Answered step by step

Verified Expert Solution

Question

1 Approved Answer

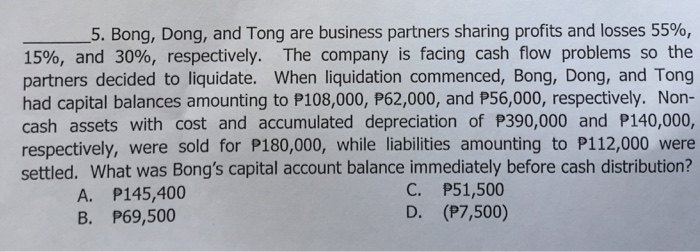

SHOW SOLUTION _5. Bong, Dong, and Tong are business partners sharing profits and losses 55%, 15%, and 30%, respectively. The company is facing cash flow

SHOW SOLUTION

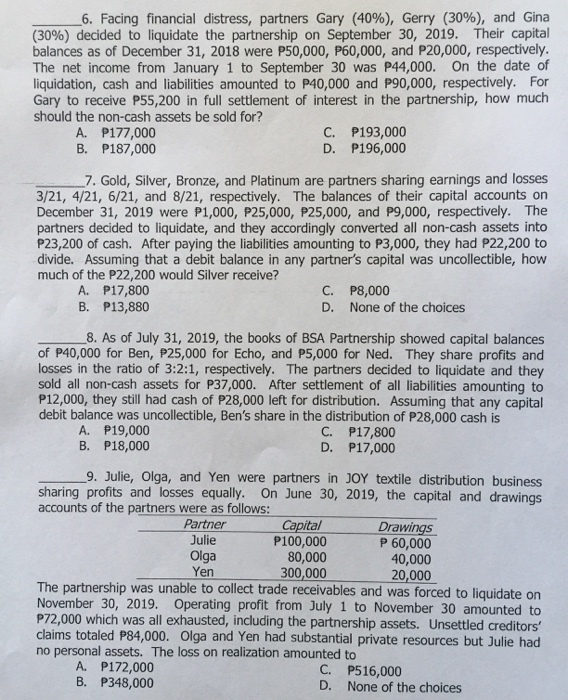

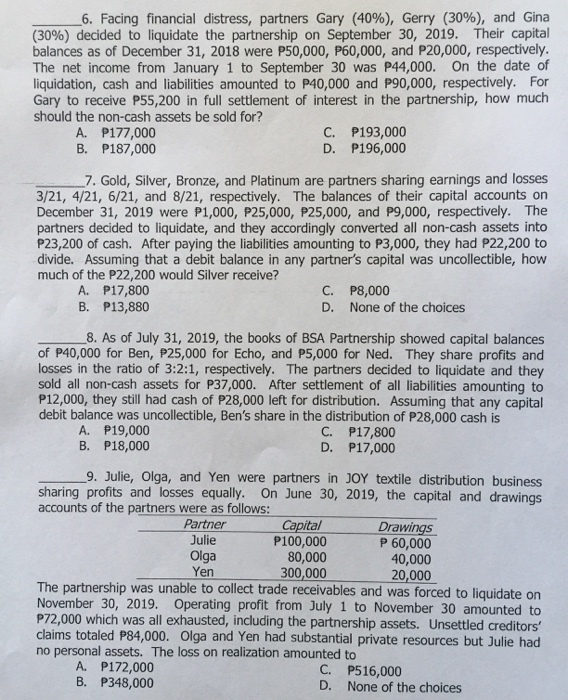

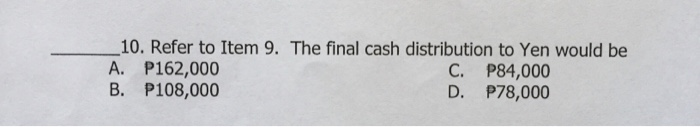

_5. Bong, Dong, and Tong are business partners sharing profits and losses 55%, 15%, and 30%, respectively. The company is facing cash flow problems so the partners decided to liquidate. When liquidation commenced, Bong, Dong, and Tong had capital balances amounting to P108,000, P62,000, and P56,000, respectively. Non- cash assets with cost and accumulated depreciation of P390,000 and P140,000, respectively, were sold for P180,000, while liabilities amounting to P112,000 were settled. What was Bong's capital account balance immediately before cash distribution? A. P145,400 C. P51,500 B. P69,500 D. (P7,500) 6. Facing financial distress, partners Gary (40%), Gerry (30%), and Gina (30%) decided to liquidate the partnership on September 30, 2019. Their capital balances as of December 31, 2018 were P50,000, P60,000, and P20,000, respectively. The net income from January 1 to September 30 was P44,000. On the date of liquidation, cash and liabilities amounted to P40,000 and P90,000, respectively. For Gary to receive P55,200 in full settlement of interest in the partnership, how much should the non-cash assets be sold for? A. P177,000 C. P193,000 B. P187,000 D. P196,000 _7. Gold, Silver, Bronze, and Platinum are partners sharing earnings and losses 3/21, 4/21, 6/21, and 8/21, respectively. The balances of their capital accounts on December 31, 2019 were P1,000, P25,000, P25,000, and P9,000, respectively. The partners decided to liquidate, and they accordingly converted all non-cash assets into P23,200 of cash. After paying the liabilities amounting to P3,000, they had P22,200 to divide. Assuming that a debit balance in any partner's capital was uncollectible, how much of the P22,200 would Silver receive? A. P17,800 C. P8,000 B. P13,880 D. None of the choices 8. As of July 31, 2019, the books of BSA Partnership showed capital balances of P40,000 for Ben, P25,000 for Echo, and P5,000 for Ned. They share profits and losses in the ratio of 3:2:1, respectively. The partners decided to liquidate and they sold all non-cash assets for P37,000. After settlement of all liabilities amounting to P12,000, they still had cash of P28,000 left for distribution. Assuming that any capital debit balance was uncollectible, Ben's share in the distribution of P28,000 cash is A. P19,000 C. P17,800 B. P18,000 D. P17,000 9. Julie, Olga, and Yen were partners in JOY textile distribution business sharing profits and losses equally. On June 30, 2019, the capital and drawings accounts of the partners were as follows: Partner Capital Drawings Julie P100,000 P 60,000 Olga 80,000 40,000 Yen 300,000 20,000 The partnership was unable to collect trade receivables and was forced to liquidate on November 30, 2019. Operating profit from July 1 to November 30 amounted to P72,000 which was all exhausted, including the partnership assets. Unsettled creditors' claims totaled P84,000. Olga and Yen had substantial private resources but Julie had no personal assets. The loss on realization amounted to A. P172,000 C. P516,000 B. P348,000 D. None of the choices 10. Refer to Item 9. The final cash distribution to Yen would be A. P162,000 C. P84,000 B. P108,000 D. P78,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started