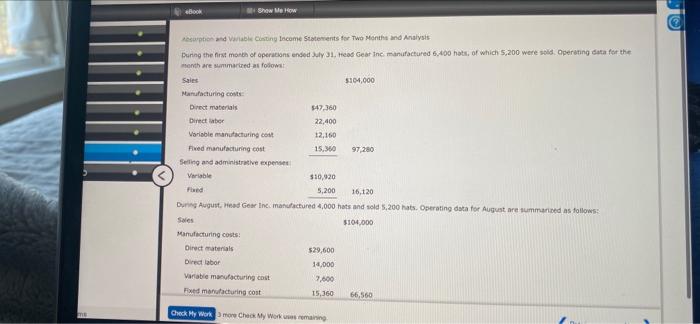

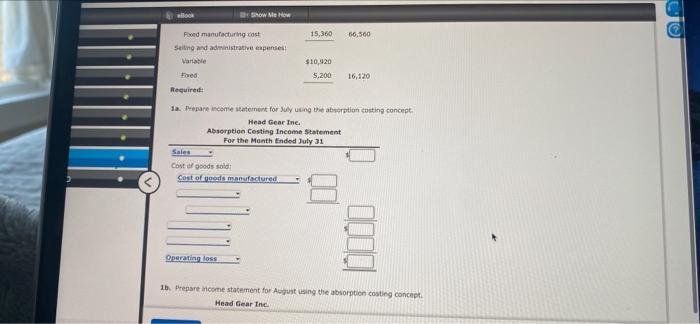

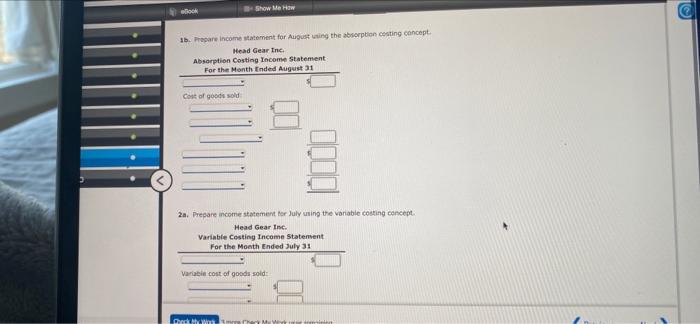

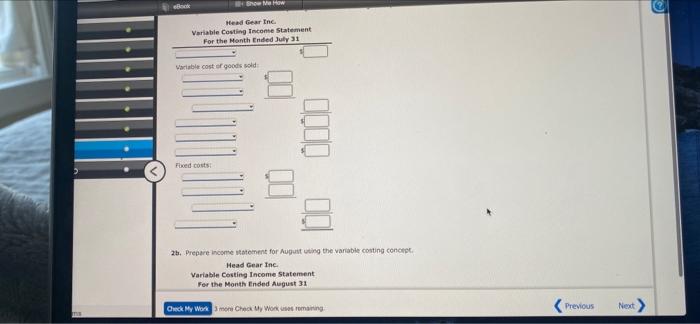

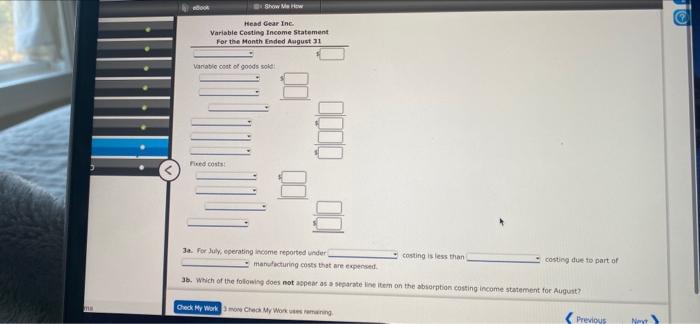

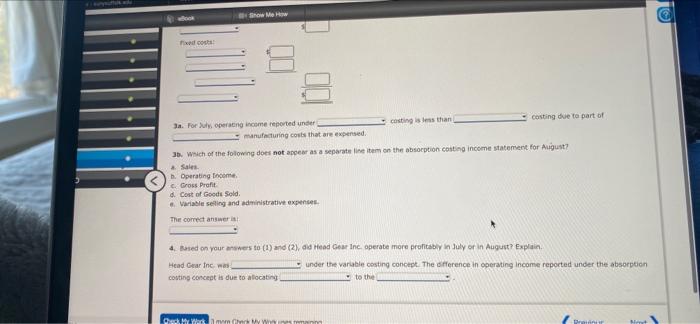

Show Me How berpandable Costing Income Statements for Two Months and Analysis During the first month of operations ended Suly 31. Head Gear in manufactured 6.400 hats, of which 5,200 were sold Operating data for the month are summarized as fodowa Sales 5104,000 Manufacturing Direct materials 547.360 Direct labor 22,400 Variable manufacturing con 12,160 Fred manufacturing cost 15.30 97280 Selling and administrative expenses Variable $10,920 Fred 5,200 16,120 During August. Head Gear Inc, manufactured 4,000 hats and sold 5,200 hats. Operating data for August are summarized as follows: Sales $104.000 Manufacturing costs: Direct materials 529,600 Direct labor 10,000 Variable manufacturing cost 7.600 Fred manufacturing cost 15,360 66,560 Check My Workmore Check My Working Br Show Me How Fixed manufacturing cost 15,360 66,500 Selling and administrative expenses Variable $10,920 Fored 5,200 16,120 Required: 1a. Prepare come Matement for July uwing the absorption costing concept Head Gear Inc. Absorption Costing Income Statement For the Month Ended July 31 Sales Cost of goods sold Cost of goods manufactured Operating loss 15. Prepare income statement for August using the absorption costing concept Head Gear Inc ook Show Me How 1. Prepare income statement for August using the absorption costing concept. Head Gear Inc. Absorption Costing Income Statement For the Month Ended August 31 Cost of goods sold 21. Prepare income statement for July using the variable costing concept Head Gear Inc Variable Costing Income Statement For the Month Ended July 31 Variable cost of goods sold: Dp Bow Me How Head Gear Inc Variable Costing Income Statement For the Month Ended July 31 Variable cost of goods sold 1000 Fixed costs 25. Prepare income statement for Augusting the variable costing concept Head Gear Inc. Variable Costing Income Statement For the Month Ended August 31 Check My Workmen Check My Workses romanting Show Me How Head Gear Inc. Variable Cesting Income Statement For the Month Ended August 31 Variable cost of goods sold DO duto Ja. For July operating income reported under manufacturing costs that are expensed costing is less than costing due to part of 3. Which of the following does not spear as separate intern on the absorption costing income statement for August Check My Wormo Check My Woman Previous Net Me 10) Fixed cost Ja. For operating income reported under costing is less than costing due to part of manufacturing costs that are expensed 35. Which of the following does not appear as a separateline item on the absorption costing income statement for August? Sales 1. Operating Income Cross Profit d. Cost of Goods Sold Variable selling and administrative expenses The corect answer 4. Based on your answers to (1) and (2) Head Gear Inc. operate more profitably in July or in August? Explain Head Gear Inc. was under the variable costing concept. The difference in operating Income reported under the absorption couting concept is due to a locating to the Peder