*************************************show me the steps how to do the excel formula

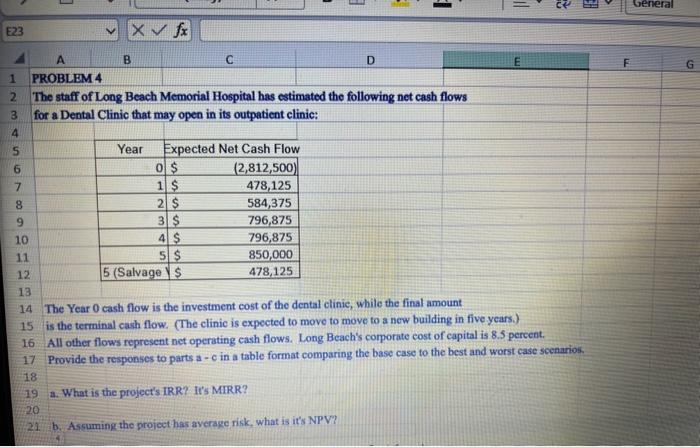

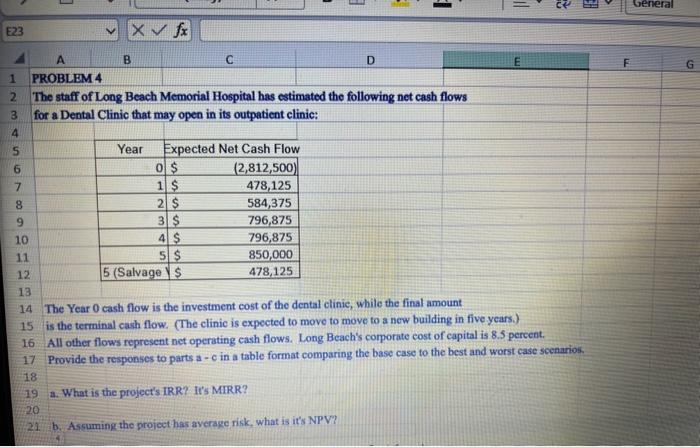

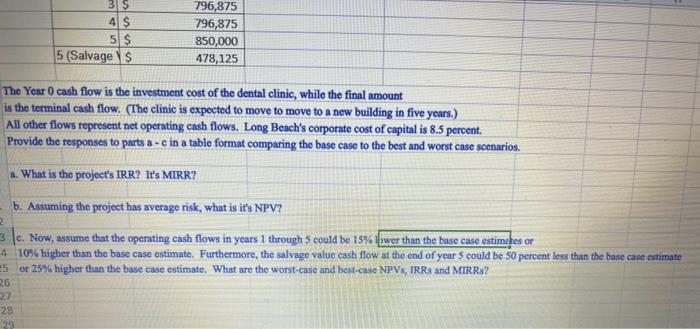

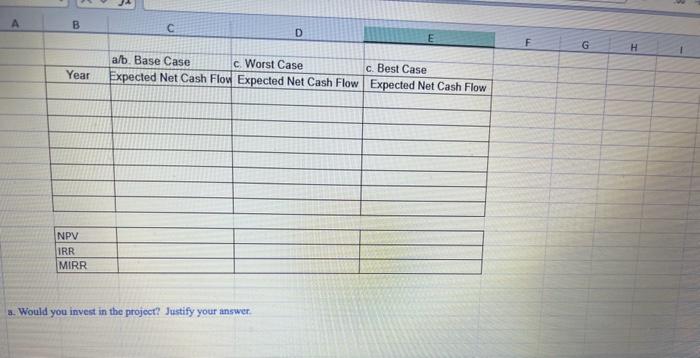

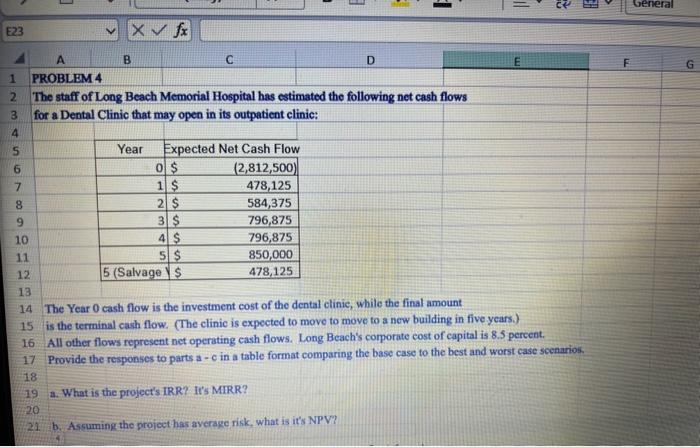

The staff of Long Beach Memorial Hospital has estimated the following net cash flows for a Dental Clinic that may open in its outpatient elinic: The Year 0 cash flow is the investment cost of the dental clinic, while the final amount is the terninal cash flow. (The clinic is expected to move to move to a new building in five years.) All other flows represent net operating cash flows. Long Beach's comorate cost of capital is 8.5 percent. Provide the responses to parts ac in a table format comparing the base case to the best and worst case scenarios. a. What is the project's IRR? Ir's MIRR? b. Assuming the project has average risk, what is it's NPV? \begin{tabular}{|r|rr|} \hline 4 & $ & 796,875 \\ \hline 5 & $ & 796,875 \\ \hline 5 (Salvage & $ & 850,000 \\ \hline \end{tabular} The Year 0 cash flow is the investment cost of the dental clinic, while the final amount is the terminal cash flow. (The clinic is expected to move to move to a new building in five years.) All other flows represent net operating cash flows. Long Beach's corporate cost of capital is 8.5 percent. Provide the responses to parts a - c in a table format comparing the base case to the best and worst case scenarios. a. What is the project's IRR? It's MIRR? b. Assuming the project has average risk, what is it's NPV? c. Now, assume that the operating cash flows in years 1 through 5 could be 15% wer than the base case cstimetres or 10% higher than the base case estimate. Furthermore, the salvage value cash flow at the end of year 5 could be 50 percent less than the base case cetimate or 25% higher than the base case estimate. What are the worst-case and best-case NPVs, IRRs and MIRRs? a. Would you invest in the project? Justify your answer The staff of Long Beach Memorial Hospital has estimated the following net cash flows for a Dental Clinic that may open in its outpatient elinic: The Year 0 cash flow is the investment cost of the dental clinic, while the final amount is the terninal cash flow. (The clinic is expected to move to move to a new building in five years.) All other flows represent net operating cash flows. Long Beach's comorate cost of capital is 8.5 percent. Provide the responses to parts ac in a table format comparing the base case to the best and worst case scenarios. a. What is the project's IRR? Ir's MIRR? b. Assuming the project has average risk, what is it's NPV? \begin{tabular}{|r|rr|} \hline 4 & $ & 796,875 \\ \hline 5 & $ & 796,875 \\ \hline 5 (Salvage & $ & 850,000 \\ \hline \end{tabular} The Year 0 cash flow is the investment cost of the dental clinic, while the final amount is the terminal cash flow. (The clinic is expected to move to move to a new building in five years.) All other flows represent net operating cash flows. Long Beach's corporate cost of capital is 8.5 percent. Provide the responses to parts a - c in a table format comparing the base case to the best and worst case scenarios. a. What is the project's IRR? It's MIRR? b. Assuming the project has average risk, what is it's NPV? c. Now, assume that the operating cash flows in years 1 through 5 could be 15% wer than the base case cstimetres or 10% higher than the base case estimate. Furthermore, the salvage value cash flow at the end of year 5 could be 50 percent less than the base case cetimate or 25% higher than the base case estimate. What are the worst-case and best-case NPVs, IRRs and MIRRs? a. Would you invest in the project? Justify your