Show solution in good accounting form

9.

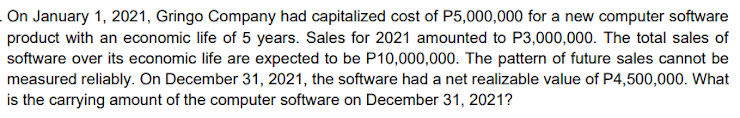

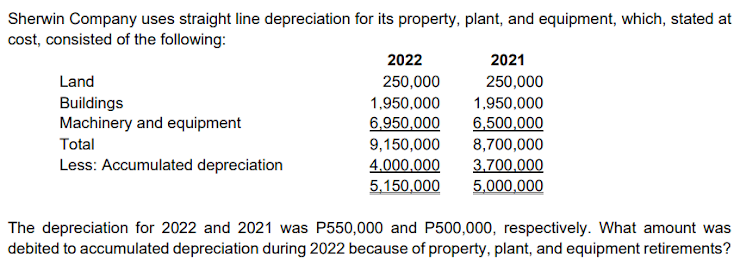

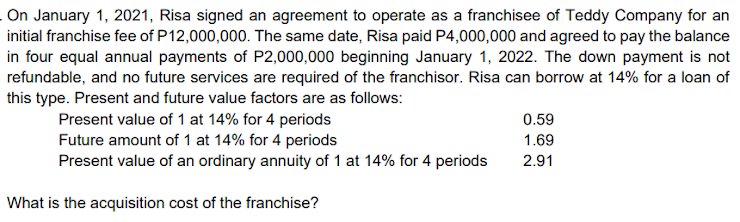

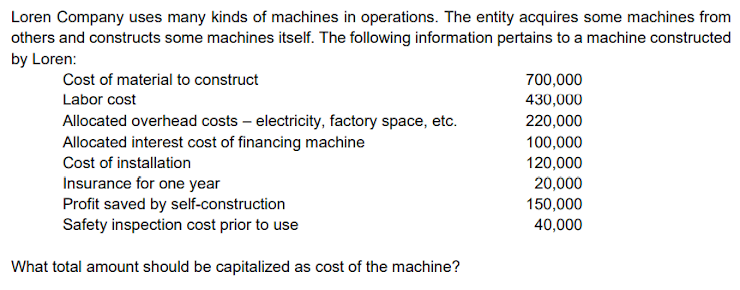

On January 1, 2021, Gringo Company had capitalized cost of P5,000,000 for a new computer software product with an economic life of 5 years. Sales for 2021 amounted to P3,000,000. The total sales of software over its economic life are expected to be P10,000,000. The pattern of future sales cannot be measured reliably. On December 31, 2021, the software had a net realizable value of P4,500,000. What is the carrying amount of the computer software on December 31, 2021?Sherwin Company uses straight line depreciation for its property, plant, and equipment, which, stated at cost, consisted of the following: 2022 2021 Land 250,000 250,000 Buildings 1,950,000 1,950,000 Machinery and equipment 6,950,000 6,500,000 Total 9,150,000 8,700,000 Less: Accumulated depreciation 4.000,000 3,700,000 5,150,000 5,000,000 The depreciation for 2022 and 2021 was P550,000 and P500,000, respectively. What amount was debited to accumulated depreciation during 2022 because of property, plant, and equipment retirements?.Dn January \"L 20211 Risa signed an agreement to operate as a franchisee of Teddy Company for an initial franchise fee of P121DD.{l. The same date, Risa paid F4,El, and agreed to pay the balance in four equal annual payments of P2,. beginning January 1. 2022. The down payment is not refundable. and no future services are required of the franchisor. Risa can borrow at 14% for a loan of this type. Present and future value factors are as follows: Present yalue of 1 at 14% for 4 periods I159 Future amount of 1 at 14% for 4 periods 1.69 Present value of an ordinary annuity of 1 at 14% for 4 periods 2.91 What is the acquisition cost of the franchise?I Loren Company uses mam.r kinds of machines in operations. The entity acquires some machines from others and constructs some machines itself. The following information pertains to a machine constructed by Loren: Cost of material to constnict F00.000 Labor cost 430,000 Allocated overhead costs electricity, factory space, etc. 220.000 Allocated interest cost of nancing machine 100,000 (lust of installation 120,000 Insurance for one year 20,000 Prot saved by self-constmcticn 150,000 Safety inspection cost prior to use 40.000 1What total amount should be capitalized as cost of the machine