Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show solution for each The following is a partial list of costs incurred last month by the Fontana Company. Product advertising P20,000 Fire insurance premium

Show solution for each

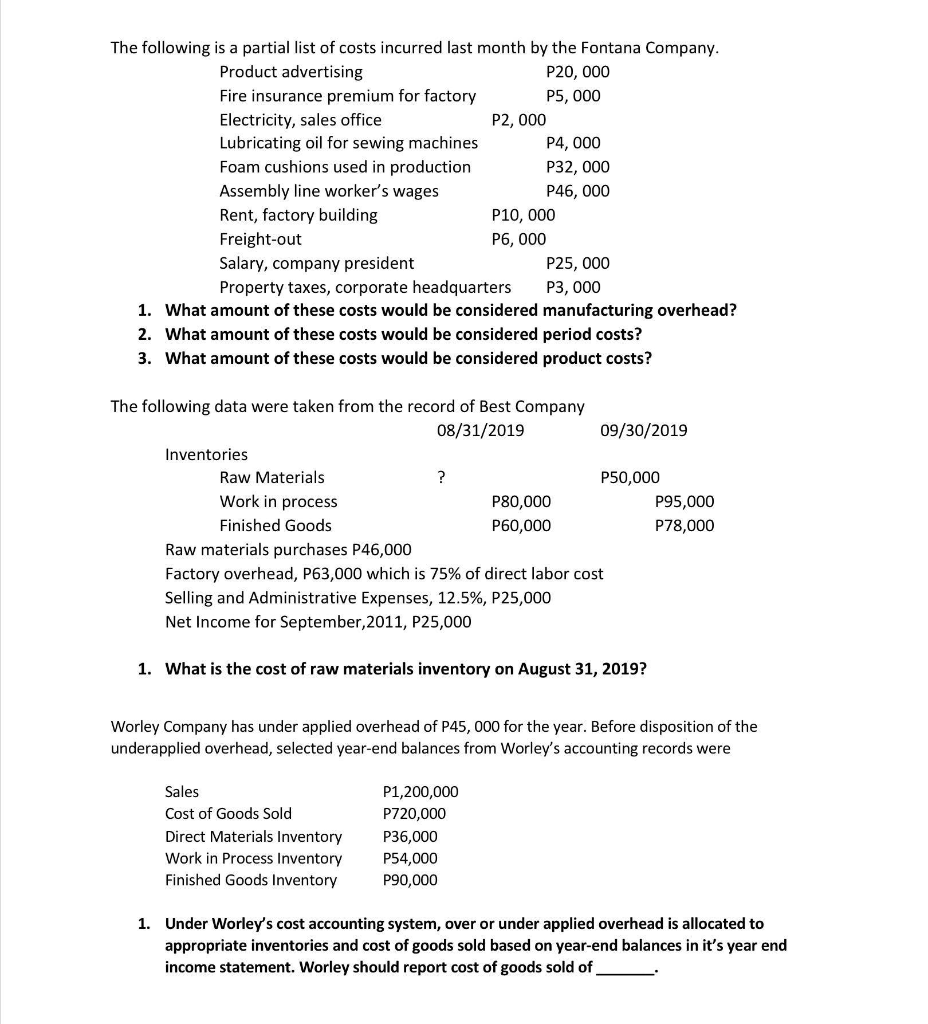

The following is a partial list of costs incurred last month by the Fontana Company. Product advertising P20,000 Fire insurance premium for factory P5,000 Electricity, sales office P2,000 Lubricating oil for sewing machines P4,000 Foam cushions used in production P32, 000 Assembly line worker's wages P46,000 Rent, factory building P10,000 Freight-out P6,000 Salary, company president P25,000 Property taxes, corporate headquarters P3, 000 1. What amount of these costs would be considered manufacturing overhead? 2. What amount of these costs would be considered period costs? 3. What amount of these costs would be considered product costs? The following data were taken from the record of Best Company 08/31/2019 09/30/2019 Inventories Raw Materials ? P50,000 Work in process P80,000 P95,000 Finished Goods P60,000 P78,000 Raw materials purchases P46,000 Factory overhead, P63,000 which is 75% of direct labor cost Selling and Administrative Expenses, 12.5%, P25,000 Net Income for September, 2011, P25,000 1. What is the cost of raw materials inventory on August 31, 2019? Worley Company has under applied overhead of P45,000 for the year. Before disposition of the underapplied overhead, selected year-end balances from Worley's accounting records were Sales Cost of Goods Sold Direct Materials Inventory Work in Process Inventory Finished Goods Inventory P1,200,000 P720,000 P36,000 P54,000 P90,000 1. Under Worley's cost accounting system, over or under applied overhead is allocated to appropriate inventories and cost of goods sold based on year-end balances in it's year end income statement. Worley should report cost of goods sold ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started