Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show the answer in excel sheet TheWART Do KTE pling des SA ed 25 11 2.000 10 IWCH SI 22 Moto O De elearnsqueduom/modique em

Show the answer in excel sheet

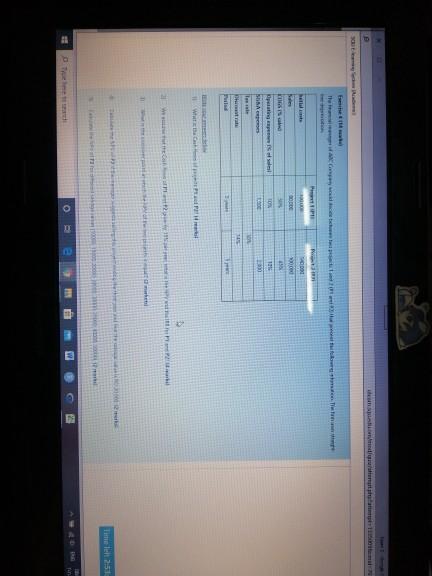

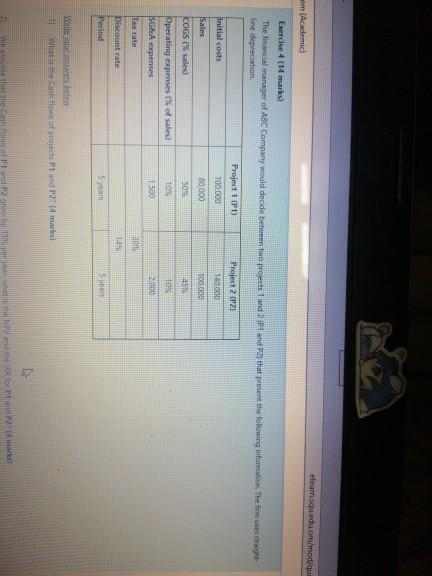

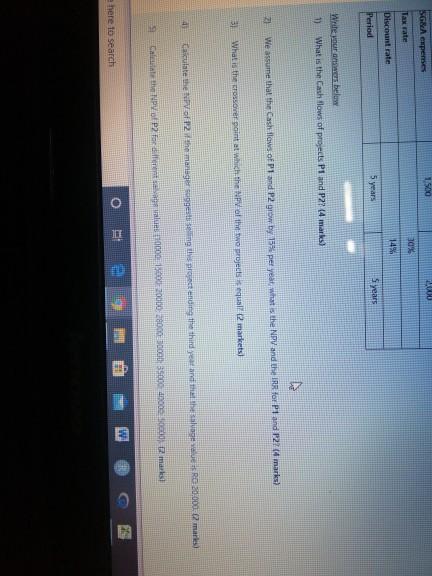

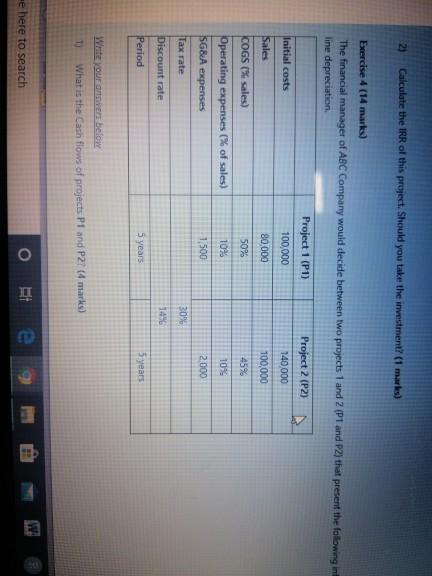

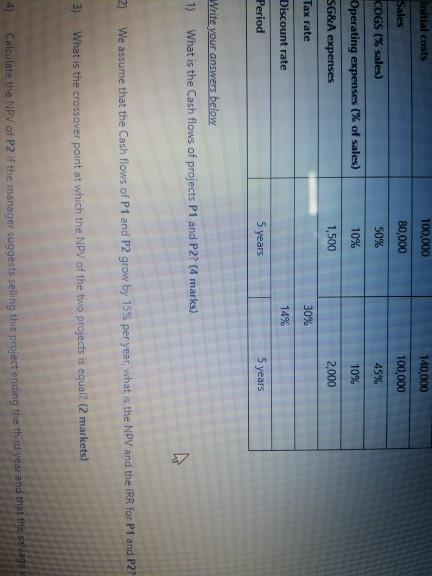

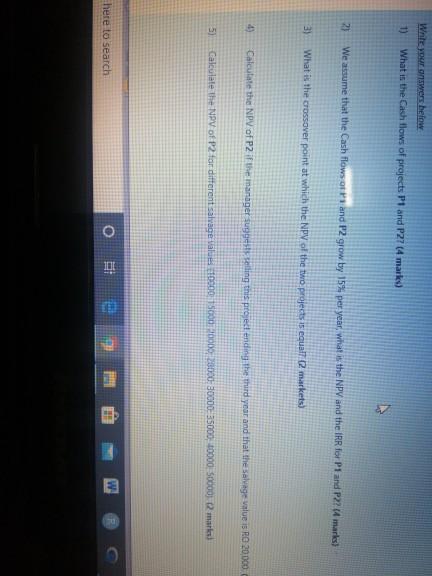

TheWART Do KTE pling des SA ed 25 11 2.000 10 IWCH SI 22 Moto O De elearnsqueduom/modique em (Academic) Exercise 4 (4 marks The financial manager of ABC Company would decide between two projects and 21 and 2) that present the following information. The first tight- line depreciation Project 1 (1) Project 2 (P2) Initial costs 100.000 143000 Sales 30000 100.000 COGS ales 50% 454 Operating expenses of sales) 10 10 SG&A expenses 1500 2.000 Tarate an Discount rate Perind Wien Wishes of projects P1 P2714 mars When the 24 1500 LLU SG&A expeme 30% Tax rate 14 Discount rate Period 5 years Syears Write nur mes below 1) What is the Cashflows of projects P1 and P2 (4 marks) H We assume that the Cashflows of Pland P2.b 15 per yeat, what is the NPV and the IRR for P1 and 27 (4 marks) What is the crossover point at which the NPV at the two projects equall 12 markets Calculate the of 12 the manager sugesting the preceding the third year and that helvageRO 20.000 marles Call NPV 2 for different les 10000 15000-20000 28000.00 35000 45000 marks w here to search O UL 2) Calculate the IRR of this project. Should you take the investment? (1 mark) Exercise 4 (14 marks) The financial manager of ABC Company would decide between two projects 1 and 2 (P1 and P2) that present the following int line depreciation Project 1 (P1) Project 2 (P2) Initial costs 100,000 140.000 Sales 80,000 100,000 COGS (% sales) 50% 45% Operating expenses (% of sales) 10% 10% SG&A expenses 1,500 2.000 Tax rate 30 Discount rate 1496 Period 5 years 5 years Write your annivers below 1) What is the cash flows of projects P1 and P2(4 marks) e here to search O W A e Initial costs 100,000 140,000 100,000 Sales 80,000 50% COGS (% sales) 45% Operating expenses (% of sales) 10% 10% SG&A expenses 1,500 2,000 Tax rate 30% Discount rate 14% Period 5 years 5 years Write your answers below 1) What is the cash flows of projects P1 and P2? (4 marks) 2) We assume that the Cash flows of P1 and P2 grow by 15% per year what is the NPV and the IRR for P1 and P2? 3) What is the crossover point at which the NPV of the two projects is equal? (2 markets) 4) Caleulate the NPV of P2 if the manager suggests selling this project ending the third year and that the salvage Write your answers below 1) What is the cash flows of projects P1 and P27 (4 marks) 21 We assume that the Cash flows and P2 grow by 15% per year, what is the NPV and the IRR for P1 and P2? U marks) 3) What is the crossover point at which the NPV of the two projects is equal markets) 4 Calculate the NPV of P2 if the manager suggests telling this proje ending the third year and that the salvage value is RO 20.000 5) Calculate the NPV of P2 for different salvage values 10000 15000 HOD 23000 30000 35000 10000 500001 2 mare O here to search 2 CH

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started