Answered step by step

Verified Expert Solution

Question

1 Approved Answer

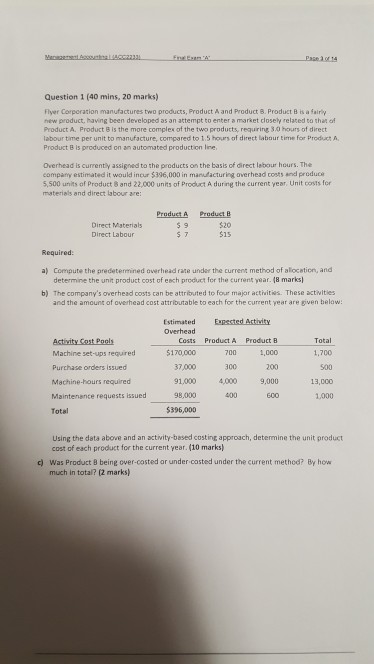

Show steps please. Question 1 (40 mins, 20 marks) Flyer Corporation manufactures two products, Product A and Product 8. Product B is a fairly new

Show steps please.

Question 1 (40 mins, 20 marks) Flyer Corporation manufactures two products, Product A and Product 8. Product B is a fairly new product, having been developed as an attempt to enter a market closely related to that of Product A. Product 8 is the more comples of the two products, requring 30 hours of direct labour time per unit to manufacture, compared to 1.5 hours of direct labour time for Product A Product B is produced on an automated production lne Overhead is currently assigned to the products on the basis of direct lebour hours. The company estimated it would incur $396,000 in manufacturing overhead costs and produce 5,500 units of Product 8 and 22,000 units of Product A during the current year, Unit costs for materials and direct labour are Product & Product Direct Materials Direct Labour 5 9 $20 Required: a) Compute the predetermined overhead rate under the current method of alocetion, and determine the unit product cost of each product for the current year-(8 marks) b) The company's overhead costs can be attributed to four major acthites. These actwities and the amount of overhead cost attributable to eath for the current year are given below imated eesl Astiaity Overhead Total 1,700 500 13,000 1,000 Costs Product A Product B Machine set-ups required Purchase orders issued Machine-hours required Maintenance requests issued Total $170,000 700 1,000 37,000 1,000 40 9,000 400 5396,000 Using the data above and an activity-based costing approach, determine the unit product cost of each product for the current year. (10 marks) was Product B being over-casted ar under-casted under the current method? Byhow much in total? (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started