show solutions please

show solutions please

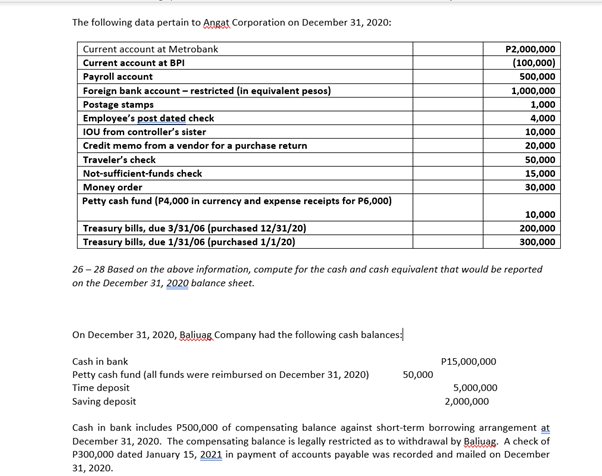

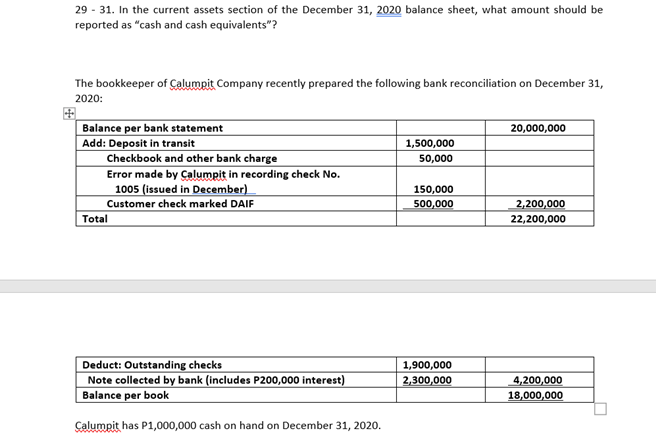

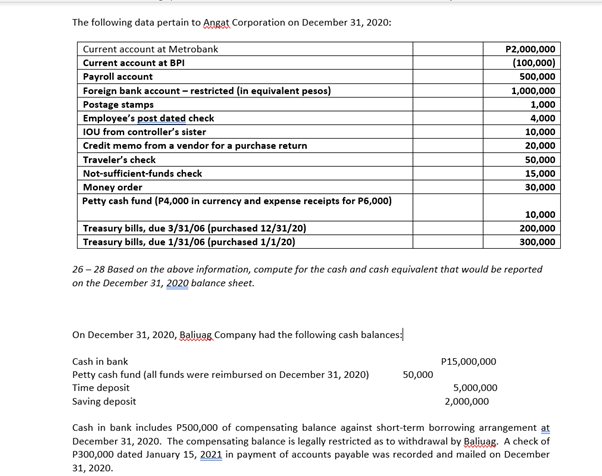

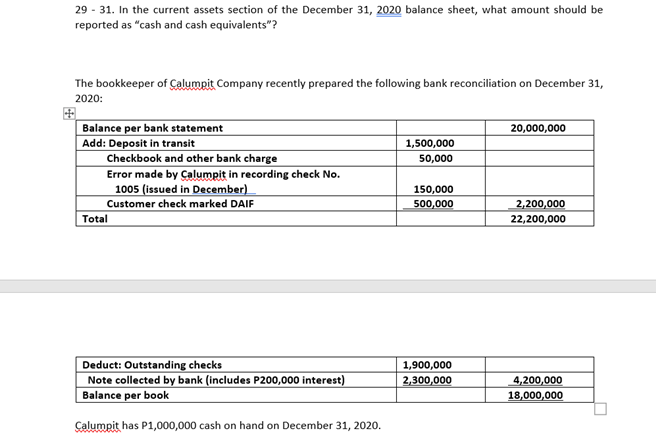

The following data pertain to Angat Corporation on December 31, 2020: Current account at Metrobank P2,000,000 Current account at BPI (100,000) Payroll account 500,000 Foreign bank account - restricted (in equivalent pesos) 1,000,000 Postage stamps 1,000 Employee's post dated check 4,000 IOU from controller's sister 10,000 Credit memo from a vendor for a purchase return 20,000 Traveler's check 50,000 Not-sufficient-funds check 15,000 Money order 30,000 Petty cash fund (P4,000 in currency and expense receipts for P6,000) 10,000 Treasury bills, due 3/31/06 (purchased 12/31/20) 200,000 Treasury bills, due 1/31/06 (purchased 1/1/20) 300,000 26-28 Based on the above information, compute for the cash and cash equivalent that would be reported on the December 31, 2020 balance sheet. On December 31, 2020, Baliuag Company had the following cash balances: Cash in bank P15,000,000 Petty cash fund (all funds were reimbursed on December 31, 2020) 50,000 Time deposit 5,000,000 Saving deposit 2,000,000 Cash in bank includes P500,000 of compensating balance against short-term borrowing arrangement at December 31, 2020. The compensating balance is legally restricted as to withdrawal by Baliuag, A check of P300,000 dated January 15, 2021 in payment of accounts payable was recorded and mailed on December 31, 2020. 29 - 31. In the current assets section of the December 31, 2020 balance sheet, what amount should be reported as "cash and cash equivalents"? The bookkeeper of Calumpit Company recently prepared the following bank reconciliation on December 31, 2020: 20,000,000 1,500,000 50,000 Balance per bank statement Add: Deposit in transit Checkbook and other bank charge Error made by Calumpit in recording check No. 1005 (issued in December) Customer check marked DAIF Total 150,000 500,000 2,200,000 22,200,000 Deduct: Outstanding checks Note collected by bank (includes P200,000 interest) Balance per book 1,900,000 2,300,000 4,200,000 18,000,000 Calumpit has P1,000,000 cash on hand on December 31, 2020. The following data pertain to Angat Corporation on December 31, 2020: Current account at Metrobank P2,000,000 Current account at BPI (100,000) Payroll account 500,000 Foreign bank account - restricted (in equivalent pesos) 1,000,000 Postage stamps 1,000 Employee's post dated check 4,000 IOU from controller's sister 10,000 Credit memo from a vendor for a purchase return 20,000 Traveler's check 50,000 Not-sufficient-funds check 15,000 Money order 30,000 Petty cash fund (P4,000 in currency and expense receipts for P6,000) 10,000 Treasury bills, due 3/31/06 (purchased 12/31/20) 200,000 Treasury bills, due 1/31/06 (purchased 1/1/20) 300,000 26-28 Based on the above information, compute for the cash and cash equivalent that would be reported on the December 31, 2020 balance sheet. On December 31, 2020, Baliuag Company had the following cash balances: Cash in bank P15,000,000 Petty cash fund (all funds were reimbursed on December 31, 2020) 50,000 Time deposit 5,000,000 Saving deposit 2,000,000 Cash in bank includes P500,000 of compensating balance against short-term borrowing arrangement at December 31, 2020. The compensating balance is legally restricted as to withdrawal by Baliuag, A check of P300,000 dated January 15, 2021 in payment of accounts payable was recorded and mailed on December 31, 2020. 29 - 31. In the current assets section of the December 31, 2020 balance sheet, what amount should be reported as "cash and cash equivalents"? The bookkeeper of Calumpit Company recently prepared the following bank reconciliation on December 31, 2020: 20,000,000 1,500,000 50,000 Balance per bank statement Add: Deposit in transit Checkbook and other bank charge Error made by Calumpit in recording check No. 1005 (issued in December) Customer check marked DAIF Total 150,000 500,000 2,200,000 22,200,000 Deduct: Outstanding checks Note collected by bank (includes P200,000 interest) Balance per book 1,900,000 2,300,000 4,200,000 18,000,000 Calumpit has P1,000,000 cash on hand on December 31, 2020

show solutions please

show solutions please