Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show steps please 7. Vienna Corporate Treasury. A corporate treasury working out of Vienna with operations in New York simultaneously calls Citibank in New York

show steps please

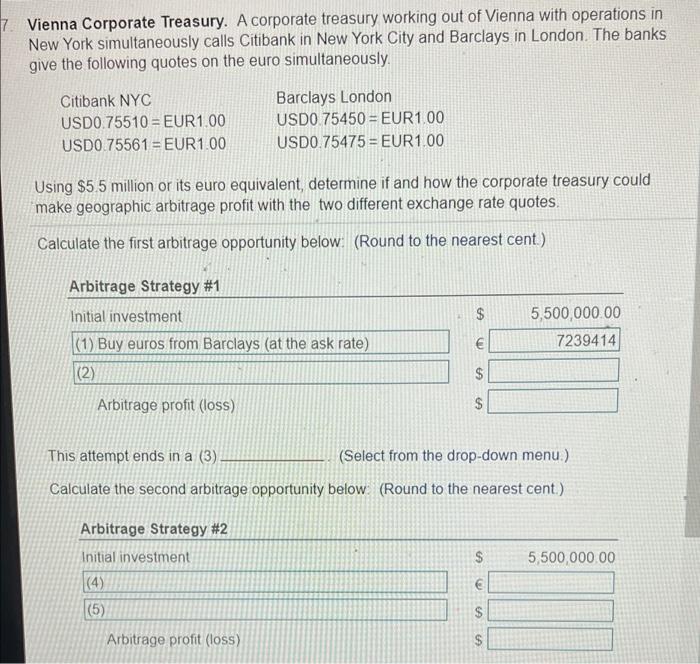

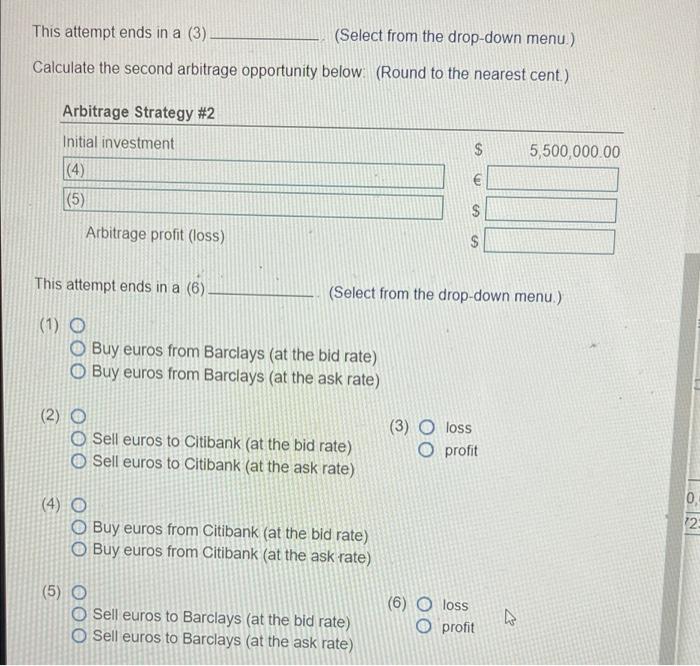

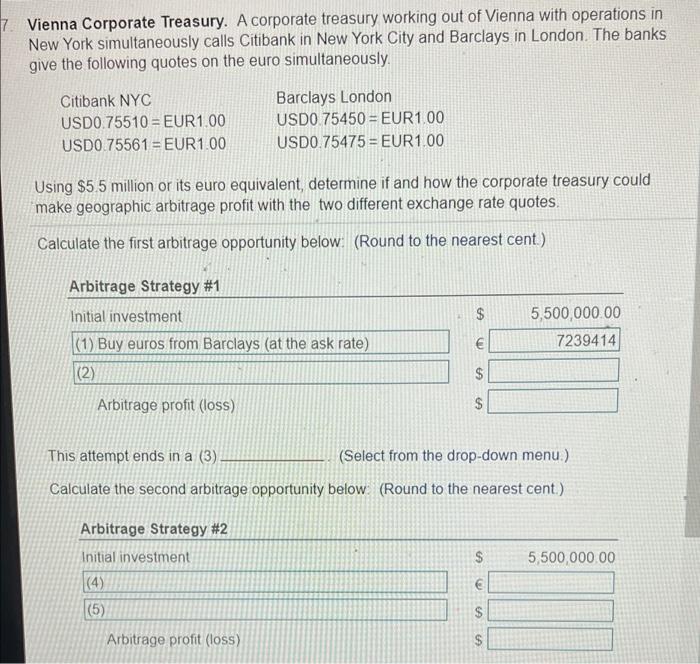

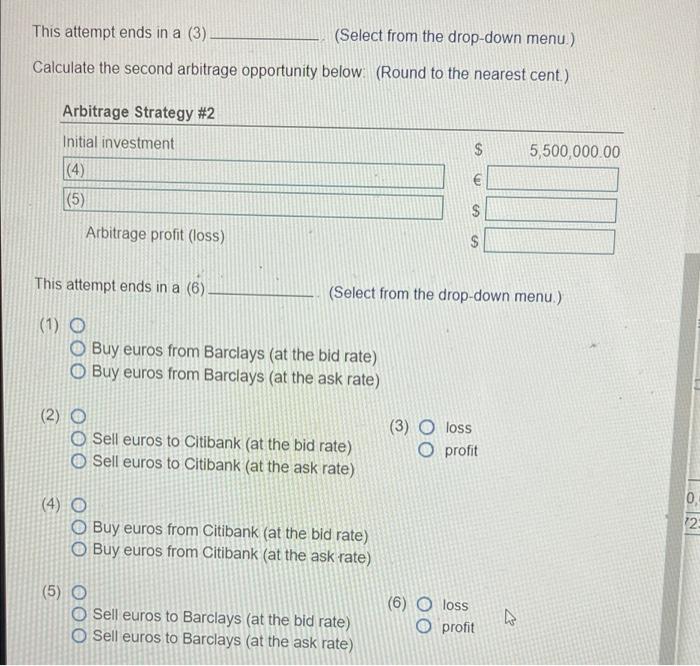

7. Vienna Corporate Treasury. A corporate treasury working out of Vienna with operations in New York simultaneously calls Citibank in New York City and Barclays in London. The banks give the following quotes on the euro simultaneously Citibank NYC USDO.75510 = EUR1.00 USDO 75561 = EUR1.00 Barclays London USDO 75450 = EUR1.00 USDO.75475 = EUR 1.00 Using $5.5 million or its euro equivalent, determine if and how the corporate treasury could make geographic arbitrage profit with the two different exchange rate quotes, Calculate the first arbitrage opportunity below. (Round to the nearest cent.) Arbitrage Strategy #1 Initial investment GA 5,500,000.00 7239414 (1) Buy euros from Barclays (at the ask rate) (2) $ $ Arbitrage profit (loss) This attempt ends in a (3) (Select from the drop-down menu.) Calculate the second arbitrage opportunity below. (Round to the nearest cent) Arbitrage Strategy #2 Initial investment (4) 5,500,000.00 $ (5) Arbitrage profit (loss) $ This attempt ends in a (3) (Select from the drop-down menu.) Calculate the second arbitrage opportunity below (Round to the nearest cent.) Arbitrage Strategy #2 Initial investment 5,500,000.00 (4) $ (5) S Arbitrage profit (loss) S This attempt ends in a (6) (Select from the drop-down menu.) (1) O O Buy euros from Barclays (at the bid rate) O Buy euros from Barclays (at the ask rate) (2) O O Sell euros to Citibank (at the bid rate) O Sell euros to Citibank (at the ask rate) (3) O loss O profit 0 (4) O O Buy euros from Citibank (at the bid rate) O Buy euros from Citibank (at the ask rate) NO1 (6) (5) O O Sell euros to Barclays (at the bid rate) O Sell euros to Barclays (at the ask rate) loss O profit V

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started