Show how these actions affect the statement sheets below. Enter answers in given format below.

| You decide to start a wedding photography business on January 1, 2020. To buy all the required equipment and supplies to get started, you estimate that you need $25k, plus an extra $50k for cushion |

| You open a checking account in which you put $50k of your own money. You incorporated the issue yourself with 1000 shares. |

| You borrow a 5-year loan of $25k from the bank at a 6.5% annual interest rate. |

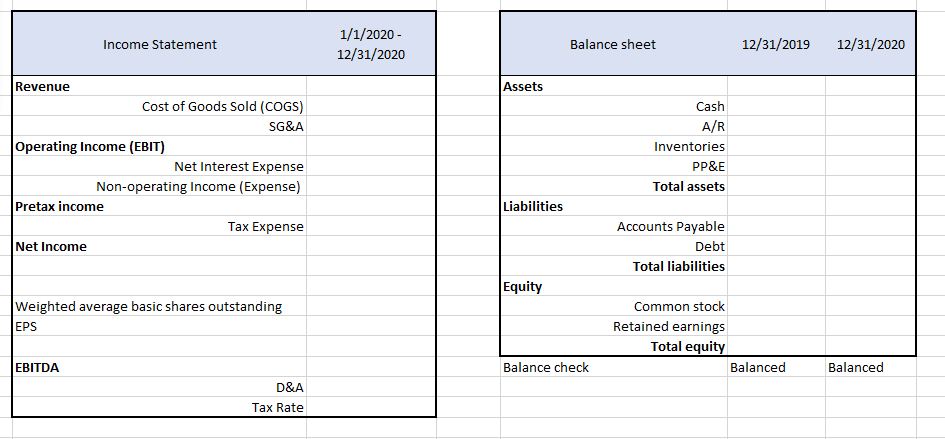

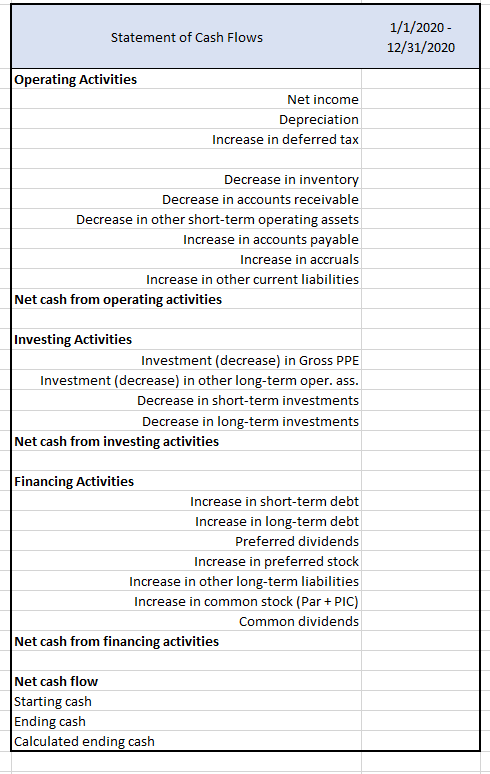

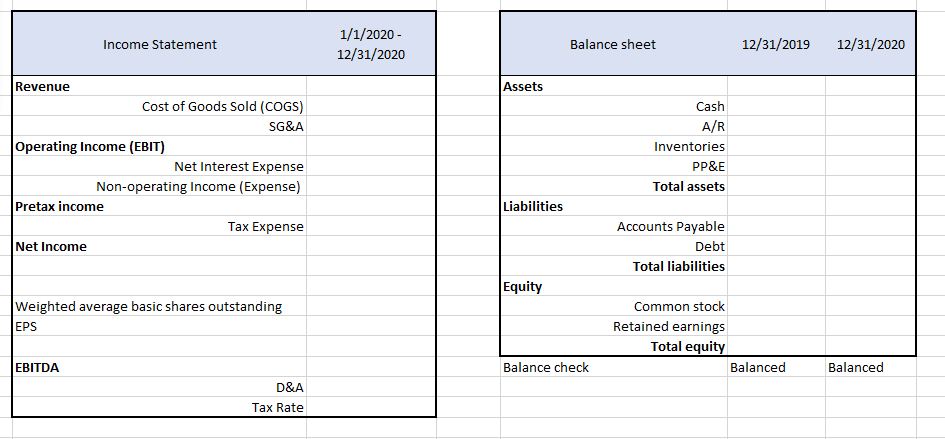

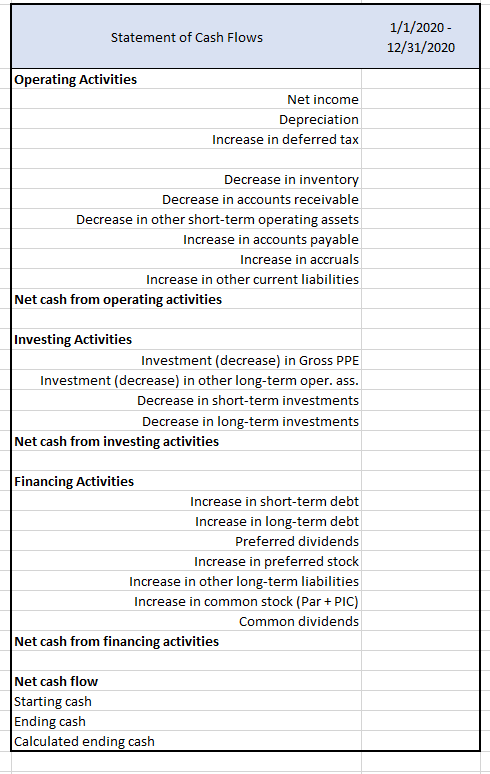

Income Statement 1/1/2020- 12/31/2020 Balance sheet 12/31/2019 12/31/2020 Assets Revenue Cost of Goods Sold (COGS) SG&A Operating Income (EBIT) Net Interest Expense Non-operating Income (Expense) Pretax income Tax Expense Net Income Cash A/R Inventories PP&E Total assets Liabilities Accounts Payable Debt Total liabilities Equity Weighted average basic shares outstanding EPS Common stock Retained earnings Total equity Balanced EBITDA Balance check Balanced D&A Tax Rate Statement of Cash Flows 1/1/2020- 12/31/2020 Operating Activities Net income Depreciation Increase in deferred tax Decrease in inventory Decrease in accounts receivable Decrease in other short-term operating assets Increase in accounts payable Increase in accruals Increase in other current liabilities Net cash from operating activities Investing Activities Investment (decrease) in Gross PPE Investment (decrease) in other long-term oper. ass. Decrease in short-term investments Decrease in long-term investments Net cash from investing activities Financing Activities Increase in short-term debt Increase in long-term debt Preferred dividends Increase in preferred stock Increase in other long-term liabilities Increase in common stock (Par+PIC) Common dividends Net cash from financing activities Net cash flow Starting cash Ending cash Calculated ending cash Income Statement 1/1/2020- 12/31/2020 Balance sheet 12/31/2019 12/31/2020 Assets Revenue Cost of Goods Sold (COGS) SG&A Operating Income (EBIT) Net Interest Expense Non-operating Income (Expense) Pretax income Tax Expense Net Income Cash A/R Inventories PP&E Total assets Liabilities Accounts Payable Debt Total liabilities Equity Weighted average basic shares outstanding EPS Common stock Retained earnings Total equity Balanced EBITDA Balance check Balanced D&A Tax Rate Statement of Cash Flows 1/1/2020- 12/31/2020 Operating Activities Net income Depreciation Increase in deferred tax Decrease in inventory Decrease in accounts receivable Decrease in other short-term operating assets Increase in accounts payable Increase in accruals Increase in other current liabilities Net cash from operating activities Investing Activities Investment (decrease) in Gross PPE Investment (decrease) in other long-term oper. ass. Decrease in short-term investments Decrease in long-term investments Net cash from investing activities Financing Activities Increase in short-term debt Increase in long-term debt Preferred dividends Increase in preferred stock Increase in other long-term liabilities Increase in common stock (Par+PIC) Common dividends Net cash from financing activities Net cash flow Starting cash Ending cash Calculated ending cash