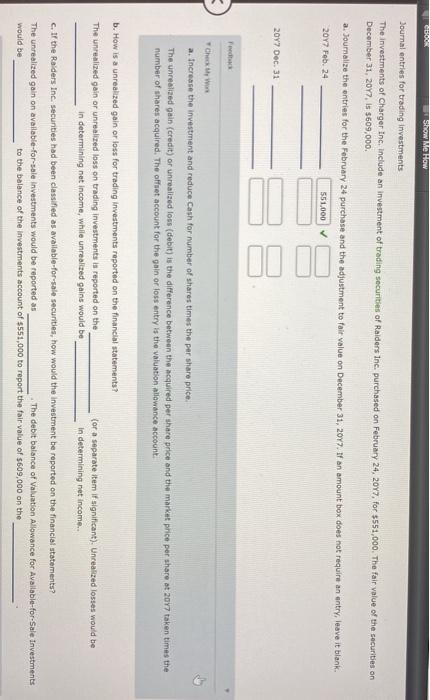

Show Me How Journal entries for trading Investments The Investments of Charger Inc. Include an investment of trading securities of Raiders Inc. purchased on February 24, 2017, for $551,000. The fair value of the securities on December 31, 2017. Is $609,000. a. Journalize the entries for the February 24 purchase and the adjustment to fair value on December 31, 2017. If an amount box does not require an entry, leave it blank 2017 Feb 24 551,000 II II 2017 Dec. 31 Check a. Increase the investment and reduce Cash for number of shares times the per share price The unrealized gain (credit) or unrealized lous (debit) is the difference between the acquired per share price and the market price per share at 2017 taken times the number of shares acquired. The offset account for the pain or loss entry is the valuation allowance account b. How is a unrealized gain or loss for trading Investments reported on the financial statements? The unrealized gain or unrealized loss on trading investments in reported on the (or a separate item if significant). Unrealized losses would be in determining net income, while unrealized gains would be in determining net income.. c. If the Raiders Inc. securities had been classified as available for sale securities, how would the investment be reported on the financial statementu? The unrealized gain on available for sale investments would be reported as The debit balance of Valuation Allowance for Available-for-Sale Investments would be to the balance of the investments account of $551,000 to report the fair value of 609,000 on the Show Me How Journal entries for trading Investments The Investments of Charger Inc. Include an investment of trading securities of Raiders Inc. purchased on February 24, 2017, for $551,000. The fair value of the securities on December 31, 2017. Is $609,000. a. Journalize the entries for the February 24 purchase and the adjustment to fair value on December 31, 2017. If an amount box does not require an entry, leave it blank 2017 Feb 24 551,000 II II 2017 Dec. 31 Check a. Increase the investment and reduce Cash for number of shares times the per share price The unrealized gain (credit) or unrealized lous (debit) is the difference between the acquired per share price and the market price per share at 2017 taken times the number of shares acquired. The offset account for the pain or loss entry is the valuation allowance account b. How is a unrealized gain or loss for trading Investments reported on the financial statements? The unrealized gain or unrealized loss on trading investments in reported on the (or a separate item if significant). Unrealized losses would be in determining net income, while unrealized gains would be in determining net income.. c. If the Raiders Inc. securities had been classified as available for sale securities, how would the investment be reported on the financial statementu? The unrealized gain on available for sale investments would be reported as The debit balance of Valuation Allowance for Available-for-Sale Investments would be to the balance of the investments account of $551,000 to report the fair value of 609,000 on the