Answered step by step

Verified Expert Solution

Question

1 Approved Answer

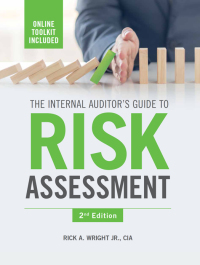

SHOW SOLUTION PLEASE THANKS ASAPP How much is the projected net cash flows for Year 2?* 2 points Banana Republic Inc. reported the following prospective

SHOW SOLUTION PLEASE THANKS

ASAPP

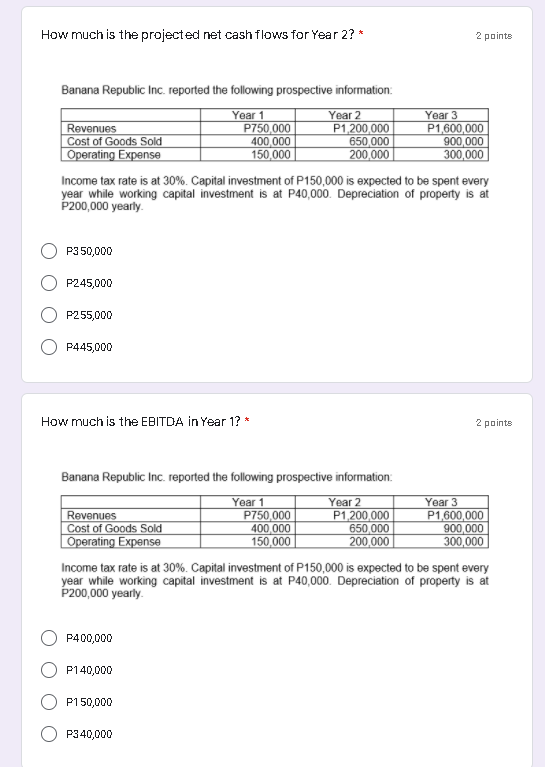

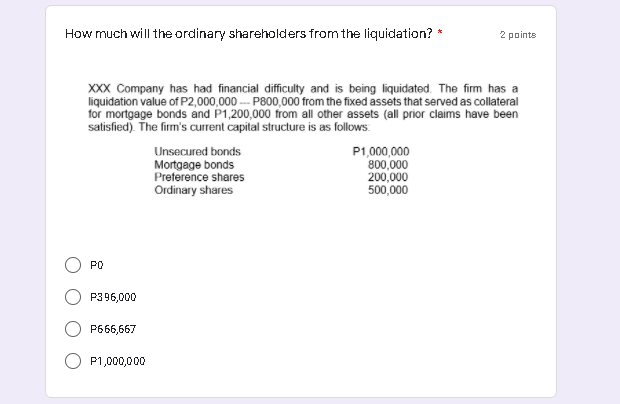

How much is the projected net cash flows for Year 2?* 2 points Banana Republic Inc. reported the following prospective information: Year 1 Year 2 Year 3 Revenues P750,000 P1,200,000 P1,600,000 Cost of Goods Sold 400 000 650 000 900,000 Operating Expense 150,000 200,000 300,000 Income tax rate is at 30%. Capital investment of P150,000 is expected to be spent every year while working capital investment is at P40,000. Depreciation of property is at P200,000 yearly P350,000 P245,000 P255,000 P445,000 How much is the EBITDA in Year 1? * 2 points Banana Republic Inc. reported the following prospective information: Year 1 Year 2 Year 3 Revenues P750,000 P1,200,000 P1,600,000 Cost of Goods Sold 400,000 650 000 900,000 Operating Expense 150,000 200.000 300,000 Income tax rate is at 30%. Capital investment of P150,000 is expected to be spent every year while working capital investment is at P40,000. Depreciation of property is at P200,000 yearly P400,000 P140,000 P150,000 P340,000 How much will the ordinary shareholders from the liquidation? * 2 points XXX Company has had financial difficulty and is being liquidated. The firm has a liquidation value of P2,000,000 --P800,000 from the fixed assets that served as collateral for mortgage bonds and P1,200,000 from all other assets (all prior claims have been satisfied). The film's current capital structure is as follows: Unsecured bonds P1,000,000 Mortgage bonds 800,000 Preference shares 200,000 Ordinary shares 500,000 PO P396,000 P666,667 P1,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started