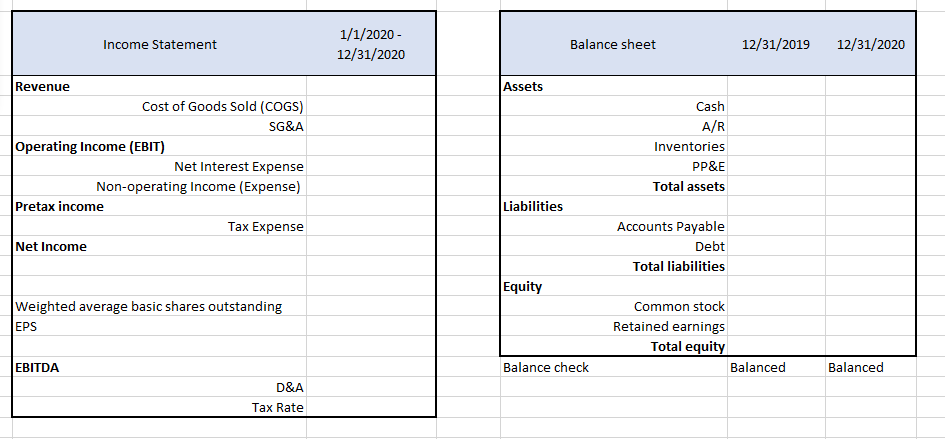

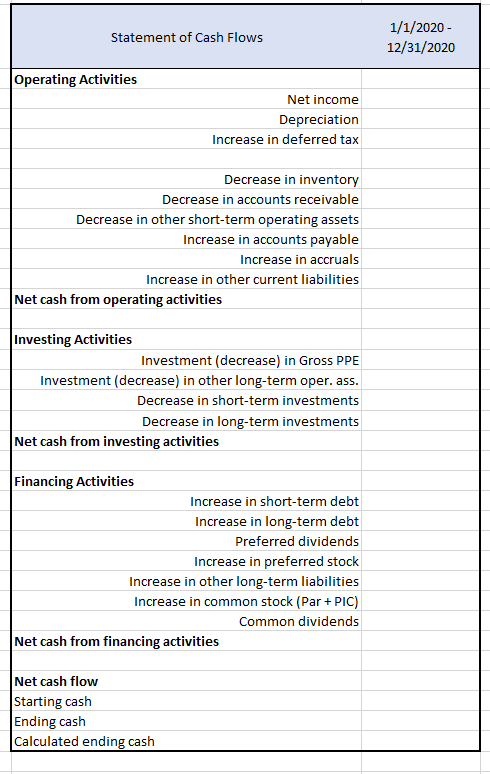

Show how these actions affect the statement sheets below. Enter answers in given format below. 1 You decide to start a wedding photography business on

Show how these actions affect the statement sheets below. Enter answers in given format below.

| 1 | You decide to start a wedding photography business on January 1, 2020. To buy all the required equipment and supplies to get started, you estimate that you need $25k, plus an extra $50k for cushion |

| 2 | You open a checking account in which you put $50k of your own money. You incorporated the issue yourself with 1000 shares. |

| 3 | You borrow a 5-year loan of $25k from the bank at a 6.5% annual interest rate. |

| 4 | You buy $20k worth of camera equipment with cash. All of which have a useful life of 5 years. |

| 5 | You shoot 32 weddings during the year for $10,000 per wedding. Your 32nd wedding was paid with credit and you have not yet collected the cash. |

| 6 | You pay a second shooter $1,500 per wedding. |

| 7 | You pay an editor $2,000 per wedding to help process the photos. |

| 8 | You hire a business manager for $40,000 per year to help answer emails and set your schedule. |

| 9 | You earn 2k in interest income from your business account. |

| 10 | On June 30, 2020, you find an investor who invests $20k and you issue them 400 shares. |

| 11 | You pay down $5k on your debt during the year. |

| 12 | With your future in mind, you purchase a piece of land for a future studio building for $100,000. |

| 13 | The tax rate for the photography company is 25%. |

| 14 | You pay no dividends. |

| 15 | The accounting period ends on 12/31/2020 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started